Total production in October 2014 averaged 1,182,174 bopd. That is down a smidgeon (2,461 bopd) from the preliminary of 1,184,635 in September, and down a smidgeon more (4,054 bopd) compared to the slightly revised 1,186,228 amount for September.

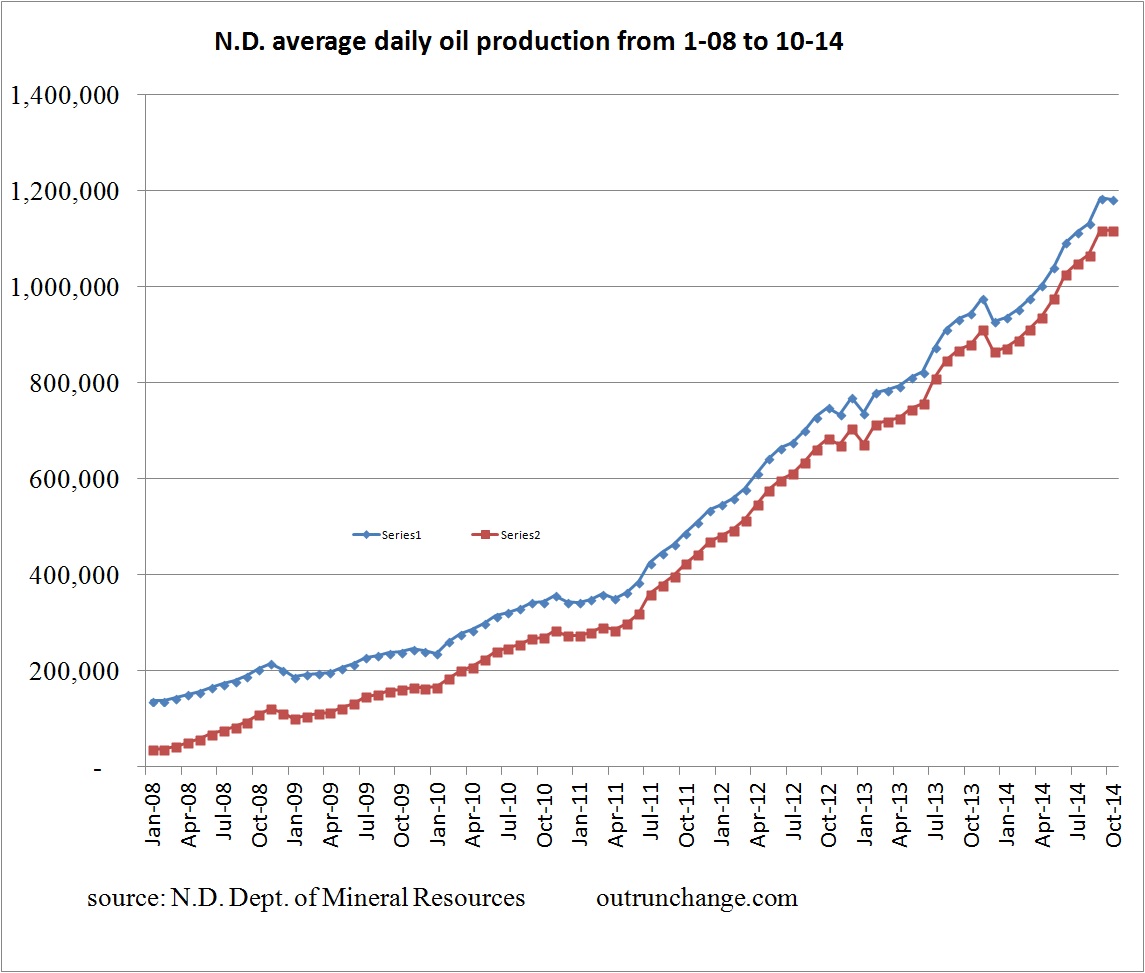

Here is what the total and Bakken-only production looks like:

The Director’s Cut each month has narrative on the month along with more statistical data. The December report is here.

Price of sweet crude

One tidbit in each month’s report is the price of sweet crude from the month. I think the reference point mentioned is price in North Dakota. I’ve accumulated that reference point for as far back as the Director’s Cut reports are available online. Here’s what it looks like, with the December data point being as of the day the report was published, not an average for the month.

That is a rather rapid collapse. The numbers are far lower that I thought they would be. I think that is because those prices reflect the cost of transport by rail just to get the oil to refineries on the Gulf or east or west coast. New York Mercantile was $57.81 on the same day.

Rig count

The rig count goes up and down as shown in the numbers for a long time. However…

Here is a biggie in the report:

Rig count in the Williston Basin is set to fall rapidly during the first quarter of 2015.

New wells completed will fall in the spring. The waiting list of 640 wells awaiting completion may get caught up, which will help maintain the amount of newly completed wells as the count is reduced. On the other hand, drillers may let the completion work lag until prices recover.

Factors holding down count of new wells

Completions dropped a lot in October. Here is the Directors’ comment:

The drilling rig count dropped 2 from September to October, an additional 3 from October to November, and has since fallen 5 more from November to today. The number of well completions decreased from 193 (final) in September to 134 (preliminary) in October. Three significant forces are driving the slow-down: oil price, flaring reduction, and oil conditioning. Several operators have reported postponing completion work to achieve the NDIC gas capture goals.

Add cold and snow to the list.

My guess is completions and production will drop for the winter because of:

- oil price – will have a slow hit to drilling, but there will be an impact on the totals

- flaring reduction – my guess is this will be a drain for a while

- oil conditioning – this is barely started as an impact; my guess is this will be a big deal for a while

- cold and snow – take a look at the production graphs above; without looking at the months at the bottom, you can easily see where winters are on the chart.

In terms of winter impact, based on eyeballing the above graph, the production dropped in five of the last six winters. The months needed for oil output to surpass the fall peak for the last six winters were 8, 3, 7, 0, 2 (but there was another drop in month 3), and 5. As a rough average, it takes about 4 months for production to surpass the level before winter kicked in.

My guess is we will have to wait quite a few months before we again see record production numbers. Well after the roads dry out in the spring. Maybe fall?

What do you think?

One thought on “North Dakota oil production in October ’14 plateaus, likely for the winter”