This page pulls together the second volume of “Peak Oil” posts in one place. Enjoy!

Previous discussions are in Peak Oil (volume 1).

We don’t have to prosper from all that oil we found, world edition – Peak Oil #15

How much shale-gas is underground? The Wall Street has a great graphic in their article Global Gas Push Stalls (behind paywall).

Here are a few of the largest estimated deposits, in trillions of cubic feet:

- 862 – U.S.

- 388 – Canada

- 681 – Mexico

- 1,275 – China

- 774 – Argentina

- 187 – Poland

- 180 – France

- 396 – Australia

There’s huge amounts of shale gas waiting to be tapped. Enough to power economic and manufacturing revival in many countries. What we’ve seen in the U.S. market in terms of dropping prices (benefiting consumers a lot) and generating manufacturing growth could happen in Argentina, Poland, France, South Africa, Brazil, Algeria, and Libya.

But will it? Doesn’t look likely at the moment.

Why? Many countries are stalling development.

Here’s a great one sentence description from the article about what’s happened in the U.S.

Shale oil and natural gas have rejuvenated the North American energy industry and boosted the economy by supplying companies and consumers with cheap fuel.

A summary of the reasons this will be slower elsewhere? Check this out:

Among the reasons for the glacial pace abroad are government ownership of mineral rights, environmental concerns and a lack of infrastructure to drill and transport gas and oil.

Poland had looked to be a bright spot for development. That 187 trillion ft estimated reserve is compared to their 17.2 billion annual consumption. Doesn’t seem to me it would take a very large percentage recovery to cover their annual consumption. I’m an accountant, so I can’t stop myself from calculating that is a 10,872 multiple of estimated reserves to annual consumption.

But.

The WSJ article says that’s less likely to happen now. Initial wells aren’t as good as expected, the government has changed the tax & royalty laws, and concerns about fracking have cooled interest of the majors. The Polish government has been slow to issue permits, according to the article.

Surface topography, population density, and water availability will make drilling in China difficult.

The article says some countries are so worried about fracking that they have banned its use. France and Bulgaria are in this category.

France doesn’t want to touch their shale gas. For comparison, that 180,000B cubic feet estimated reserve mentioned earlier compares to their 49.8B annual consumption. Again, I can’t stop myself from calculating a 3,614 multiple.

Knowledge of the underground geology along with the lack of infrastructure to get fracking prop in and the oil out are major issues as well. Those could be worked through.

Governments however, are creating intentional obstacles.

Argentina is the best example in the article. Or perhaps I should say the worst example. Check this out:

Argentina recently nationalized the assets of a Spanish company that discovered an enormous shale deposit there that is estimated to hold nearly one billion barrels of oil. This has chilled outside investment, which already suffered from rules that made it difficult to import needed technology and export potential profits. Houston-based Apache Corp. … which holds rights to drill in 450,000 acres of Argentine shale, says it can cost twice as much to drill a well there as the U.S., and then two to four times as much to frack the well so it can begin producing.

So production in Argentina costs twice as much to drill and 2-4 times as much to frack as the U.S. Let’s round that to a multiple of 3. I’m making a wild guess that it would cost somewhere in the range of $18M to $30M to get a well online in Argentina ( 3 x $6M – $10M).

Add rules, again from the government, that make it difficult to get technology into the country and difficult to get profits out.

Then compound that with the risk that if you have a big success, the government can expropriate your wells on a whim.

An article in The Economist (12-1-12 paper copy) discusses Argentina Media – Messenger shot . The government plans to seize some of the TV licenses of a television network that is an outspoken critic of government policies. The ‘excess’ licenses over what the government says they may now have will be sold off. Sub-headline says

The government prepare to grab a television empire.

Just how enthused would you be to put hundreds of millions of dollars to work in Argentina?

If I’m a stockholder, I wouldn’t want you taking that severe of a risk with my money.

Just a wild guess, but I’m guessing there won’t be many majors wanting to drill in Argentina anytime soon. Why should they? It’s expensive to do, the government makes it hard to get resources in and profits out, and the government may take your assets if you succeed.

Apparently the government in Argentina doesn’t want to tap 774 trillion cubic feet of gas. That is in relation to their 43.5B annual consumption. Can’t help but calculate a 17,793 ratio.

I also can’t help but scratch my head about a government, who if they actually tried to encourage shale gas would then have to work really hard in order to spend all the tax money they’d collect. Guess they don’t want all that tax money that is trapped underground and the prosperity that gas would create.

Other countries around the world don’t have to prosper from the huge amounts of resources under their soil if they don’t want to,

posted 12-10-12

US oil production in 2012 increased by the largest amount ever. And 2013 will probably be better. – #16

Article in the Wall Street Journal indicates 2012 saw the largest increase in oil production since we started producing oil in 1859.

Here’s the lede from U.S. Oil-Production Rise is Fastest Ever:

U.S. oil production grew more in 2012 than in any year in the history of the domestic industry, which began in 1859, and is set to surge even more in 2013.

The article cites the American Petroleum Institute as saying U.S. production averaged 6.4 million bopd, an increase of 779k bopd.

The Energy Information Administration predicts 2013 production will rise by 900K bopd.

I looked for just a moment and couldn’t find the info at the API website.

Carpe Diem pulled data from the EIA site and produced an eye-popping graph showing the annual change in US production from 1860 through 2012. Check out the amazing change in the last four years at the post US oil production grew more in 2012 than in any year in the history of the domestic oil industry back to the Civil War. Astounding.

To give just a teeny tiny bit of credit to the Peak Oilers, if you looked at the two previous high points in the graph (one in the mid-1930s and the other in about 1949) and the string of large drops of production (see the 1980s and 1990) and drew some sort of large-scale overall trend, there would have been a peak in the 1940s and a continued drop in production through the turn of the century. Conclusion? Peak Oil!

The severe fallacy of that way of thinking is illustrated by two crippling errors.

That reasoning ignores human ingenuity and technological change.

Don’t use the past to make a straight line projection of the future. If we use that flawed concept, we could foolishly predict the increase in US production will go from around 400k bopd in 2009 to the 800K increase in 2012, surging quickly to 1,200K bopd increase in 2015, and a staggering 1,600K barrels of oil a day in 2018. That flawed logic would suggest an annual increase of a million and a half barrels a day by 2018. That would be silly.

Just as silly as projecting a straight line from the big increases in the 1940s to the big drops in the 1980s.

As Professor Perry would say, Peak what?

posted 1-23-13

Cline Shale – another name you want to learn – “The shale rush has just begun” – Peak Oil #17

One of the biggest reasons that Peak Oil is so astoundingly foolish is the assumption that there will never, ever be any more oil found under the ground. Another huge assumption is that those dirty, evil, money-grubbing oil barons will never, ever figure out a new way to get the oil out.

This month’s object lesson that both assumptions are completely wrong is Cline Shale. I will have another object lesson in a few days.

Yeah, I’ve not heard of Cline Shale before reading this afternoon’s post from Million Dollar Way – Peak Oil? What Peak Oil? Now We Have the Cline Shale.

Another website you will want to check out and mark for future visits is The Cline Shale. I can’t tell who is running the site, but it looks to be useful. Looks like the domain name is in a GoDaddy proxy registration.

Home page has a great report from CBS7 in the basin. Check out the report. One of the last comments about a second boom in the Permian basin is:

The shale rush has just begun.

Another source mentioned by Million Dollar Way is StreetAuthority, who reports: The Latest Major Energy Discover Could “Dwarf North Dakota”.

Two comments, with stock listings removed:

Two companies, Devon Energy Corp. .. and Chesapeake Energy … recently reported impressive test results in the region. Devon’s wells show that the formation contains 3.6 million recoverable barrels of oil per square mile. As the Cline is roughly 9,800 square miles in size, this works out to estimated reserves in excess of 30 billion barrels.

These reserves could easily eclipse the Bakken (4.3 billion barrels according to conservative government estimates) and the Eagle Ford (3 billion barrels).

Remember, those are wild guesses. Several pieces of info there. Current estimates for Bakken are 4.3B barrels, with estimated 3B in Eagle Ford.

That very wild guess for Cline is 30B, which is 6.98 times as large as Bakken. Let’s round that to 7 times.

Let’s take that multiple and cut it in half. That means a wild guess would be Cline is equal to 3.5 Bakkens. Let’s say it is only one-fourth as large as the wild guess. That means it would be about 1.7 Bakkens, or 2.5 Eagle Fords.

Any way you look at it is astounding.

Drilling Info has an article: Cline Shale Holds Enormous Potential.

They have the same info on possible size as mentioned in StreetAuthority. Article also looks at the heavy leasing activity and notes that housing is already very tight in the Cline Shale area.

Cline Shale.info has a list of news articles over the last few months – Cline Shale News.

Do a ‘net search on ‘Cline Shale’ and you will find a lot of articles in the last few months.

How will this develop?

Maybe Cline Shale will fizzle out. Maybe the only good wells have already been found. Maybe the field isn’t what it looks like and maybe the layers are a fraction of the expected thickness. Maybe it will be a yawner of a field. Maybe it is all hype. Maybe the regulators will shut it all down.

But…

Maybe there will be 30 billion barrels of oil there. Or 15. Or even 3.

Peak what?

Big hat tip to Million Dollar Way.

posted 1-30-13

On Peak Lunacy, “you’ve been wrong long enough” – Peak Oil #18

Carpe Diem quotes the current issue of “The Gartman Letter” in a post, Quotation of the day on ‘peak lunacy.’ The newsletter is subscription only and I’m sure it’s far beyond my price range, so I have to quote the quote.

Mr. Gartman recalls his undergrad days when the Malthusians said the world would be out of crude oil by 1984. He calls this “sheer lunacy.”

Since it is now 2013 and I’m still driving a car powered by gasoline, I think we can call that a failed forecast.

What is Peak Oil?

Let’s pause for moment and remember what “peak oil” means. As has been advocated since Dr. Hubbert produced his world-famous theory in 1949 , peak oil means we will soon hit a maximum point of oil production, then see a rapid drop-off (the forecast looks like a bell curve), to be followed shortly thereafter by a complete exhaustion of all oil on the planet with said exhaustion point subject to calculation with reasonable accuracy.

Not a decades-long, gently declining slope. Not hitting a point at which production will never again surpass. Not that it will eventually become uneconomical to use oil. Not that energy will get more expensive. Not that it will get more difficult to get oil out of the ground.

The point, for over sixty years, is that we will exhaust every drop of oil on the planet in the near future. And we can calculate the date.

Think I’m making that up? Exaggerating? Putting words in the mouth of the Peak Oilers? Please, please read what Dr. Hubbert and his followers actually say.

“You’ve been wrong long enough”

Mr. Gartman points out that ExxonMobil increased its proven reserves last year. The reserves didn’t decline. Didn’t stay the same. Their reserves increased.

At the same time as ExxonMobil pulled an incredible amount of oil out of the ground, they increased their reserves by a larger amount. They increased the proven reserves that they own by 115% of production.

By the way, Mr. Gartman points out this is the 19th consecutive year they’ve added to reserves.

Increased reserves. 19 years. In a row.

Carpe Diem ends their quote with this:

Thus, to the eco-radicals and to the Peak Oil enthusiasts we say: Sit down and shut up; you’ve been wrong long enough.

We will need to continue pointing out the folly of Peak Oil as long as its advocates continue to make the failed argument. Comments at Carpe Diem show the idea is alive and well as of this morning. I’ve even started getting those comments on my blog.

published 2-22-13

Failed predictions of resource exhaustion – Peak Oil #19

Carpe Diem calls attention to the silliness of many past predictions of our dire future in his post, Great moments in failed predictions of resource depletion.

I’m not sure which is larger – the magnitude of error or arrogance from the cited prognosticators.

His discussion starts with:

The idiocy of “peak oil” and other claims of pending resource depletion have a long history, dating in many cases back to the 1800s. ”Peak nitwitery” experienced an especially strong revival in the 1960s and 1970s, thanks to Paul Ehrlich and his 1968 book “The Population Bomb.”

The post refers to a list of failed predictions compiled for a course at the University of Georgia (Go Dawgs!) –Economic Development of the US – David B. Mustard – Exhaustion of Resources.

Here are the first six items on the list, all of which deal with energy.

-

In 1865, Stanley Jevons (one of the most recognized 19th century economists) predicted that England would run out of coal by 1900, and that England’s factories would grind to a standstill.

-

In 1885, the US Geological Survey announced that there was “little or no chance” of oil being discovered in California.

-

In 1891, it said the same thing about Kansas and Texas. (See Osterfeld, David. Prosperity Versus Planning : How Government Stifles Economic Growth. New York : Oxford University Press, 1992.)

-

In 1939 the US Department of the Interior said that American oil supplies would last only another 13 years.

-

1944 federal government review predicted that by now the US would have exhausted its reserves of 21 of 41 commodities it examined. Among them were tin, nickel, zinc, lead and manganese.

-

In 1949 the Secretary of the Interior announced that the end of US oil was in sight.

Let’s see how those turned out.

I think the factories in England are still in operation.

There’s been just a tad bit of oil found in California.

I remember seeing huge numbers of oil pumps when we lived just outside Wichita when I was a kid.

I’ve not seen it myself so I can’t say for sure, but I believe to be true the stories floating around that there is a fair amount of oil in Texas.

Current predictions from the prognosticators may be true that the U.S. will run out of oil by the end of this summer or 2016 at the latest, but that would be substantially past the predictions made in 1939 and 1949.

Check out the rest of the list.

The failed predictions of widespread starvation due to overpopulation and worldwide environmental cataclysm are even more astoundingly wrong. Check out the prediction of continent-wide dust storms stopping traffic on freeways and striping paint off houses, again all across the continent.

Oh, the degreed college professor making that particular prediction stands by his claim. That’s not the way I remember 1996, the year it was supposed to happen.

Sorry for the sarcasm. Well, only a little bit. It’s just so easy to ridicule all those silly predictions, whether made in 1885, 1970, or last week.

Perhaps Professor Perry should apply for a trademark. Wouldn’t it be fun to have to type Peak What?™ and Peak Nitwitery™?

published 3-7-13

Can we finally bury the Hubbert curve? It keeps getting more wrong. Peak Oil #20

Check out this great graph from The Economist: Peak oil.

I don’t understand the copyright rules well enough to include the graph in my post. In case their article goes away, you can also see the graph at Carpe Diem – Chart of the day: Peak oil.

Let me describe the graph.

Take the standard Hubbert curve, which is a smooth bell curve peaking in 1970. Production then falls off rapidly, always going down, and flattens out at around 10% or 15% of the peak.

That is the Peak Oil dogma in one graph – we hit the peak in ’70, oil production will fall off consistently and permanently, and then we will run out of oil at a date that was calculable in the 1950s.

Overlay that with the graph of actual production and a forecast by BP through 2030.

Then try to restrain the chuckles.

Professor Hubbert underestimated the high point by more than 10%. He missed the curve moving up and to the right in the 1980s. He missed the even bigger increase underway now. He missed the plateau that will run for 2 decades.

So today we are running about three times more oil production in the U.S. than the professor calculated. In 2030 we will be producing around seven or nine times more oil than he calculated with exact precision.

Off by a factor of 3 in 2012. Off by a factor of 7 or 9 in 2030. Can we finally call that concept busted?

Just in case you think I’m being too hard on the good professor and his disciples, please remember that he precisely calculated the total amount of oil on the planet out to two or three signficant digits. That means he knew within a couple of percentage points accuracy the total amount of oil that would ever be produced. Though the concept is denied by some today, one of the core concepts is we will run out of oil – Dr. Hubbert said we will use up the last drop of oil on the planet.

