This page pulls together the third volume of “Peak Oil” posts in one place. Enjoy!

Previous discussions are in Peak Oil and Peak Oil vol 2.

Crude production increase in 2014 is largest in 100 years. What Peak Oil – #38

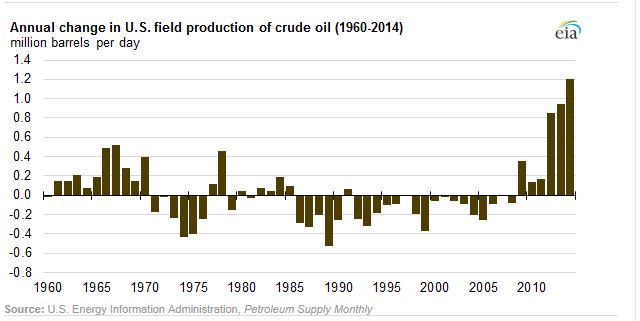

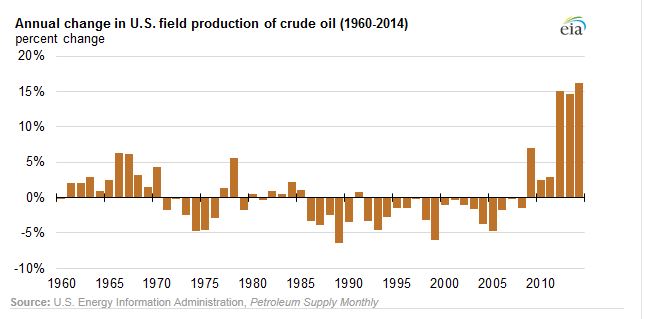

The Energy Information Administration says the increase in crude oil production (counting lease condensate also) during 2014 was 1.2M bopd. That is the largest increase since 1900, when record keeping started. The percentage increase is 16.2%, which is the largest percentage increase since 1940.

Is the cratering of crude oil prices going to crater oil production as OPEC wants to make happen? