As I have long been predicting, the legalized marijuana industry in California is struggling. The illegal market is still dominant. Tax collections are far below projection.

Articles for your consideration today:

- Legal-marijuana executives report their industry is on verge of collapse.

- Tax collections fall short of projection.

- Actual tax collections in state of California.

Previous articles on burdens the state of California has placed on the legalized industry can be found by clicking on the regulation experiment tag.

PJ Media – 12/18/21 – Pot Industry in California on Verge of Collapse – Entertaining opener:

“… getting the government involved in anything either makes it more expensive or ruins it completely.”

Embrace the power of “and”– – government involvement makes things more expensive AND ruins it.

KTLA television station in Los Angeles reports two dozen executives from the legal marijuana industry sent a letter to the governor. They assert “our industry is collapsing.”

What do they want?

Not much.

Just an end of the cultivation tax paid by growers, an excise tax holiday for three years, and a lot more retail shops across state, which means repealing the law that allows local governments to ban dispensaries. Like I said, they don’t want much.

Article explains why there is so much pressure on the legal side of marijuana sales. The state government is trying to squeeze every penny out of the legal market through high taxes while at the same time backing off on enforcement on the illegal market because of concerns over racial justice.

Rephrased, here’s the plan in California. Squeeze every dime out of the legal side through taxation or the same time imposing massive regulations on legal growing, processing, and sales. Because people of color disproportionately get in trouble and suffered disproportionate penalties, make it easier for illegal operators to operate.

No wonder the legal market is in such distress.

Author also explains state is trying to restrict the supply of legal marijuana in order to force prices high. Unstated, the goal that would be to drive up tax collections.

Well, the state is succeeding. Article reports legal marijuana from a legal dispensary costs twice as much as illegal stuff from your sometimes-friendly neighborhood dealer.

I have no first-hand or secondhand knowledge of pricing in either the legal or illegal market. What I do know is every report I read indicates prices in the legal market are dramatically higher than the illegal market. That is a surprise to no one who has actually thought about the issue.

The current wild guess on the sales of marijuana in the state is $8 billion.

Los Angeles Times – 10/17/19 – Column: California’s pot tax came in way below projections – and not for the reason you think – Projections during the debate on Proposition 64 to legalize recreational marijuana back in 2016 were that tax collections would run $1 billion each year.

Actual amount for the year ending 6/30/19 was $288 million. Projection for year ending 6/30/20 was $359 million.

Author reports actual collections are running below forecast in most states. The exception is Colorado and Nevada which beat the expectations but the rate of growth is shrinking.

Contention from the article for a major reason why tax collections don’t hit forecasts is the estimated volume of the marijuana market is dramatically overstated. Hard numbers of illegal activity are possible to gather which leaves us with wild guesses. Author points out the starry eyed guesses are either from marijuana legalization advocates or government agencies with a vested interest for increased enforcement budgets or wanting bragging rights on the size of drug seizures.

Author points out the arguments in favor of legalization stand even if the size of the market is overestimated by unknowable amounts.

Legislative Analyst’s Office, part of the California Legislature – 8/23/21 – Cannabis Tax Revenue Update – Detail of tax collections:

- $527M – total state tax revenue for FYE 2020

- $817M – estimated total of full year of FYE 2021

Most recent two quarters:

- $197M – third quarter of FYE 2021

- $213M – fourth quarter of FYE 2021

The fourth quarter total of $213M consists of:

- $172M – retail excise tax

- $40M – cultivation tax revenue

The full year amounts for FY 20 consists of:

- $652M – retail excise tax

- $165M – cultivation tax

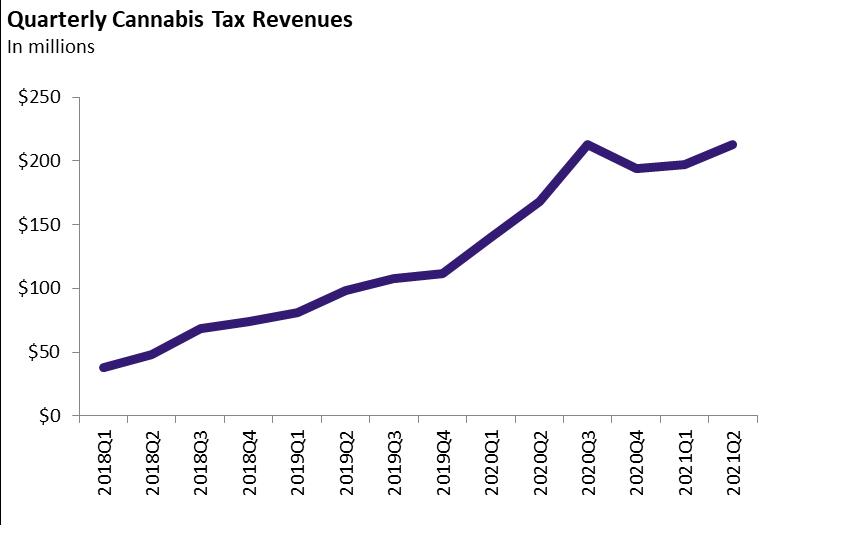

Graph at top of this post shows the quarterly sales tax revenues as provided by the Legislative Analyst’s Office:

You can see from the above hard numbers that revenue for the year ending 6/30/21 was $817M. You can tell from the graph above this is a significant increase from 2020 and even more dramatic increase from 2018 and 2019.

Tax collections seem to have increased during the pandemic. Whether there is a causal relationship driven by isolation and destress, or merely correlation driven by natural growth in legal market is not known at this point.

The ongoing pandemic might drive tax collections over the $1 billion point in FY 22. That would merely be five years and one pandemic into the marijuana legalization experiment. Obviously not that billion-dollar bonanza every year forever which was one of the arguments in favor of legalization.

One caveat to all of these numbers, including whether tax windfall is over or under the 1 billion point is the above numbers do not include retail sales tax. I have not yet come across articles which quantify those amounts.