If you wonder whether Peak Oilers have lost their faith, check out the comments at either of the above posts. Peak Oil true believers are alive and well as of yesterday afternoon.

I use the words dogma, disciples, faith, and true believers intentionally. Didn’t bother to weave the word doctrine into this post.

Why use those words? That’s the topic for another post someday soon.

Why is the Peak Oil curve so phenomenally, astoundingly, completely wrong?

Dr. Hubbert made an extremely long list of wrong assumptions that are fatal to his argument. The first five that come to mind are:

- Explorers would never, ever find a new oil field.

- Scientists would never develop new technology to get more oil from existing fields.

- Geologists would never find out that oil fields were bigger than what was known when the field was first drilled.

- We would never develop new technology to get out oil we couldn’t touch in the 1950s.

- Nobody ever changes their behavior when prices change, either on the demand side or the supply side.

When can we get rid of the Peak Oil concept?

posted 3-12-13

Inconvenient production data – Peak Oil #21

Vaclav Smil has an article at The American, “Memories of Peak Oil” that looks at oil production data over the course of a decade.

He pulls data from BP’s annual energy report. Great stuff there.

These are some highlights he points out for production between 2001 and 2011:

- +10.8% – global production

- +20% – Saudi Arabia

- +47% – Russia, although that reflects recovered from political problems the collapse of the Soviet Union

- +17% – to the Mideast production

- +37% – Canada

- +130% – Angola

He breaks up the US production into little more detail:

between 2001 and 2008 it dropped by nearly 13 percent

Between 2008 and 2011, US production increased by 16% (I calc that from production up 50Mt from 304.9Mt = +16.4%).

Does this invalidate the ‘Peak Oil’ concept? Yes. The article continues:

That may be too much to expect but, in any case, U.S. oil output disproves any preordained and immutable validity of Hubbert’s curves (which attempt to infallibly predict U.S. and world oil output for decades to come! …).

That link takes you to a pro-Hubbert web site that briefly explains why it is possible to calculate the rapid drop in production and when we will hit zero.

Mr. Smil makes a guess at future production trends:

Obviously, there will come a time when global oil extraction will reach its peak, but even that point may be of little practical interest as it could be followed by a prolonged, gentle decline or by an extended output plateau at a somewhat lower level than peak production. At the beginning of 2013, there are no signs that the beginning of this new oil era (regardless of its specific course) is imminent, and forecasting its onset remains an exercise in futility.

He addresses the folly of Peak Oil in his conclusion:

Only one thing is abundantly clear to me: for the past 15 years I have been quite confident that there is no imminent danger of any sharp peak of global oil extraction followed by an inexorable production slide — and early in 2013 that confidence is greatly strengthened by new facts. Is it too much to hope that even some catastrophists and peak-oil cultists will find it impossible to ignore those numbers?

Yes, Mr. Smil, that is probably too much to hope.

posted 3-26-13

Yet another analysis why the Peak Oil concept is dead – #22

An investment manager, The Boston Company, has a paper out which explains from an investment perspective why Peak Oil is dead. The paper starts with an explanation of the concept:

For decades, pundits have been trying to predict a tipping point for Peak Oil – when a sustained and unabated climb in oil prices sparks a near-collapse of the global economy. According to Peak Oil theory, the rate of petroleum extraction will crest and then begin an immutable decline, pushing oil prices ever higher as demand for this finite resource permanently exceeds supply.

You can find End of an Era: The Death of Peak Oil at their website.

They cite several causes for the passing of the late Peak Oil.

New technologies are getting oil out of the ground that was untouchable before. What would those technologies be? Horizontal drilling and hydraulic fracturing. This is the same story I’ve mentioned repeatedly.

More elastic demand. As prices rise, people drive less. If you actually think back to your Econ 101 class, this won’t be a surprise.

Large new discoveries of off-shore oil. Exploration is up. A new field has been found in the North Sea:

Activity has also recovered in the North Sea, where a recent discovery, the Johan Sverdrup field, boasts 3.3 billion recoverable barrels, making it the area’s largest discovery since 1980.

Yeah, you read that right. Three billion barrels…

Recoverable…

That the engineers didn’t know about a few years ago…

In a place where you would think the geologists knew everything.

Exhibit 4 shows a sharp rise in off-shore discoveries in the last 7 years. Very cool.

Finally, increasing investment dollars are flowing into exploration.

As I think about their paper, it is a presentation of the same issues I’ve been reading and talking about since starting this blog:

- The geologist whizzes keep finding oil they didn’t know about

- New technology allows getting to oil that was untouchable previously

- People respond to price signals with changed behavior, whether it is using less oil or increasing investments in upstream, midstream, and downstream capacity.

Check out the paper.

There are lots of Peak Oil devotees around. Just do an internet search for the above paper. You will find a number of places that discuss the report. Check out the comments to see lots of people arguing that Peak Oil is just around the corner. The immutable decline will start soon and the collapse of civilization will follow shortly thereafter.

Any day now.

Really soon.

posted 4-5-13.

Peak Oil = Flat Earth? – #23

Has the Peak Oil concept, which is the idea we can calculate the day that oil production irreversibly starts a catastrophic drop and calculate the specific year we use the last drop of oil, finally gone the way of the Flat Earth Society?

The answer is yes. At least that is the suggestion from an article by Mr. Colin Sullivan at EnergyWire: Has ‘peak oil’ gone the way of the Flat Earth Society?

The article starts with a graph from the 1950s showing a bell curve of all the oil production from 1850 through 2200 (yes, that would be 240 years out). The cumulative production to the c.1950s is exactly 90×10^9, or 90B. Proven reserves are 250B barrels. All future discoveries, under a smooth bell curve peaking at 2000 are 910B barrels. Total oil on the planet ever to be produced is precisely 1,250B barrels, give or take a rounding error.

Only problem with the entire concept? It’s wrong. Why?

Those behind the theory appear to have been dead wrong, at least in terms of when the peak would hit, having not anticipated the rapid shift in technology that led to exploding oil and natural gas production in new plays and areas long since dismissed as dried up.

Those are the same points visible in all critiques of Peak Oil: technology change, new fields, new oil in fields thought used up.

Disappearing spokesmen

For several weeks the author tried to track down 6 named experts who were high profile Peak Oil evangelists in the past. None were willing to talk.

He is not impressed with the persuasive powers, nor the logic, nor command of the facts in the new generation of evangelists.

Check out the article for some of the conversations.

One of the intriguing factors in this article that I’ve seen elsewhere is the fluid definition of Peak Oil. As production levels and proved reserves grow, the meaning of Peak Oil shifts. It now includes either the end of cheap oil, or it means oil will be more difficult to get out of the ground. It might also mean that some day, eventually, somewhere in the distant future that production levels will decline for a long time. I’ve also seen commenters on blogs say that the declining production in a one specific well or area or one entire field proves Peak Oil is correct.

New Predictions

One of the new disciples of Peak Oil has been able to calculate the total amount of shale gas under the ground. He says

there is about eight years’ worth of shale gas available in the United States

He says many of the shale fields have already hit peak production, although I don’t know and won’t research which ones he includes on this list:

He also believes that about 80 percent of U.S. shale plays have already reached their peak.

Please make a note for the future – – we will have no more shale gas in 2021 and only 1 out of 5 shale plays will ever see an increase in production.

You may also note I’m using words from the religious world: disciples and evangelists. That is appropriate because in my opinion the Peak Oil concepts are in the realm of faith – you just have to believe.

When will we stop using oil?

The Peak Oilers say we will stop using oil when we run out. And they can calculate the day.

I don’t know any of the background and implications, but see in the following comment a perceptive hint of the future.

Check out this observation:

Ralph Cavanagh, a senior attorney at the Natural Resources Defense Council … {says} … “Now we know we will stop using oil well before we run out of it. We will do that almost independently of who turns out to be right on what the actual reserves were.”

The Aha! from that comment for me is the idea that economical alternatives to oil will develop and we will gradually phase out our reliance on oil as we adopt whatever is the next superb energy source.

We just don’t see what that nifty new source will be yet.

Check out the full article. It is a very good read. Several other sources quoted who take a dim view of Peak Oil.

posted 4-23-13

Another Bakken’s worth of oil discovered. And it’s underneath the current Bakken. Oh, and what Peak Oil? (#24)

The USGS updated their estimate of the amount of oil that is undiscovered, technically recoverable in the Bakken field. Second paragraph of their press release says:

The USGS assessment found that the Bakken Formation has an estimated mean oil resource of 3.65 BBO and the Three Forks Formation has an estimated mean resource of 3.73 BBO, for a total of 7.38 BBO, with a range of 4.42 (95 percent chance) to 11.43 BBO (5 percent chance). This assessment of both formations represents a significant increase over the estimated mean resource of 3.65 billion barrels of undiscovered oil in the Bakken Formation that was estimated in the 2008 assessment.

This means the mid-point (statistically correct phrase: mean) of the total oil that is technically recoverable with current technology is 7.4 billion barrels of oil. Their assessment is that the probability is 95% that there will be at least 4.4B and the probability is 5% that there could be as much as 11.4B.

That’s the standard way they estimate a field’s size – a mean with accompanying estimates at the 95% and 5% level (I think that’s called confidence level, but my recollections of grad school stats class and studying of stats since then are a bit fuzzy).

Million Dollar Way has a good post that accumulates info as it accumulated yesterday: US Government Agency Announces “Another Bakken” Discovered In North Dakota! USGS Doubles Estimate of the Bakken: 7.4 Billion Bbls Of Recoverable Oil; And That’s The Mean; Top Line Is 11.4 Billion Bbls; Both Numbers Considered Conservative By Some

The biggest change in the estimate is including the Three Forks formation, or layer. Previous estimate only included the Bakken formation. As I understand, there are multiple layers of oil bearing shale in the Bakken field. Three Forks is below Bakken. Look at this comment from the USGS report:

Since the 2008 USGS assessment, more than 4,000 wells have been drilled in the Williston Basin, providing updated subsurface geologic data. Previously, very little data existed on the Three Forks Formation and it was generally thought to be unproductive. However, new drilling resulted in a new understanding of the reservoir and its resource potential.

MDW quotes and links to this comment from The Oil & Gas Journal:

The updated assessment represents a two-fold increase from the 2008 estimate of 3.65 billion bbl in the Bakken, it noted. The update includes the Three Forks for the first time.

USGS’s latest assessment found that the Bakken has a 3.65 billion bbl estimated mean resource—unchanged from 5 years ago—and Three Forks has an estimated mean 3.73 billion bbl. The formations’ combined estimate ranges from 4.42 million bbl, with a 95% chance of production, to 11.43 billion bbl, with a 5% chance.

Since 2008, however, more than 4,000 wells have been drilled in the 2 formations producing 450 million bbl of crude, and Three Forks activity has increased significantly, warranting its inclusion in the area estimate, the US Department of the Interior agency said.

Current mean estimate of Bakken Formation is 3.65B. Now we can add to that the Three Forks with mean estimate of 3.73B.

That means another Bakken’s worth of oil is underneath the current Bakken.

I browsed the official assessment which can be found here. Won’t discuss it because it is way over my head. Only thing I really understood is the Three Forks layer had not been included in the previous assessment.

What Peak Oil?

Not that any more nails are needed for the coffin containing Peak Oil, but this is another. A huge amount of oil is officially included in the reserve calculations now which hadn’t been included before because previously the considered opinion was the oil could not be pulled out of the ground.

Now we have 2 Bakkens worth of oil in the Dakotas & Montana.

published May 1, 2013.

Record increase in U.S. oil production. Lots of shale oil and gas around the world. Explain Peak Oil to me again please. #25

Because of fracking and horizontal drilling, the one year increase in U.S. oil production in 2012 was the largest increase in our history. The bounties from shale could spread to other countries.

U.S. production increase

The Wall Street Journal reports in their article U.S. Oil Notches Record Growth on data released by BP:

In the latest sign of the shale revolution remaking world energy markets, crude production in the U.S. jumped 14% last year to 8.9 million barrels a day,

The 1.04 million bopd increase in production was driven by shale production in North Dakota and Texas.

Check out the cool graph, provided by BP, which shows slow & steady production declines from 1988 through 2008. Then the graph takes a sharp & accelerating turn upward in 2009 through 2012.

And around the world?

The article describes visible hints that the shale revolution could eventually spread elsewhere:

…recent government reports suggest that Argentina and Russia could have enormous deposits of crude oil accessible through fracking.

Via Meadia explains The World is Swimming in Shale by summarizing a new report from the Energy Information Administration which can be found here

The amount of shale oil and shale gas is huge and the expanded study identifies more technically recoverable that previously realized.

Table 5 shows Russia has the largest amount of technically recoverable shale oil with North America having more that Russia (U.S. is #2, Mexico is #7, and Canada is #9).

The report has lots of detail on shale, including the difficulties in extraction and complexities of drilling. Also distinguishes between technically recoverable and economically recoverable. Good background I’d not read before on the variability of production over the distance of a few hundred feet and the need for a sufficient amount of natural gas in the rock to force oil into the pipe.

Lots of hurdles need to be cleared for shale production to increase elsewhere. The geology is more difficult, the governments and economic systems aren’t as favorable to risk taking, and the people and equipment aren’t available.

Peak Oil

To refresh our memory, Peak Oil doctrine as expressed most clearly in the Hubert curve says oil production peaked in the 1970s and will shortly thereafter enter a severe and irreversible decline in oil production. Won’t develop the idea in this post, but either Hubert is wrong or what we are seeing today isn’t really happening.

The outlook from Via Meadia’s concluding paragraph:

Still, it’s clear that there’s a lot more oil and gas out there than the peak oil Chicken Littles were predicting just ten years ago. And as drilling technology continues to expand, the shale boom will become a more global phenomenon than it already is.

published June 13, 2013

Survey of shale oil; also the Peak Oil Myth – #26

Matt Ridley provides an overview of the flood of fracked shale oil in his post, The dash for shale oil will shake the world.

He points to The Shale Oil Boom: a US Phenomenon, a newly released report from Leonardo Maugeri.

I’ve mentioned this in the past, but look again at the explosion of estimated recoverable oil in Bakken:

In 1995 the Bakken field was reckoned by the US Geological Survey to hold a trivial 151 million barrels of recoverable oil. In 2008 this was revised upwards to nearly 4 billion barrels; two months ago that number was doubled. It is a safe bet that it will be revised upwards again.

That growth is not newly discovered fields, or the result of correcting bad estimates. That oil wasn’t in the recoverable category because until a few years ago there was no way to get it out. With horizontal drilling and hydraulic fracturing, there is 50 times more recoverable oil than 18 years ago.

Remember that core concept of Peak Oil doctrine that there won’t ever be a way to get oil out of the ground that we can’t get today?

Busted.

Again.

Look at this survey of the four biggest shale oil plays in the US:

Now the Bakken is being eclipsed …

…even more productive shale formation in southern Texas called the Eagle Ford. Texas, which … has doubled its oil production in just over two years

Then there’s the Permian Basin in west Texas, which looks as big as the other fields…

Monterey shale in California … which, at 15 billion recoverable barrels, could be bigger than the Bakken and Eagle Ford combined…

The numbers are so large they are almost ludicrous.

Rate of production drop

Regarding that very steep dropoff in production, take a look at how astoundingly profitable these wells are:

Mr Maugeri calculates that at $85 a barrel most shale oil wells repay their capital costs in a year.

