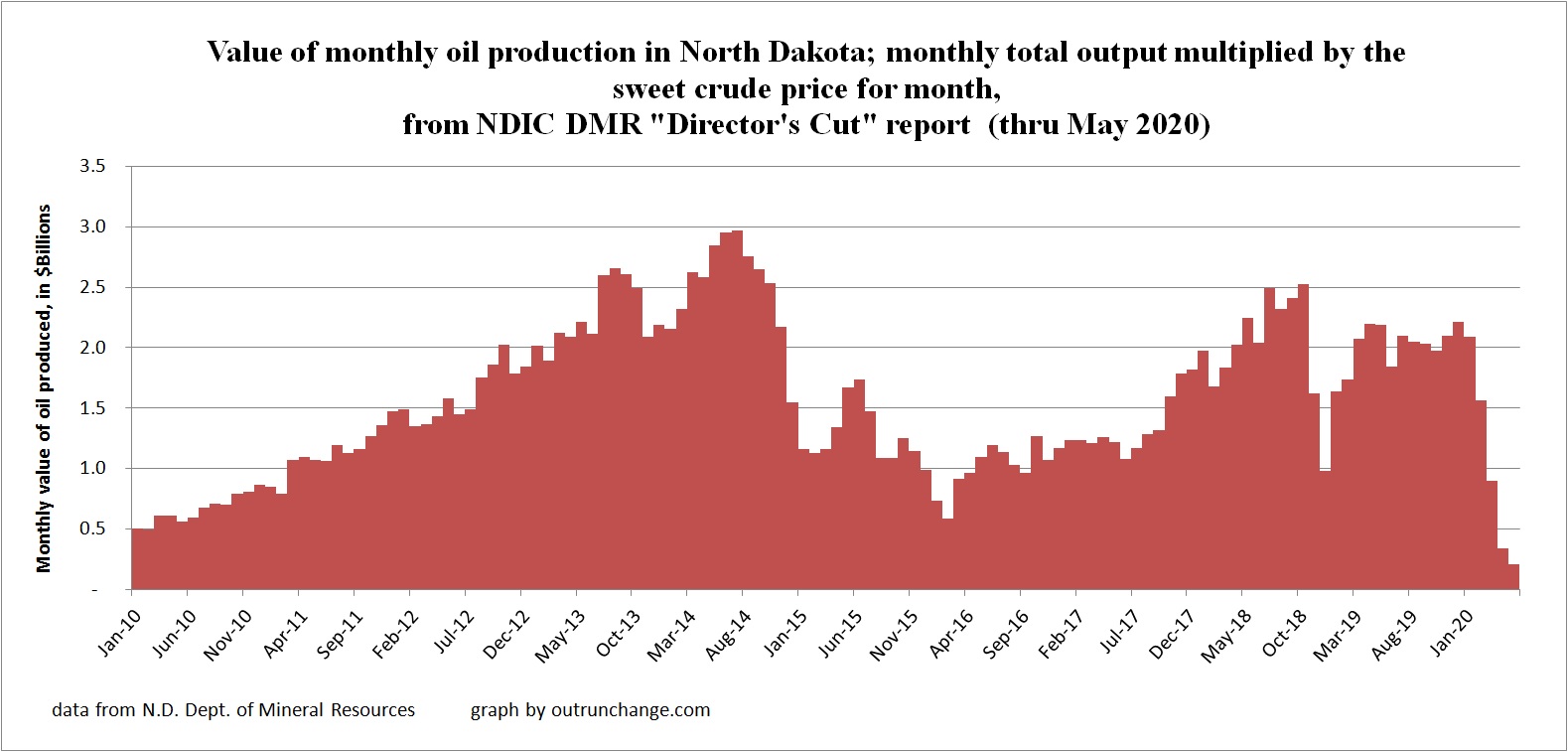

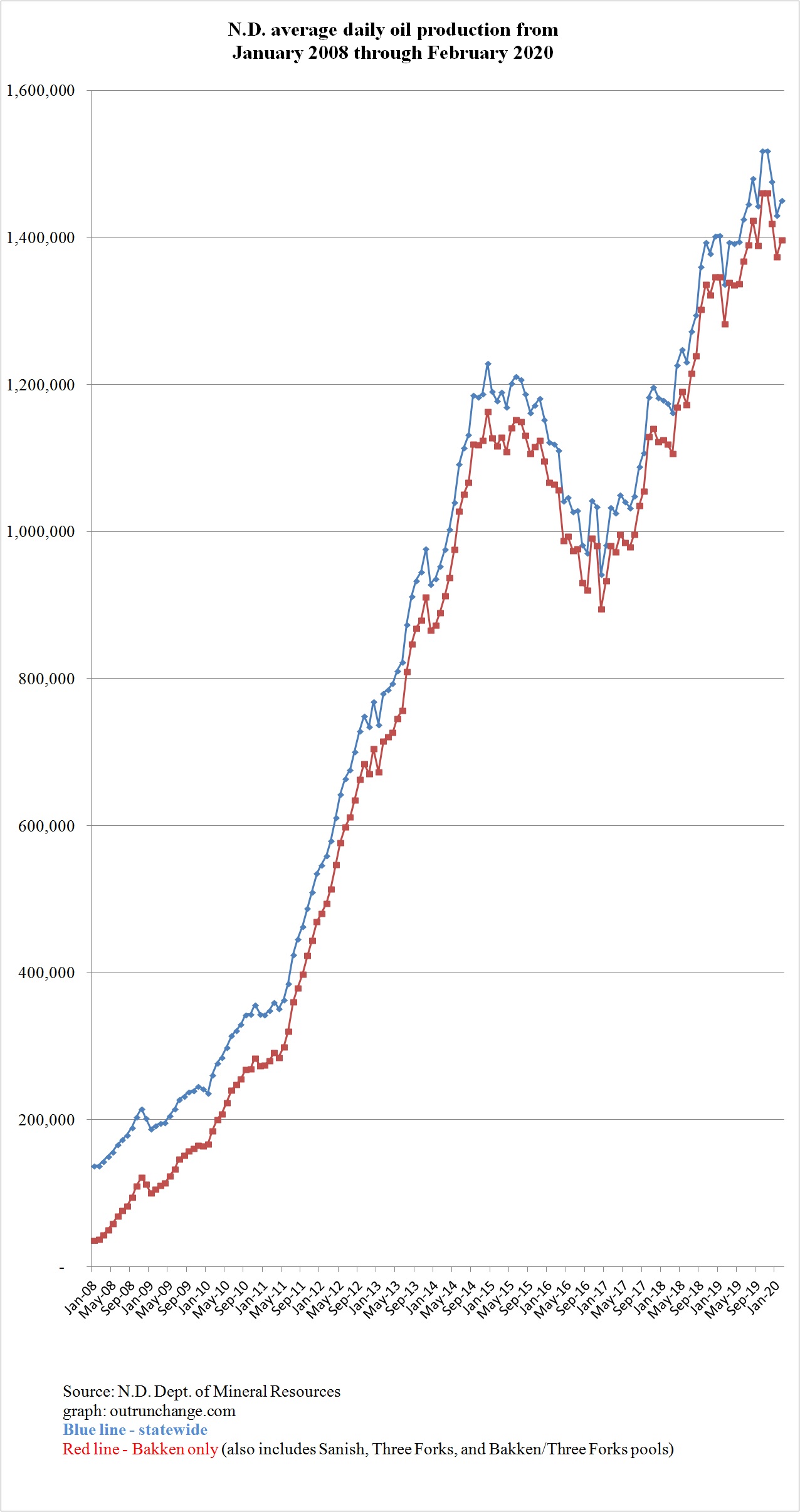

Market price of oil collapsed last spring. In looking at the data by month, you can see a one month lag in the drop of production. As a result, the value of oil produced in North Dakota dropped substantially last spring and summer.

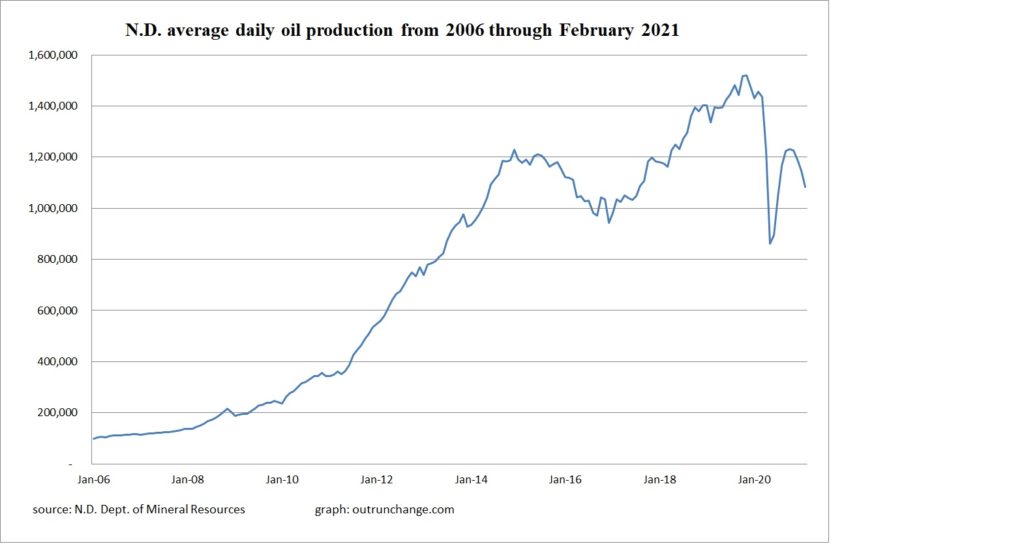

As the price of North Dakota light sweet dropped in March to $20.33 from $37.21 the prior month, production slid about 210k bopd in April to 1.225 bopd.

The shock decline in April 2020 to $9.16 from $20.33 led to a drop of production in May of 363K bopd, with average output down to 862k bopd.

A further drop in May 2020 to $7.92 from the prior $9.16 led to another month of low production in June at 895k bopd, an increase of a mere 33k bopd.

Average prices recovered the next month and then over the next seven months were in a range between $29 and $33. Production increased to the range of 1.0m bopd to 1.2 bopd since prices recovered.

Prices have accelerated in the last four months.

The driver for this wild roller coaster ride can be seen in the average of monthly prices:

Continue reading “Value of oil production by month and recent prices in North Dakota – April 2021.”