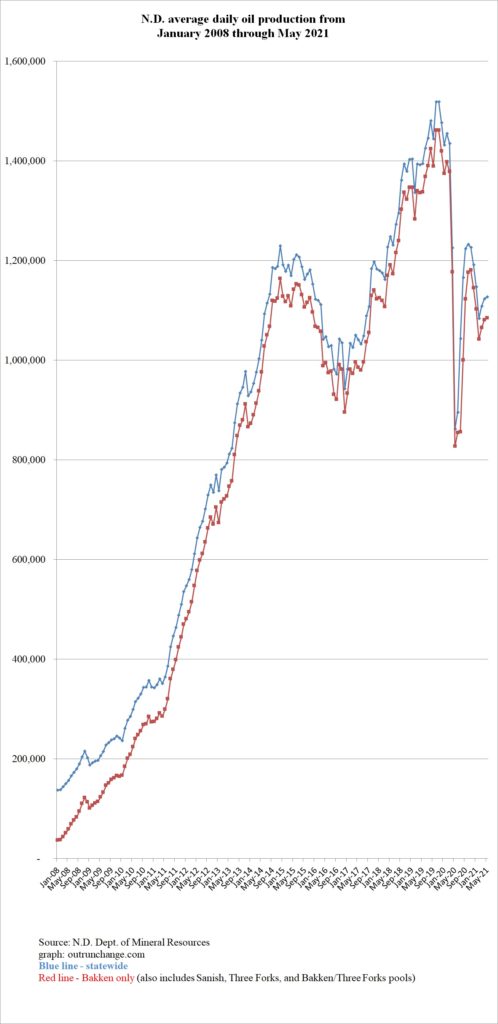

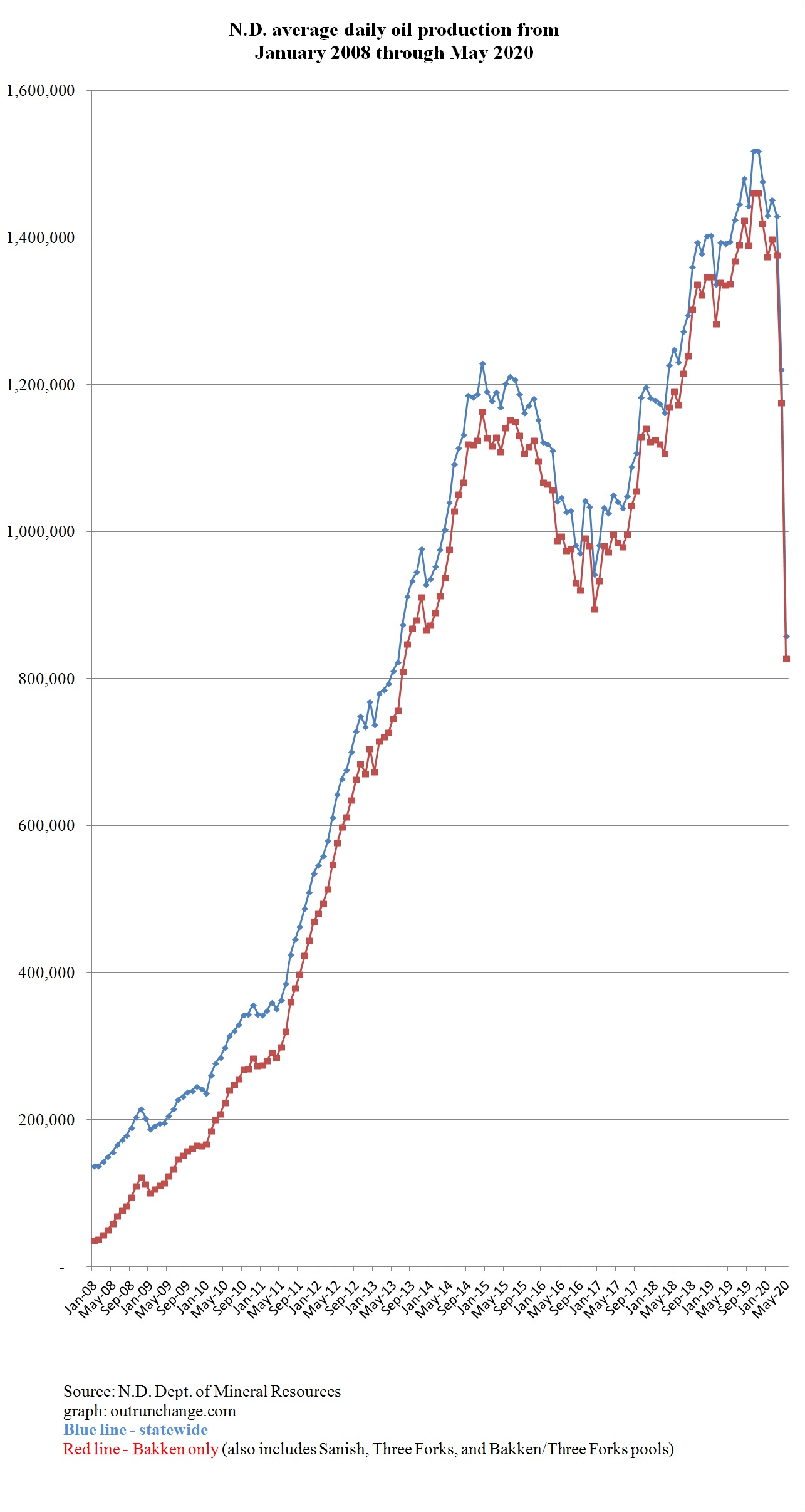

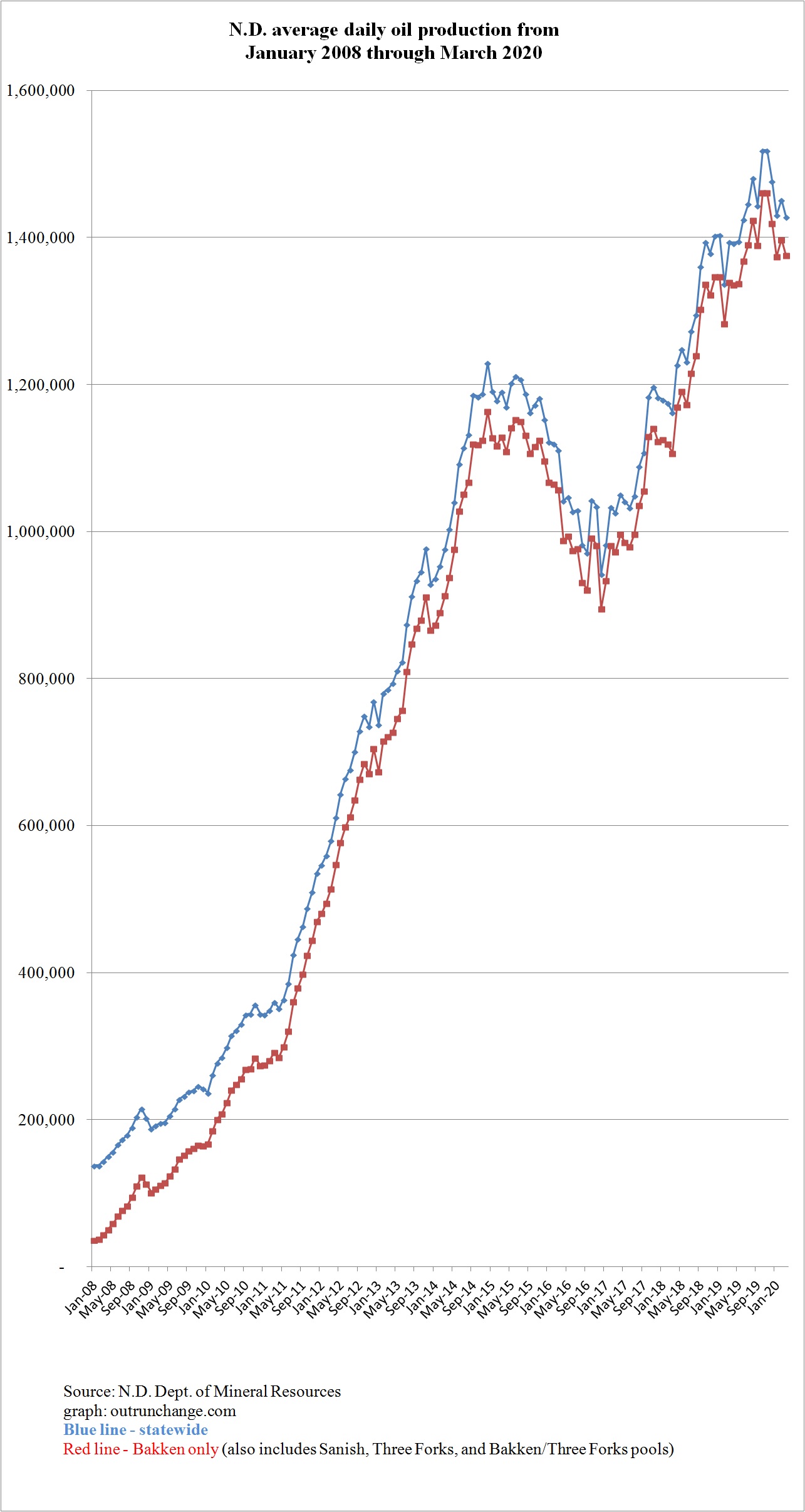

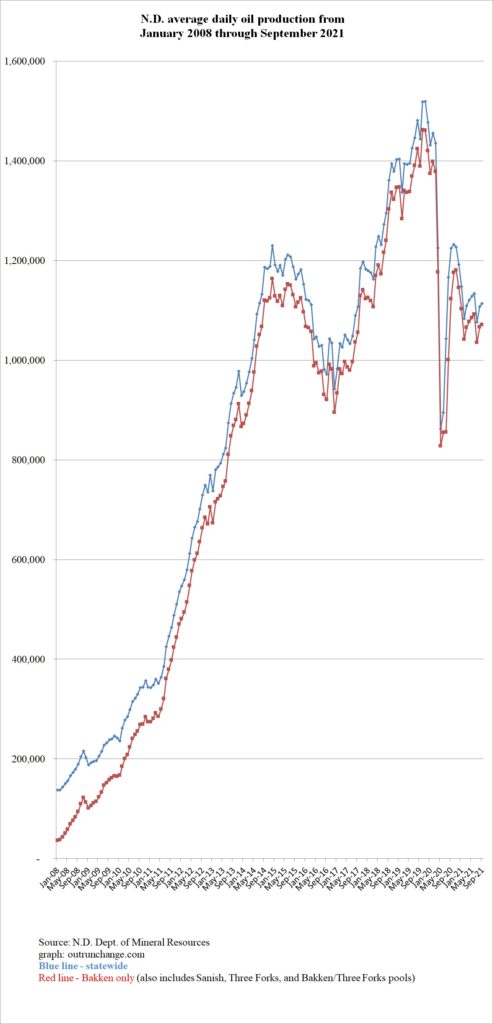

Crude oil production averaged 1,113,410 barrels of oil per day (BOPD) in September 2021.

Production has been in the range of 1.1 or 1.2 million BOPD since August 2020. Production was 1.44M BOPD back in March 2020 before the pandemic hit. Production quickly dropped to 0.9M in both May and June 2020 before climbing to around 1.1M since then.

Graph at the top of this post shows average production since January 2008. The blue line is total production in the state with the red line showing production from the Bakken pool only, which also includes the Sanish, and Three Forks pools. The blue line essentially excludes the old wells and areas which have been in production since before the current boom started in the 2008 timeframe. You can easily see the radical impact of horizontal drilling and hydraulic fracturing.

