First article below says that predicting oil prices is a fool’s errand. The payoff of trying to do so, it seems to me, is it requires diving into the dynamics and trying to understand the production and demand aspects underlying the price of oil. Second article below delves into the dynamics.

11/28 – The Million Dollar Way – Musings on Shale as We Anticipate the “OPEC Meeting” – Discussion points me to the next article, which I would have missed otherwise.

Mr. Oksol agrees with the major points: OPEC’s effort (meaning Saudi Arabia) to shut down shale producers has been unsuccessful. They tried this once before back in the 1980s.

On the second point, he agrees shale producers will respond fast to any rise in prices.

Author agrees that the phrase “big bet” is an acceptable way to describe the Saudi strategy to take out shale producers but thinks a more accurate description would be “trillion dollar mistake.” As for me, either description works well.

11/28 – Mark Mills at Forbes – Shale Wars: Whither Oil Prices As Saudi Arabia Lets The Big Bet Play Out? – The author, to whom you need to pay serious attention if you are otherwise reading my blog, asks two questions on his way to sort out where oil prices are going:

- How much damage has Saudi Arabia caused the shale drillers? In other words will they be able to respond to any change in prices are they out of the game.

- If the answer is yes, how fast will shale drillers be able to respond?

On the first question, a lot of shale drillers have left the industry. But not all. Not even most. A few things to keep in mind:

- There are a tremendous number of players still around.

- Even more importantly none of the equipment has melted.

- The knowledge to drill at radically higher productivity has not faded from memory.

- The pipeline and rail infrastructure has not been disassembled.

- The rock-trapped oil hasn’t moved.

- The land leases haven’t expired.