If you can recover your capital costs in a year, do you really care that your production rate will drop rapidly? If you get your capital back in 12 months, then starting in month 13 the difference between revenue and marginal costs of maintaining the well goes straight to the bottom line.

What if the 500K estimated ultimate recovery (EUR) as spread over 30 years? The well would still be profitable. It would take a decade (just a wild guess) to recover your costs instead of one year. The return is very front loaded. There are very few places in the US economy where you can invest $10M and recover your investment in a year. CEOs of manufacturing or retail companies would love to have those kinds of investment opportunities.

Peak What?

As to Peak Oil doctrine, Dr. Ridley says:

Predictions that the oil supply in the US would peak, loud a few years ago, are a distant memory.

He puts Peak Oil into the myth category:

… there is little doubt that the inevitably ever-rising price of fossil fuels as they run out is, for the third time in my life, proving a myth.

Check out the full article. I’ve downloaded Mr. Maugeri’s booklet and will dive into it soon.

published 7-8-13

New tech is changing undersea drilling too – peak oil #27

Amazing technology developments are making drilling in the ocean easier, reducing cost, and revealing the locations of hard-to-find oil.

Six Tech Advancements Changing the Fossil Fuels Game at Rigzone outlines the changes.

I like this sentence that points out what everyone knows (specifically that a particular well or field only so much oil and will eventually run dry) with what the peak oilers refuse to believe (that there is another field to drill which is now reachable with new technology):

Rig advancements are coming online in tandem with the significantly increased momentum to drill in deeper waters as shallower reserves run out.

Oh, and advancement in technology is just one of several fatal flaws to the “peak oil” foolishness.

Here’s some of the new tech. One of the 6 applies to drilling on land – at least I think it doesn’t apply to deep sea drilling.

Ultra deep drilling, already mentioned.

Subsea production – doing some of the processing on the ocean floor instead of pulling stuff to the surface, processing there, and pushing the fluids back to the ocean floor.

The details are beyond my comprehension, but then that is why I read articles like this – to learn.

E&P companies are expected to invest a whopping $19 billion this year in new equipment to help out.

Multipad drilling – 4, 12, 36 (Devon Energy in Barnett Shale) or 51 (Encana in Colorado) wells from one pad.

Supercomputing applied to massive amounts of data – Putting supercomputers to work processing vast amounts of data allows precise calculation of where the sweet spots are.

Just like with ultrasounds for diagnosis of unborn babies has advanced to 3D and 4D, the geology whizs have 3D and 4D imaging. 3D gives a multidimensional view of an entire field. 4D somehow allows the whizs to calculate how a field is changing over time. It’s way beyond my simple brain how you can figure that out, let alone how that helps you determine where to drill.

Here’s what it looks like now, compared to the ancient days of 20 years ago:

What would have taken decades with supercomputing technology in the 1990s, now can be accomplished in a matter of weeks.

As if we needed more nails in the coffin of “Peak Oil”:

Supercomputing essentially puts the idea of peak oil to bed for the foreseeable future.

Floating LNG liquification plants – Yeah, dropping natural gas to -260F on a platform floating over the undersea field. It’s commercially feasible now. No need to build pipelines from the wells to the shore. No need to build a plant that has a limited life –

…these floating facilities can be moved to a new location once existing fields are depleted.

Shell is building a huge facility that will be moored 200 km out to sea. It will cost around $11B or $13B to construct (yeah, billions) and will be 6 times the size of an aircraft carrier. Capacity?

The facility will produce about 3.6 million metric tons of LNG and 1.3 million tons of gas condensate a year.

Wireless connectivity – Putting lots more monitoring equipment in place that can talk wirelessly to each other. Way over my head why this is a big deal in energy exploration, but it is apparently a very big deal.

Amazing.

All of those things are making exploration and production cheaper, making oil available that wasn’t reachable before, making it economical to get oil and gas that wasn’t economical before, and revealing energy that the geologists didn’t know about before.

If you’ve read this far in my post, you will really enjoy the full article. Check it out.

Can we finally bury “Peak Oil?”

posted 7-20-13

Maybe there is a Peak Oil issue after all. That would be Peak Oil Consumption, not Peak Oil Production – #28

We may be hitting a peak in demand for oil. That’s the idea raised in The Economist two weeks ago – Yesterday’s Fuel.

Between a tremendous surge in natural gas production and car efficiencies, they perceive demand for oil may stabilize instead of continuing to grow.

Thus, we might finally have a real Peak Oil issue:

This is not the “peak oil” widely discussed several years ago, when several theorists, who have since gone strangely quiet, reckoned that supply would flatten and then fall. We believe that demand, not supply, could decline. In the rich world oil demand has already peaked: it has fallen since 2005. (emphasis added)

As the article points out, a Peak Oil (Demand) issue creates problems for Big Oil and OPEC. It would be a good thing for all of us consumers.

Late last week the Washington Post tumbled to the idea – Is peak oil demand just around the corner?

(Yeah, you can pray for me that I pay so much attention to media that I can see {and enjoy} when one media outlet that got scooped plays catch up a few days or weeks later.)

The article points out that making predictions 50 years out is difficult and forecasting energy demands is particularly difficult.

Possible peak in demand would come from rising prices, auto efficiencies, electric cars, and alternative fuels based on the Post article. Not to worry, the author is still a true blue believer in Peak Oil (Production):

And if that [peak oil demand] happens before peak oil production hits, well, that would come as a relief.

posted 8-13-13

Why the Malthusians always get it wrong – #29

“We are about to starve to death” is a recurringly popular idea. And it is recurringly wrong.

Rich Karlgaard surveys the Malthusians of several ages before giving two reasons such folks always miss the boat in his article Bad News Bear at Forbes.

Mr. Karlgaard mentions four people in the we’re-gonna’-starve-this-afternoon camp. I’ll add a fifth.

First, the Malthus who provided the name for Malthusian foolishness:

In papers written between 1798 and 1826 the British economist and demographer Thomas Malthus said the world would run out of food. … Malthus said population growth would lead to catastrophe.

A second severe error:

Stanford professor Paul Ehrlich wrote the bestseller The Population Bomb. It said hundreds of millions of people would die of starvation in the 1970s.

A third:

In 1972 another neo-Malthusian book appeared, The Limits to Growth, which was published for the Club of Rome. This book said economic growth could not go on forever because of scarce resources.

He mentions a current investment manager, which I won’t mention because this isn’t an investment site

I will add a fifth (wrong) Malthusian.

In 1949, Dr. M. King Hubbert wrote that world population would at best plateau very soon but more likely would drop substantially and could decline to the very low levels of agrarian agriculture of the distant past. Don’t take my word for it, check out his writings at “Energy from Fossil Fuels” in Science [scanned, 260 kb] where he said:

Among the inevitable characteristic of this future will be the progressive exhaustion of the mineral fuels, and the accompanying transfer of the material elements of the earth from naturally occurring deposits of high concentrations to states of low concentration dissemination. Yet despite this, it will still be physically possible to stabilize the human population at some reasonable figure, and by means of the energy from sunshine alone to utilize low-grade concentrations of materials and still maintain a high-energy industrial civilization indefinitely.

Whether this possibility shall be realized, or whether we shall continue at present until a succession of crises develop-overpopulation, exhaustion of resources and eventual decline-depends largely upon whether a serious cultural lag can be overcome.

The cultural lag, as I understand it, is the difference between his precise calculation of the total quantity of coal and oil on the planet (which was about to run out in 1949) when compared to our inexcusable, irrational, unsustainable, and silly desire to have a growing standard of living.

What are the two major errors of the Malthusians over the last 200 years?

