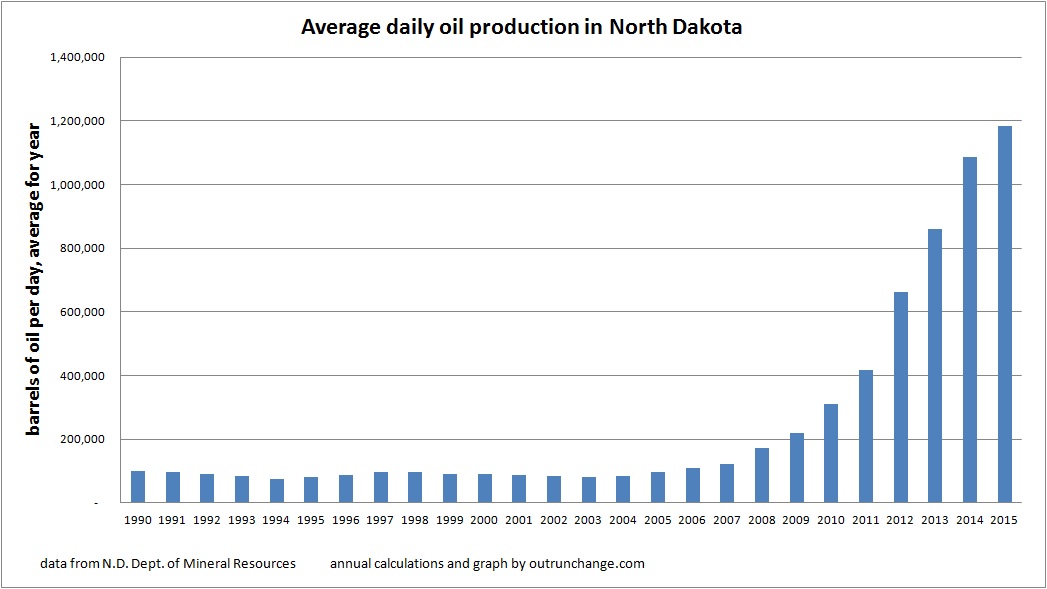

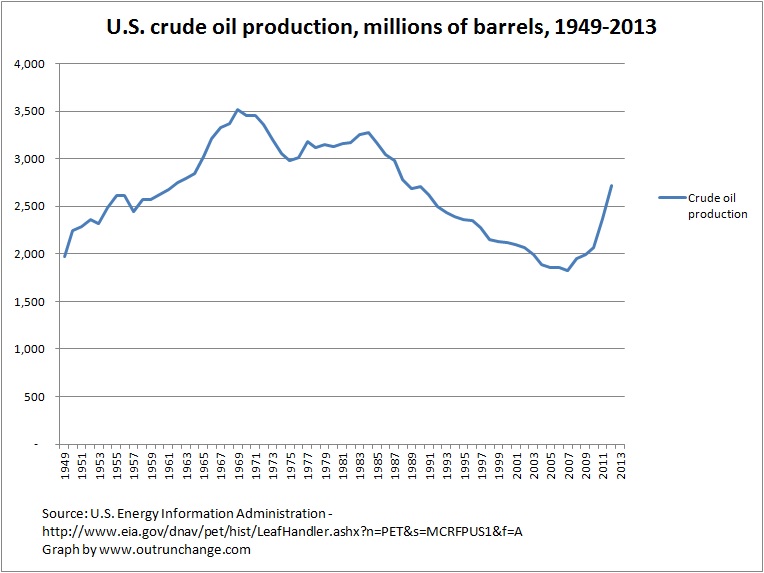

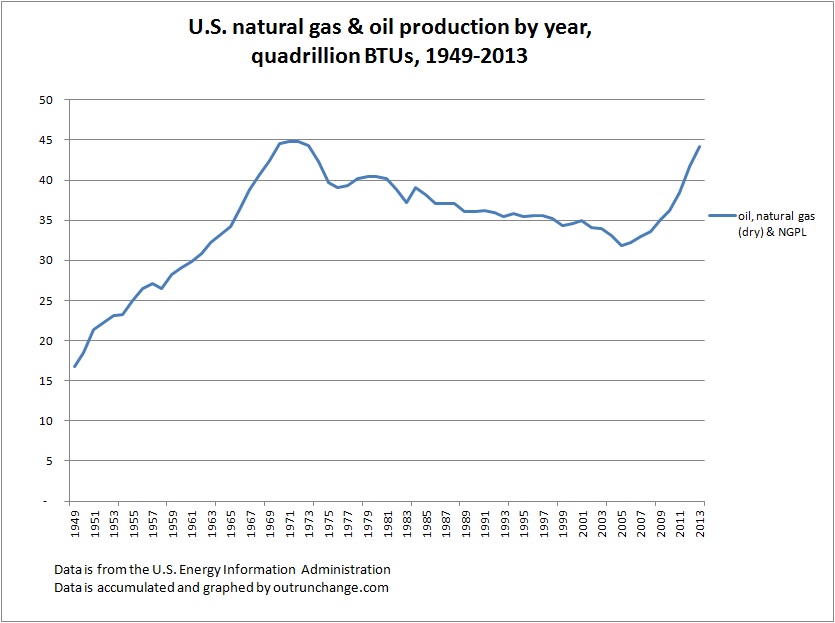

Here are more views of crude oil production in August. Previous post mentions the output hit 1.087M bopd in the month.

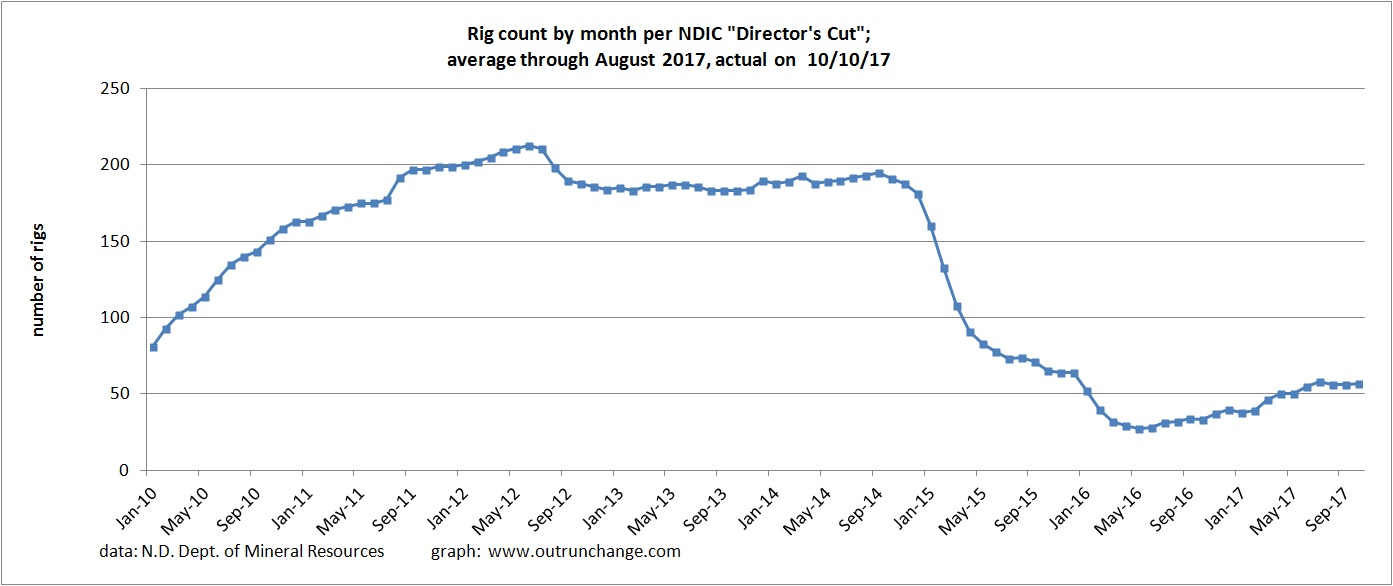

The 10/10/17 Director’s Cut says the DMR thinks the daily count of drilling rigs will drop if WTI goes below $45 for over 30 days. If WTI is above $55 for over 90 days, the rig count will increase.

That suggests price stability in the range of $45 to $55 will keep the rig count around the current level of 57.

The rig count has been in the high 50s for the last few months. It seems to have stabilized since spring 2017 and is up substantially from the low. Remember that the rig count today does not compare to the rig count a few years ago because drilling rigs today are far more productive than just two years ago.

Here is the view of monthly rig count:

What is the value of the crude produced at the average sweet price in the state? Check it out:

Continue reading “Additional graphs of North Dakota oil production in August 2017”