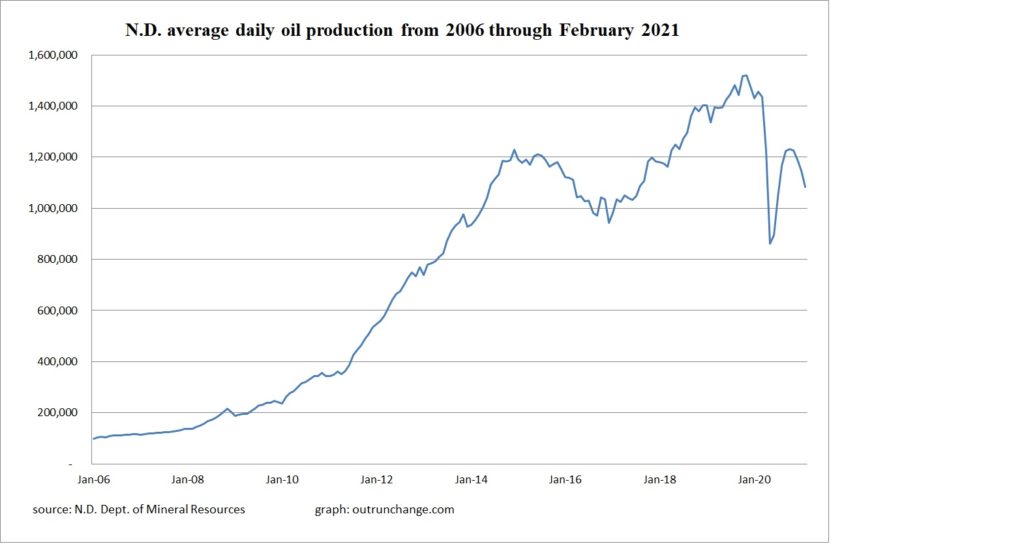

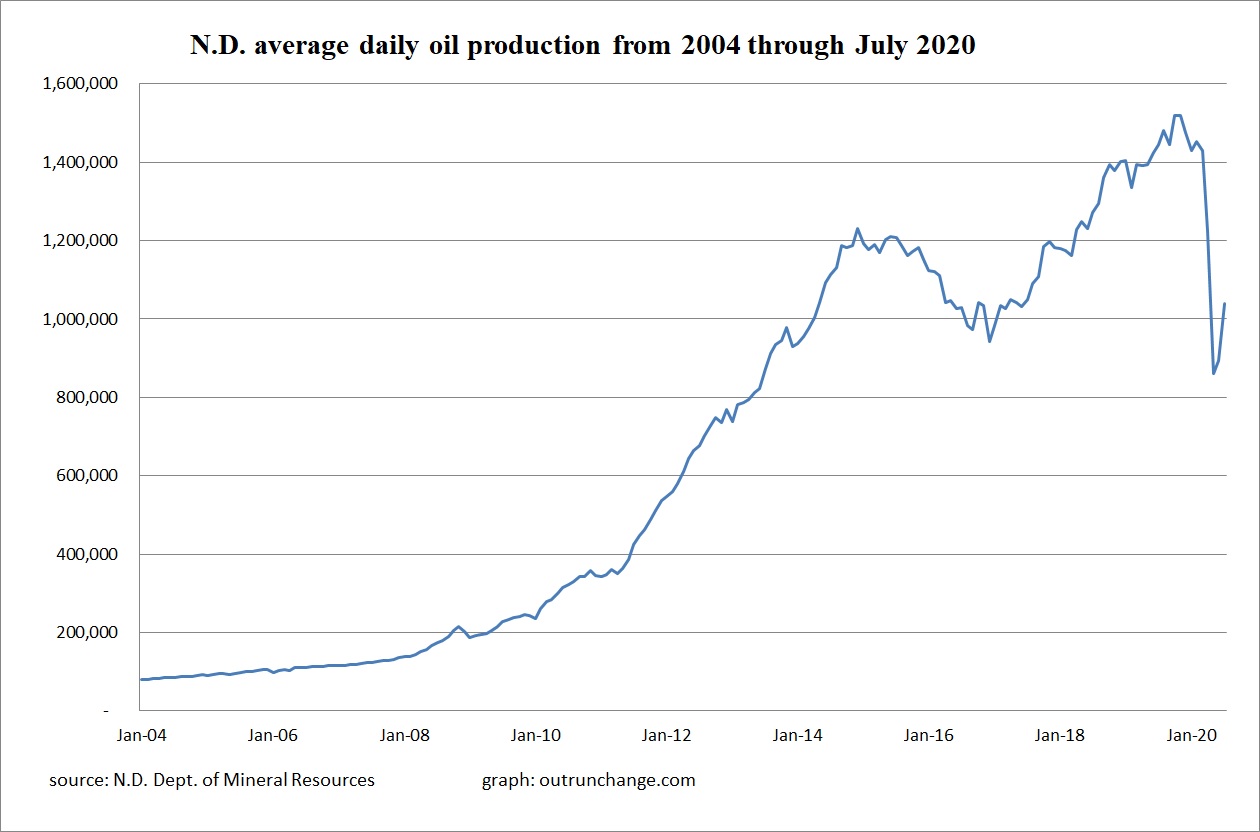

For a longer-term perspective, check out the average production in the state since 1990:

Continue reading “Production of crude oil in North Dakota in September 2021 has been flat for the last 14 months.”