Mr. Karlgaard identifies them as ignoring:

• Exponential technology. Our brains were evolved to think in linear terms. Human fallacy, then, is to see the future as linear extrapolations. But technology often surprises us with exponential gains, from the steam engine to the microprocessor. (For more on this topic read Abundance by Peter Diamandis [Free Press, 2012].)

We think straight line. Technology develops geometrically or logarithmically.

I’ve seen articles lately suggesting that Moore’s law was in place a very long time before semiconductors existed (no ready links and I am not going to bother looking for one).

• Human creativity. The second Malthusian error is to view people chiefly as consumers, not producers. For most of history the productive side of people has been hindered by lack of education, freedom and access to markets. But those barriers are falling around the world.

People are incredibly creative. When standing on the shoulders of those who came before, people can come up with amazing solutions. As one of many examples, consider hydraulic fracturing and horizontal drilling.

New technology and human creativity open incredible opportunities. Hmm. That’s what I’ve talking about on this blog.

posted 12-15-13 – forgot to add it to this page at the time.

I’d be worried about Peak Oil if… (#30)

If exploration of the third shelf of Three Forks had been completed instead of just started,

if exploration of fourth shelf were done instead of *not* started,

if price increases didn’t make economically unrecoverable oil economically recoverable,

if new technology didn’t make technically unrecoverable oil technically recoverable,

if the geologists had explored below the Bakken and Three Forks formations and found nothing,

if the boundaries of known oil fields didn’t expand as the geologists fully developed a field,

if secondary and tertiary methods didn’t increase the amount of oil recovery,

if new technologies for drilling on land were never again invented (think fracking and horizontal drilling),

if new technologies for drilling under the ocean were never gain invented,

if new oil fields were never again discovered instead of being found regularly,

if people didn’t change their behavior with increases in prices,

if profit seeking entrepreneurial inventors weren’t looking for substitutes because of increasing oil prices,

and

if human ingenuity didn’t exist,

then

I’d agree we have a Peak Oil problem that needs to be ‘solved.’

Those are my thoughts in response to comments from ‘antred’ and ‘Max Sommers’ in a post here.

In the meantime, check out Maugeri’s report mentioned in the post and other recent news – It is very likely that there is still far more oil in the Bakken region than we know about or can get to currently, there is likely more oil in Eagle Ford than Bakken, there might possible be more oil yet to be pulled from Permian using horizontal drilling & fracking than Eagle Ford or Bakken, and Monterrey could have more recoverable oil than Eagle Ford and Bakken combined.

There is a slight possibility the Bakken area, astounding as it is, could be the smallest of those four fields.

Embedded in antred’s question are at least three of the largest fallacies of Peak Oil doctrine:

- We will never find any more oil fields

- We won’t discover new technology that allows getting to oil we couldn’t get to before

- We don’t change our behavior based on changing prices

Phrased differently, the question gets to the definition of proved reserves. My casual description is that is the amount of oil that is economically recoverable with current technology. As more fields are discovered, current fields are fully explored, new technology develops, and prices change then more oil gets counted in the proved category. The worry arises from Peak Oil theory because of the assumption that none of those factors change. If it was possibly true that those factors would never ever change, I’d be worried.

If the incorrect assumptions underneath Peak Oil theory were actually correct, I’d be very worried.

posted 8-20-13

Another 600 million barrels of recoverable oil the experts didn’t know about a year ago – Peak Oil #31

Add a fresh discovery of up to 600,000,000 barrels of oil 300 miles off the Newfoundland coast to the list of oil that no one knew existed before it was found, evaluated, and an estimate made of recoverable oil.

One of a long list of fatal fallacies in Peak Oil doctrine is that no more oil will ever be discovered.

The only way to project the day we run out of oil is to calculate how long it will take to use up what we know about at the rates we are using oil. That assumes there won’t ever be another field discovered. Having made that fatal assumption, one can then conclude we are in Peak Oil.

That is, until Statoil of Norway comes along and finds another half billion barrels in Bay du Nord.

And until another field is discovered next week or next month. And excluding 200 million new barrels in the Mizzen field, announced in January.

Check out Reuters’ article: In Canada’s North Atlantic, New Oil Frontier Shows Life Beyond Shale

Eventually, we will bury Peak Oil doctrine, but in the meantime it is still necessary to point out the folly and fallacies contained therein.

posted 10-1-13

A simple explanation why we will never run out of oil – Peak Oil #32

In one sentence: Some other energy source, perhaps fusion, will provide our energy needs before we actually use up all the oil.

That is my summary of the comments by Professor Bernard Weinstein in a presentation made in North Dakota, as summarized by The Dickinson Press: Energy expert: World will ‘never run out of oil’.

We simply do not know how much oil is recoverable. Check out these two comments:

“We’ll never run out of oil,” … “There are five factors that go into the amount of oil that’s available: geology, technology, price, capital and policy. “

and

“We don’t really know how much shale oil and gas is recoverable because the numbers keep going up.”

As technology improves, as geologists learn more about the current fields, and as new fields are discovered & explored, more oil is counted as recoverable.

Here’s how the professor explains his conclusion we will never run out of oil:

“Will we ever have a peak shale level?” Weinstein asked. “I don’t know. There very well could be but by the time that happens, we’re going to have fusion or something else in the place of fossil fuels. A hundred years from now, we probably won’t be using much in the way of fossil fuels. Certainly for the next century, we have plenty of fossil fuels around the world under any scenario.”

That gets back to the technology issue. Just like the nearly one million barrels a day of production from Bakken wasn’t known a decade or two ago, we don’t know what the next round of technology will produce. He believes that something we don’t even know about will replace all the oil we are using a long time before we actually start draining the bottom of every single oil field in existence.

It is hard to get my brain around the idea we won’t ever run out of oil. But it makes sense the more I read and learn. Something else will replace oil before we run out of oil.

Posted 11-14-13.

The shale revolution. Or, what Peak Oil? #33

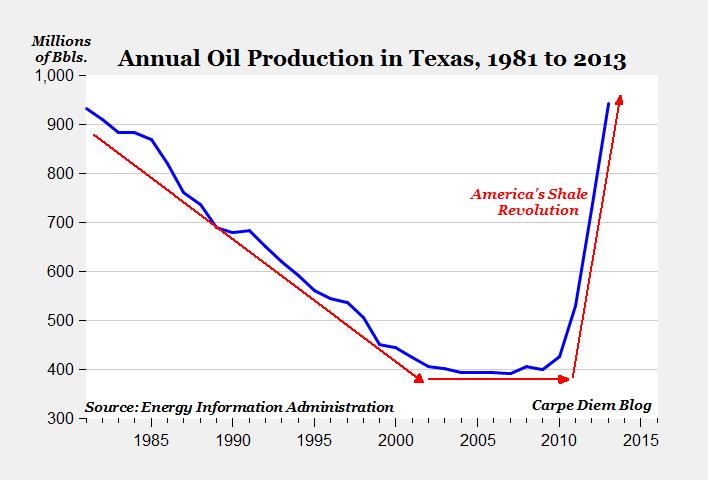

The change in oil production in the last few years is astounding. For perspective, look at the following two charts by Prof. Mark Perry, from his Carpe Diem blog. Both graphs used with permission:

Oil production in Texas:

From The remarkable rise of Texas crude oil: The state produced nearly one billion barrels last year, and 34.5% of all US crude. Just under a billion barrels. That’s around a third of US production.

