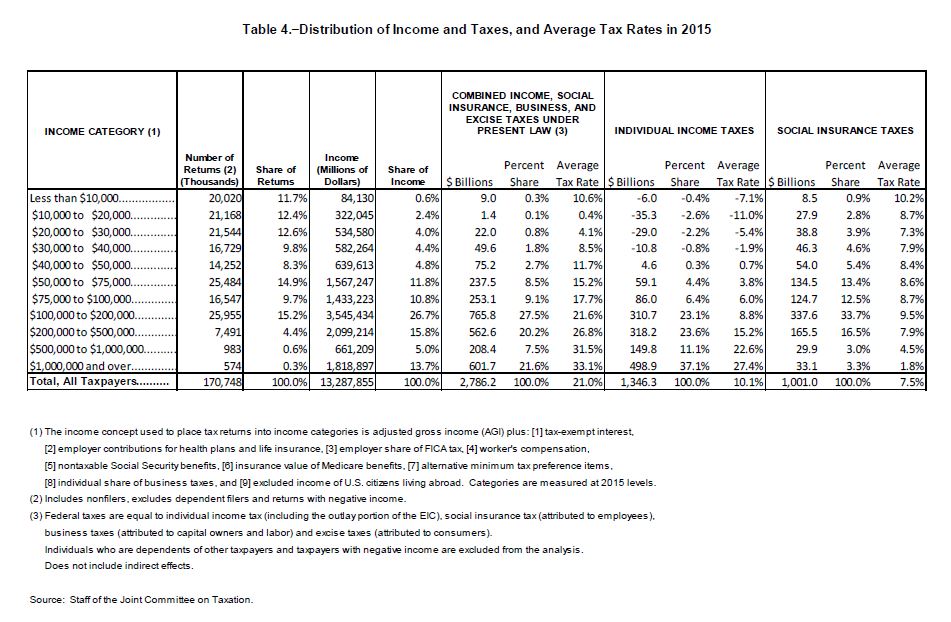

Table 4 of the Fairness and Tax Policy document from the Joint Committee on Taxation contains projections from the committee for 2015 tax returns. The table projects income and taxes paid by income level.

All of the following income numbers are based on a fairly broad definition of income, starting with AGI and adding items such as employer social security taxes, employer payments for health insurance, workers comp payments, and nontaxable social security benefits.

Key items that jump out at me:

The top 0.9% earners, or 1,557,000 taxpayers, are expected to have 18.7% share of income as defined and pay 48.2% of total individual income taxes. That is an average of $1,592,875 income with average $416,635 taxes paid.

The bottom 46.5% of earners, or 79,461,000 taxpayers, are expected to have 11.4% share of income as defined and not pay any tax as a group. Average taxpayers below the $40,000 income level won’t pay any income taxes. That group of taxpayers will be getting refunds.

You have to cross the $75,000 income level before the 69.7% of taxpayers start to pay taxes as a group.

Let me round those numbers off:

- People with the top 1% of income will pay 48% of individual income taxes.

- People with the bottom 46% of income won’t pay any income taxes.

Let me round off the Joint Committee’s projection for 2015 a bit further:

- The top one percent of taxpayers are projected to pay half of income taxes.

- The bottom half of taxpayers are projected to pay no income taxes.

The document is available at the link above. Check out page 20. Since this is a government document, it is not copyright protected. Here is the table:

Hat tip: TaxProf Blog.

Jim,

This subject comes up a lot, so I will put in my 2 cents worth.

My thoughts on this subject are that no tax system is ‘fair’ (as fair is determined/thought of), by most people for most things in life. But the top 20+% can easily afford to pay what they pay, (and remember, if someone is claiming $100,000+ a year, they are likely making much, much more, especially if they are self-employed). What does someone need to take home so much money for? How much does a person need?

I have never had children but I have been paying property taxes for decades, and as you know most of property tax goes to the school system. I have never felt that I should not have to pay for the school system portion of my property tax, or that those with many children should have to pay more. Tax is never ‘fair’ but we have a pretty great system compared to most if not all other countries, so I am content with the tax rates in the chart you provided. I doubt most of those top earners could earn the money they are earning if they were living in most other countries. As a matter of fact, many come here every year so they earn, and also keep, more than they would in their country.

Hi Mark:

Going down the ‘fair’ path will troublesome because it is so subjective. You make a great point – our system works really well compared to most places and most times.

Jim

Jim,

Here is a thought.

We are already going down a ‘fair’ path because no matter what path we go down, it will be ‘fair’ to some.

The info you provided above really become a hot button topic in this country, especially in the last few decades. But after spending many months of time in several 3rd world countries over the years as someone who lived with the people, not as a tourist, I have seen and felt what happens when governments can’t charge enough taxes to run a country.

I think every one who was born here should spend a few months living over-seas so they have a better perspective about how good they have it here, and what our taxes have provided for.

Hi Mark:

Great points!

I’ve had opportunity to visit several countries several times and spend a few days in places beyond where tourists go. We are amazingly blessed here in the United States.

One of a long list of goals of my writing is to sort out what factors contributed to how well off we are and how can that possibly be shared everywhere.

Jim