It’s hiding. It is taking place outside those things measured by the CPI.

There’s not any inflation in the CPI. The annual inflation rate for the preceding 12 months was 1.2% in November ’13. Notice something odd in the monthly inflation rates from January through November? 0.0%, 0.7%, (0.2%), (0.4%), 0.1%, 0.5%, 0.2%, 0.1%, 0.2%, (0.1%), 0.0%.

Three things jump out. First, three months had a decrease. Second, only one month had a large increase and it was followed by two declines. Third, the numbers are really small.

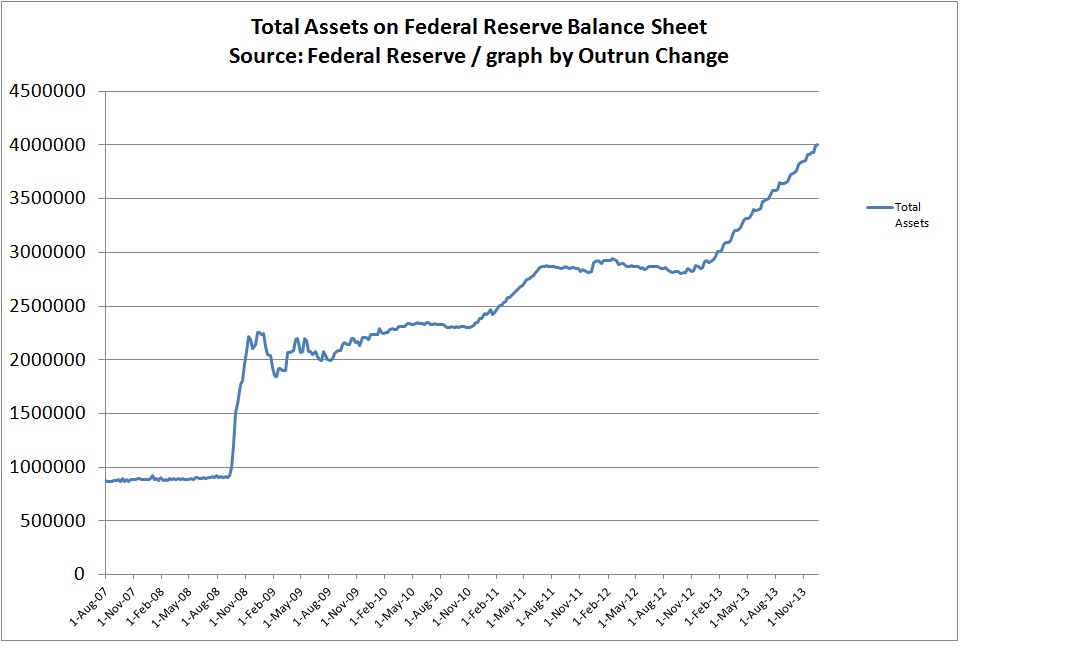

The ever-expanding Fed balance sheet

I’ve been scratching my head for years about the really low inflation shown in the CPI measurements. Why the head scratching?

Check out the ongoing explosion in the Fed’s balance sheet. Amounts are in millions, so the amount before the financial crisis was just under a trillion.

So, is inflation cured?

Not quite.

Where did all that cash go from QE I, II, and III? It went into the economy somewhere.

For the last few years I’ve been wondering where it went.

Then Against Crony Capitalism provided one possible explanation: Where’s the inflation? Stocks, bonds, real estate (especially farm land), rents, college tuition, health care, food.

A comment from the article:

Inflationary bubbles rise up in different places each time the Fed keeps things too easy for too long. In the late 90s it was tech stocks. In the mid 2000s it was housing. Now we have bubbles emerging in many asset classes.

Inflation is taking place outside those things measured by the CPI. Real estate, the stock market, and bonds have especially absorbed a lot of cash and shown lots of price run-up. If interest rates ever increase, bond prices will get clobbered.

I think that’s where all that cash went. I fear there are several bubbles building.