More news on the energy market. Supply and demand may equalize soon. Maybe.

Saudi Arabia may have bit off more than they can chew. The US and world markets will benefit, along with everyone who consumes energy.

7/1 – AP at Bakken.com – US energy secretary sees oil market coming into balance – The Saudi oil minister thinks worldwide demand will catch up with production by around the end of 2016. The US Energy Secretary thinks it will go into 2017, perhaps another year. Prices likely to go up as demand and supply stabilize.

7/18 – Wall Street Journal – Oil Prices Steady but Products Glut Looms – There are hints in the air that several markets, such as gasoline, are oversupplied, which will put downward pressure on crude oil prices. Another indication that nobody can predict the future.

7/31 – Ambrose Evans-Pritchard at the Telegraph – Texas shale oil has fought Saudi Arabia to a standstill – This is a must-read if you follow my blog.

Twenty months ago Saudi Arabia launched a price war, generally considered to be an effort to take out American shale producers.

Didn’t quite work out that way.

Mr. Evans-Pritchard says what has been stopped instead is something in the range of $1.8 Trillion of exploration over the past two and next four years which will keep something in the range of 4M or 5M barrels of oil a day in the ground. Lots of multi-billion dollar projects that take a decade to develop have been shelved.

Here’s the implication that occurs to me: as the market rebalances and demand picks up, who will pick up the slack? Tight oil producers. In the US. Primarily Bakken and Eagle Ford.

Making things far worse for Saudi Arabia and OPEC is that productivity has increased so radically in the tight oil world that American producers will easily be able to produce new oil at prices far below what Saudi Arabia and other OPEC countries need in order to balance their national budgets. Think about that – drillers in the US will be able to beat OPEC on price for a really long time.

As yet one more indication of what has happened in terms of productivity, consider the decline rate mentioned in the article; that is the drop in production after the initial 4 months of production:

- 90% – 10 years ago

- 31% – 2012

- 18% – today

That is astounding.

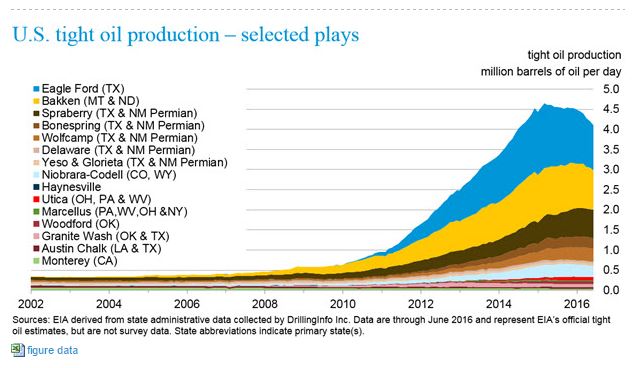

Check out the production graph at the top of this post, courtesy of EIA (public document):

Tight oil production was running something in the range of 0.5M bopd in 2009. Bakken was the first to take off, with Eagle Ford following a few years later. Production hit a high spot of just over 4.5M bopd in 2015 before dropping back to about 4.0M bopd now.

Leading production areas are Eagle Ford and Bakken. Sprayberry is in third place with production at the level of the Bakken field in 2012 or 2013.

Absolutely astounding.