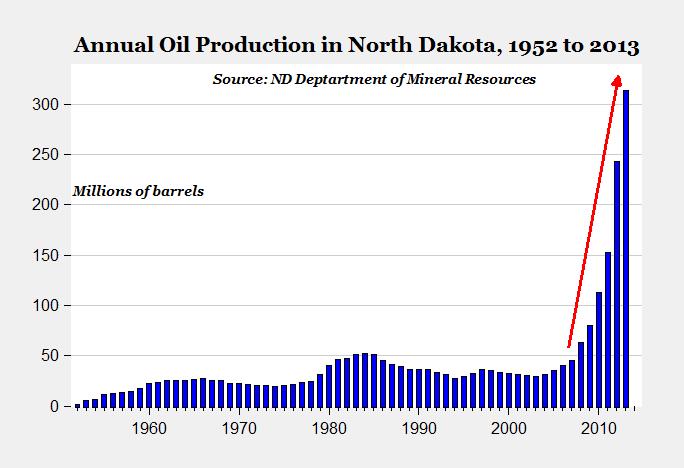

Oil production in North Dakota took off in 2008:

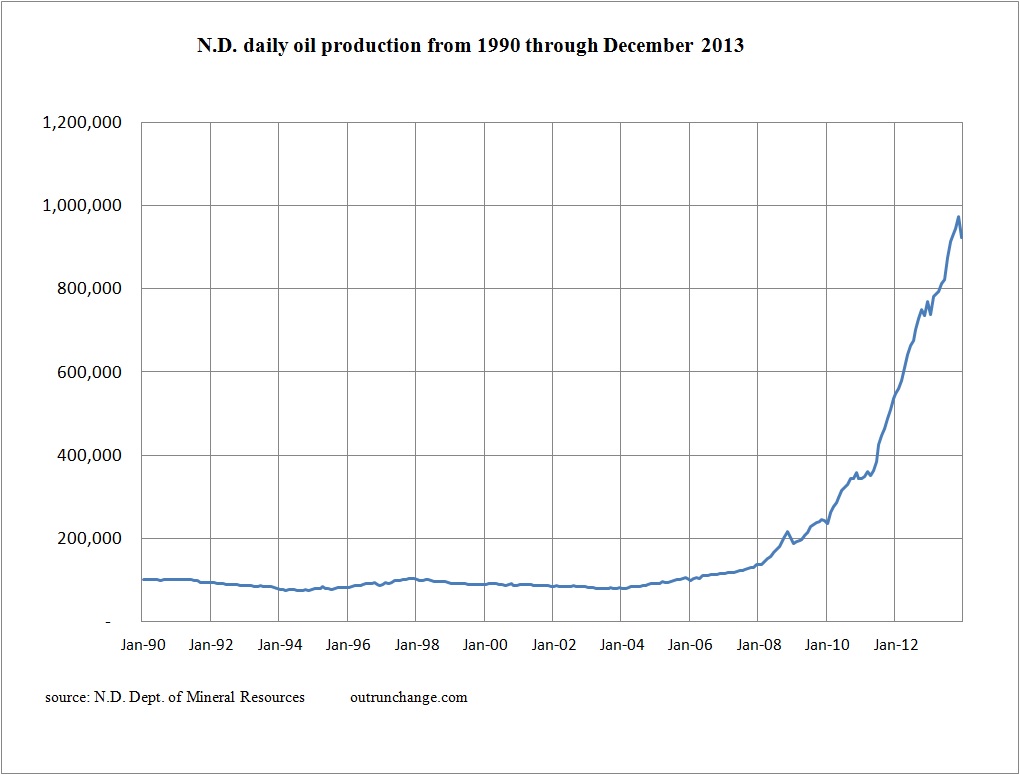

Here’s my graph of North Dakota oil production by month since 1990.

Oil production in North Dakota isn’t recovering from a long-term slide like Texas. The graph of production in Texas looks like a U or a backward check mark. Production graph in North Dakota looks more like a rocket.

And there are more fields that will likely have long-term production graphs that look like the above two states.

As the good professor often asks: Peak what?

Posted 3/5/14

Shale oil revolution drives surge in domestic production – Peak oil #34

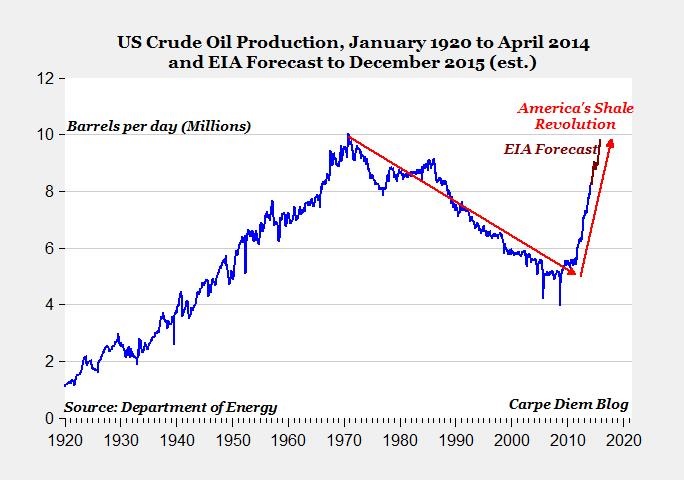

Brace yourself for this chart, used with permission from Carpe Diem: Energy chart of the day: America’s shale oil revolution will reverse a 40-year decline in crude oil output in just 5.5 years.

US energy production grew from around 1 million barrels of oil per day (1M bopd) in 1920 to a high point of 10.04M bopd in November 1970. A 40 year decline dropped production to around 5M or 5.5M bopd in 2010.

The shale boom has skyrocketed production to 8.3M bopd in April 2014. The EIA projects production will be pushing 10M bopd at the end of 2015.

Astounding.

What Peak Oil?

Remember this can’t be happening according to Peak Oil doctrine.

Dr. M. King Hubbert, PhD, outlined the core tenets of Peak Oil theology in 1949. He calculated the precise amount of oil in the earth, projected the exact production curve, and calculated the inevitable, unavoidable, permanent, perpetual drop in production as it approached zero.

So that you know there is only the merest whiff of exaggeration in my description of Peak Oil doctrine, you can find links to his original writings in my posts here and here.

Here is an overlay of the Hubbert curve with the graph of actual production.

Dr. Hubbert calculated that US production of oil would be somewhere around 0.7M bopd right now (can’t get an exact number from the graph).

Umm. No. Not quite.

I think that a prediction of about 0.7M bopd is radically divergent from 8.3M bopd. Only off by a factor of about 12. I think we can all agree that is a material error.

Can we finally call that a complete fail?

Explanation for the massive failure seen in the Hubbert curve is that the current production won’t last. Modern disciples of Dr. Hubbert tell us it is a blip. It will collapse next month or next quarter. Any year now the production will fall off the cliff, will get back to the Hubbert curve, and we draw the last drop of oil a small number of years after that.

We need to finally bury Peak Oil theory.

And if you think I exaggerate that Peak Oil true believers are still around, check out any of the multiple websites that are pushing Dr. Hubbert’s theory. Yes, there really are active Peak Oil blog sites operating today.

Still not convinced? Look at just about any discussion of fracking articles on the ‘net. The Peak Oilers are alive and well.

posted 5/21/14

Encore question: What Peak Oil? – #36

Some commenters on the ‘net did not agree with my previous post which combined the U.S. production of crude oil with natural gas (dry) and NGPL.

Fair point.

I redrew the graph showing crude oil only.

Will draw Dr. Hubbert’s peak natural gas curve and actual production another time.

Update: The time is the next day. See the graph of actual versus predicted for natural gas: What Peak Natural Gas? #1. Can you say busted?

Peak Oil

Peak Oil theory is outlined by Dr. M. King Hubbert, starting in his 1949 article, discussed here.

For anyone tuning into the discussion, here is the theory in very brief, key terms: Peak oil production will be reached at a determinable date, after which production will enter an inevitable, permanent decline. The rate of decline is calculable. The graph of production is calculable. Dr. Hubbert calculated the total amount of crude oil under the surface of the earth and within the U.S. remaining to be extracted. He made the same calculations for natural gas. He also calculated the total amount of crude to be extracted from within the state of Texas. Update: When the production appears to hit a peak, that is the point at which 50% of the resource has been extracted. Future production will be about equal to the sum of actual production and proven reserves at that point.

