In December 2015, crude oil production in North Dakota dropped from a slightly revised 1,181,786 bopd in November to 1,152,280 bopd in December, for a 2.50% decline.

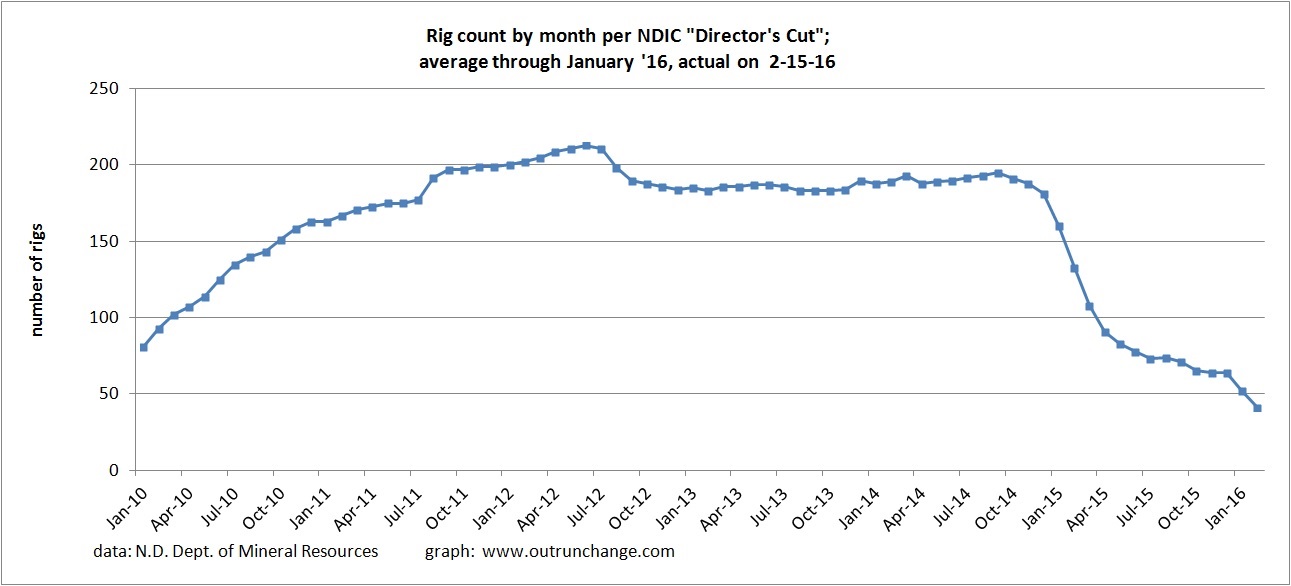

Completed well count was 76, which is a substantial drop from the 119 to 123 range in July through September. From August 2011 through December 2014 there were anywhere from 180 up to 213 rigs running. During that time, the average rig count was 192, by my calculations.