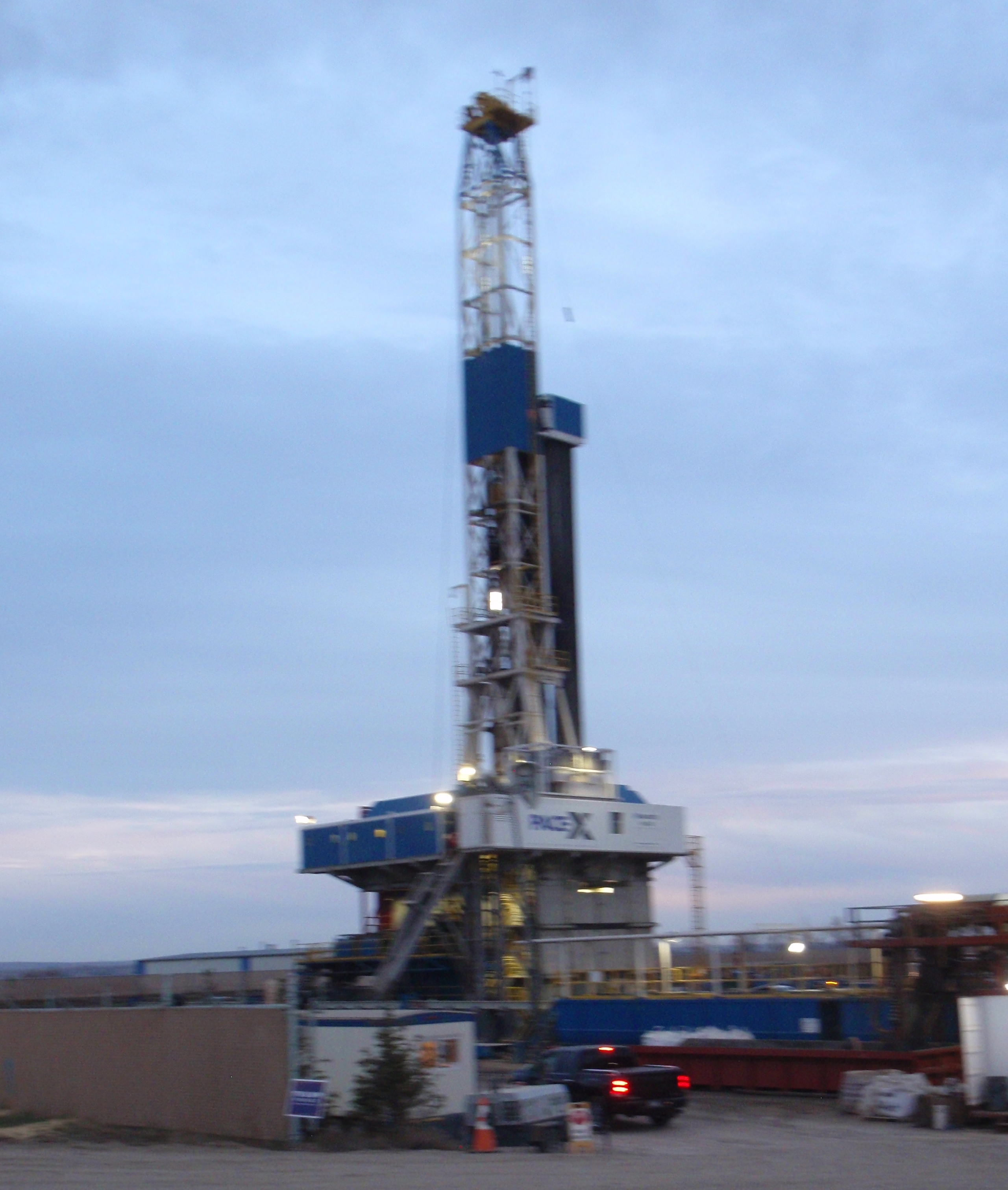

- I have seen photos of lots of drilling rigs parked on empty land. They can be trucked back quickly.

While I was driving around the Williston area recently (Thanksgiving week) I was amazed at the huge number of oil field trucks that are parked in yards. Water trucks. Pumping equipment. A couple dozen trucks for which I don’t know the purpose parked in one yard. Dozens more of a completely different kind of vehicle in another yard. More water trucks.

I will guess that a huge number of the people who left Williston can be back in state within a few days or few weeks of getting a phone call saying their old job is open and asking when can they start. If I’m reading the bumper stickers and license plate correctly, there is a guy down the street from my home who is staying with his folks while he waits for a phone call.

Mr. Mills points out that the massive amount of untapped oil and shale fields are in a country with very liquid and fast responding capital markets. Thus financing is out there to fund those projects with one- or two-year paybacks.

So no, OPEC has not taken out the US shale industry.

On the second question, Mr. Mills indicates the shale industry can respond fast to any rising prices. Mr. Oskol agrees. If it makes any difference to anyone, I agree as well.

Article points out there has been an upturn in drilling rigs in the field with just a small increase in prices of late. He thinks a significant price increase, to the range of $60 or $75, will draw a huge number of players into the market.

Just a few factors that come to mind, based on the article and what I know from elsewhere.

The current number of wells in Drilled UnCompleted (DUC) status in North Dakota is 891. This is also called the fracklog. Across the country there are about 5000 wells in DUC status. Half the work is done on those wells, in other words the drilling is complete. What needs to be done is the other half of the work of fracking the site. Lots of those wells can come on-line really fast. A whole bunch of them could start producing quickly.

A lot of wells have been intentionally throttled back to reduce production. Better to keep some of the oil in the ground waiting for a higher price than go for maximum production at a lower price. I don’t understand all the technical details, but I’ll make a guess that those wells can increase production with a quick turn or two of the wrench on the pump jack. I dunno, maybe it only takes a mouse click.

A lot of wells have been closed in temporarily. Like the wells that have been throttled back, production for those wells can change by tomorrow afternoon or maybe the next morning.

Productivity of wells has increased dramatically in the last few years. Current rig count in North Dakota is bouncing around at 36 to 39. It will not take a huge number of rigs to increase well completions back to the level when 200 rigs were in the field.

Also, keep in mind that every well completed now will have higher output than any well completed a few years ago.

So Mr. Mills thinks shale drillers will be able to increase output fast. The increased output will affect prices very quickly. His estimate is that in 2017 we will see oscillating oil prices.

Mr. Oksol agrees with the rapid run up in production. He makes a very good point. I checked my notes and found oil production dropped from a high water mark of 1.23M bopd in December 2014 to 0.97M bopd in September 2016. Cutting back rigs from 195 in 9/14 to 33 in 10/16 only dropped production 0.26M bopd over the course of two years.

Mr. Oksol’s guess is that with unthrottled drilling and production, North Dakota could generate 2.0M bopd in short order. Based on past history I would agree. It might take two years to cross the 2M bopd point but that would be doable. Increased production in North Dakota alone would be enough to reduce oil prices worldwide well before crossing the 2M point.

General background

The article provides great background – 95% of the power used to move everyone and everything on the planet comes from petroleum.

We are consuming more oil on the planet than any time in history and all predictions are demand will increase.

For the five largest markets in the world – Europe, China, North America, India, and Japan – only one will see a reduced dependency on imported oil. The exception, if you had not already guessed, is North America. And that is due to shale. Those five areas make up 75% of the worldwide GDP.

The value of oil traded on the world-wide market is bigger than the value of all minerals and metals. The oil market is bigger than agriculture, according to the article.

It makes sense to pay attention to the massive changes and turmoil in the oil market. If you are a consumer, and like to have lots of gasoline readily available for your car, and you like low prices, and you want to see the economy expand, the future is looking bright.