Graphs of Peak Oil production resemble a bell curve with a peak in 1970. His landmark 1956 paper (available here) calculated the amount of total U.S. crude oil production through 2050. The peak of the 200 billion barrel curve is about 1970 with a gradual decline. In about 2010 or 2011, the production level is one-third the peak level.

Don’t take my word for it – see Figure 21.

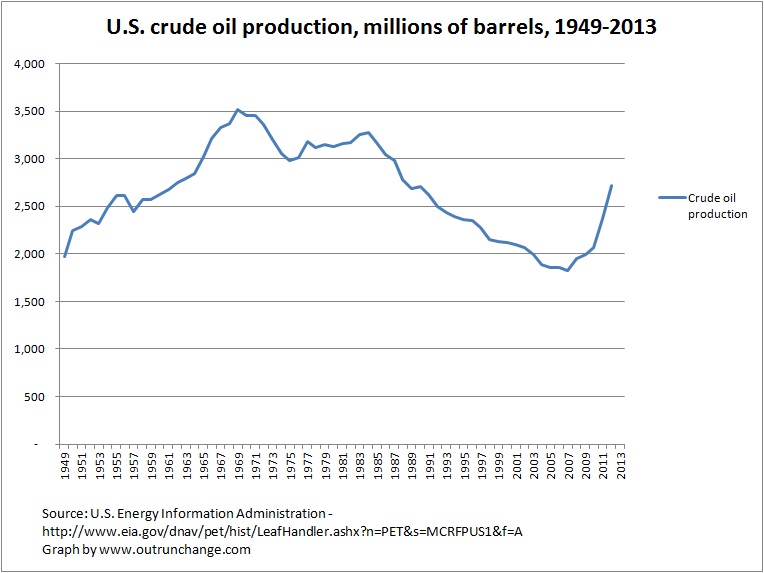

With that in mind, consider the following graph:

Just a few questions:

If you are new to this discussion, here are a few questions for you to consider:

Does it look like the production after the high point looks like a mirror image of the runup in production before the high point?

Does it look like the production in 2010 or 2011 is about one-third of the high point on the curve?

Dr. Hubbert calculated the total crude oil production in the U.S. through the year 2050 would be between 150 billion barrels on the low side and 200 billion barrels as an upper limit. The EIA tells us that cumulative production in the U.S. through the end of 2013 was 208.9 billion barrels. Has production of crude oil in North Dakota and Texas and California and Alaska shut down this year?

Are we out of oil? We should be based on the professor’s calculations.

If you are new to this discussion, please don’t take my word for what Peak Oil doctrine says.

Please check out the Peak Oil sites. Those that are still operating will give you plenty of details.

By the way, comments are allowed on my blogs if they are professional. Ad hominem attacks are not professional.

posted 7/27/14

Peak Oil debunked over and over and over again – #37

The Wall Street Journal has a delightful editorial today on Peak Oil. That prompted me to pull together several articles I’ve been wanting to talk about.

Just in case you wondered, the devotees of Peak Oil are alive and well. Many of the big names are reportedly in hiding. Do a few minute search on the ‘net and you can still find a lot of them. I’ve had a dialogue over the last few days with one gentleman on my blog.

Haven’t pointed out the foolishness of Peak Oil doctrine since July, so it’s time to look again. Here we go…

12/5 – Wall Street Journal – ‘Peak Oil’ Debunked, Again – And again. And again.

Gotta’ love the opening paragraph:

It has been 216 years since Thomas Malthus gave birth to the idea that mankind’s appetite for natural resources would outstrip nature’s capacity to supply them. There have since been regular warnings that the world is running out of soybeans, helium, chocolate, tunsgsten, you name it—and that population growth has become unsustainable. The warnings create a political or social panic for a while, only to be proved wrong.

Peak Oil is the current fad of ‘we will run out by the day after tomorrow.’

The run up in oil over the last several years to a high of around $112 this past summer has encouraged entreprenuers, or perhaps we should call them petroprenuers, to figure out how to get massive amount of shale oil out of the ground.

Production in the US has been surging for years.

Editorial says the Saudis are fine with letting prices fall since it will hurt their geopolitical foes, such as Iran and the drillers in North Dakota and Texas.

Editorial takes a shot at Paul Krugman’s prediction in 2010 that Peak Oil had arrived, but points out that criticizing him is like shooting fish in a barrel.

Such false predictions have been around a loooooong time. WSJ quotes Daniel Yergin relaying this story:

… in 1885 the state geologist of Pennsylvania warned that “the amazing exhibition of oil” was “a temporary and vanishing phenomenon—one which young men will live to see come to its natural end.”

Um, check with John D. Rockefeller on production levels and his grandchildren on that timeline.

There are so many fallacies in all the Malthusian tales. I’ve spent time on this blog going into some detail in general and great detail on the Peak Oil variation.

Here’s yet another way to explain the errors, from the editorial:

The happy ending is that the notion that the world is running out of resources always fails because the ingenuity of entrepreneurs, spurred by necessity and incentive, always exceeds the imagination of doomsayers. So we are learning again, and let’s hope memories will be longer this time.

11/5 – Forbes – Lessons from the U.S. Energy Miracle – Steve Forbes describes the highlights of a speech by Daniel Yergin. The vast and rapid expansion of shale energy puts the daily production of oil in the US ahead of every country in OPEC except Saudi Arabia.

Some lessons:

Entrepreneurship trumps all. … But entrepreneurs are never constrained by what is.

Governments kill innovation.

Mineral rights, the U.S.’ not-so- secret superweapon.

Private ownership of what’s underground is a huge part of the change. Hmm. Private ownership. Economic progress. They are tightly linked.

Energy is a tough business with tight margins.

It is tough to make money in oil, but when you do, there are fortunes to be made. Lots and lots and lots of people fail. I’m fine with that.

9/24 – Carpe Diem – Peak What? The shale revolution is just getting started – Prof. Perry points out that innovation and expertise have driven the shale revolution. Not only have innovation and expertise not stopped, they are accelerating.

Check out his comments on innovation, expertise, and competition:

There are two important reasons why the shale pessimists are wrong: innovation and expertise. The shale revolution was launched because of breakthroughs in a range of technologies, most notably advances in horizontal drilling paired with advanced hydraulic fracturing.

Competition and innovation drive the oil and gas industry, particularly in the U.S. The innovation that unlocked the nation’s oceans of shale resources hasn’t stopped but instead has actually intensified. New ideas, technologies and ways of cracking the shale code emerge daily. And America’s amazing “petropreneurs” have obviously gotten very good at what they do.

Article says efficiency is increasing in Bakken. And Eagle Ford. And Marcellus Shale. Time to drill a well is falling and the output from each well is rising. Think about what that does to the breakeven point. I dare say the Saudis are not taking that into consideration.

Just read a comment in the last few days at Million Dollar Way (won’t bother to find link) that one driller just put in a three section well. That means a horizontal lateral around 15,000 feet long after drilling down 8,000 or 10,000 feet. That will be an amazing payoff for drilling in relation to total oil that will be produced.

It is a long shot, but Mexico recently reformed their energy laws to allow something resembling free markets and private property rights. That could open up their shale resources. I do hope they follow through. The blessings to the people of Mexico would be incredible. Blessings to the rest of the world would be wonderful too.

Mexico just passed groundbreaking energy reform after 75 years of a state-run energy monopoly and our neighbor to the south is now poised to join the shale revolution.

Prof. Perry foresees the shale revolution continuing. He says

…rapid gains in production and drilling efficiency, and the steady march of technological innovation all tell a much different story of a new, unprecedented era of energy abundance. Instead of moving toward its twilight, the shale revolution is likely only in its opening act. Stay tuned.

So yet again, we ask:

Peak what?

posted 12/5/14

By the way, in case it isn’t obvious, the above is: Copyright © 2012, 2013, 2014 James L. Ulvog