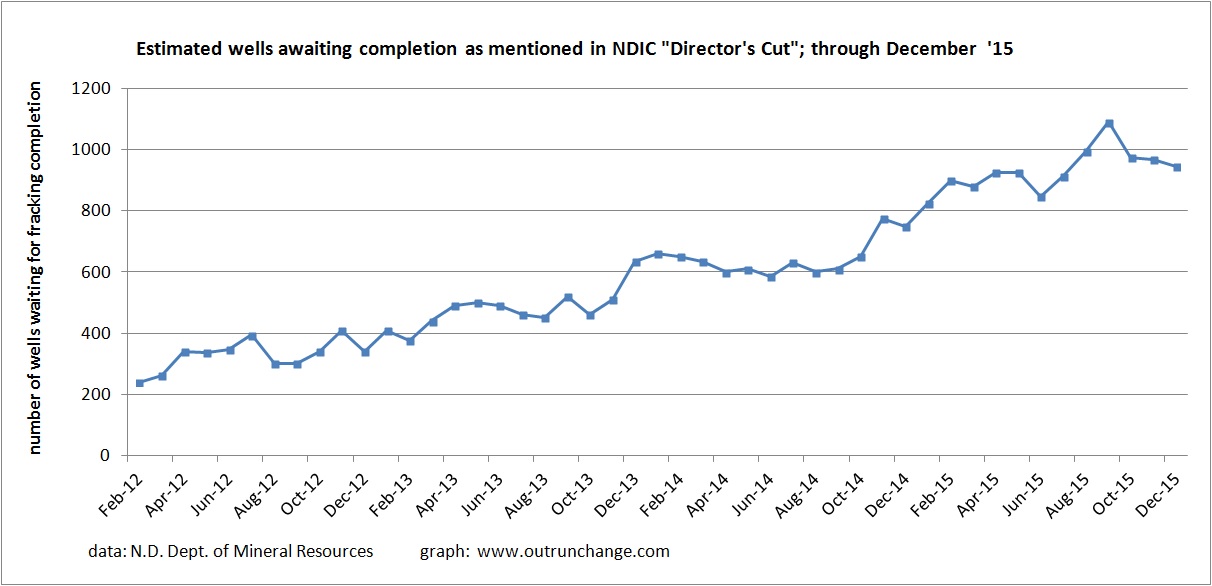

Fracklog is 945 at the end of December, which is a drop from the count during August through November but is higher than any month before that. This is the estimated tally of wells that have been drilled to total depth but have not yet been fracked & completed. As a result these are wells essentially held in inventory pending a price increase of oil.

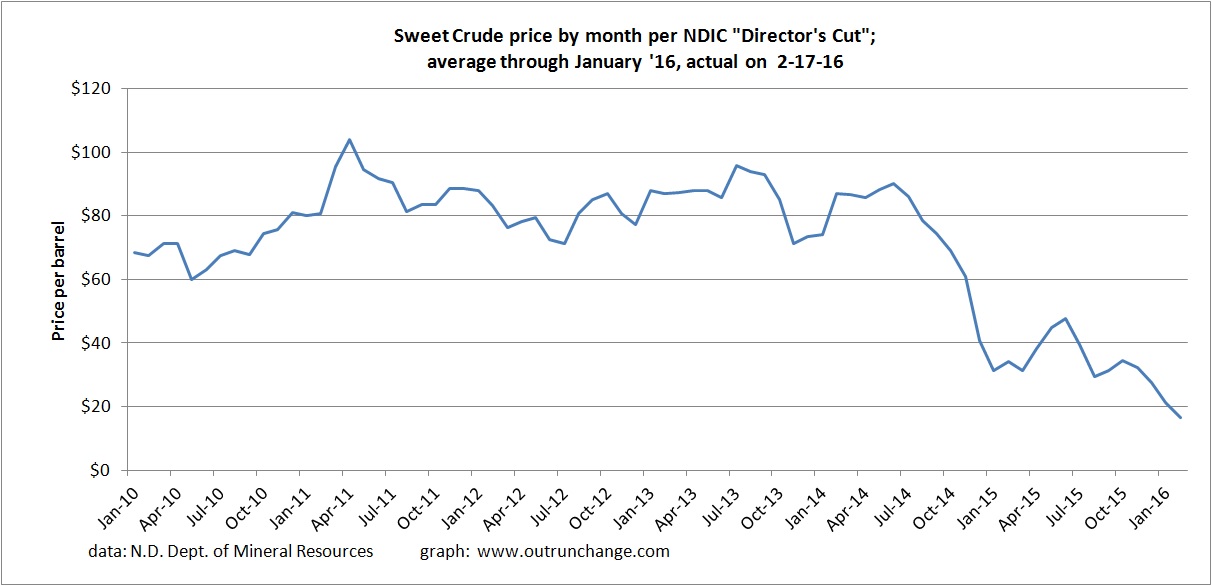

The February Director’s Cut report indicated oil prices continue to drop, hitting $16.50 a barrel, yes under 17 bucks in February. The director’s expectation is for low oil prices to continue through the third quarter of 2016 with further drop in number of rigs in operation.

As you would expect with the dramatic drop in prices, exploration & production companies are cutting back operations. Today’s news making that point:

2/25 – Energy Media Group at Bakken.com – Whiting suspends fracking, cuts budget 80 percent – investors cheer – the largest oil producer in North Dakota, Whiting, will put a hold on all fracking and completions beginning April 1. This will reduce the capital budget 80% in 2016.

Article does not say they will stop drilling, but I guess there will likely be a big cut back there as well.

Here’s a picture of the number of rigs in operation statewide:

To see why companies are cutting back, check out the price at the wellhead in North Dakota:

With that drop in price it is no wonder the number of rigs is down. Sixteen a barrel is a tough price to handle.

Further indication of contraction is that companies are holding off on fracking until the prices recover. Here is a graph of the fracklog: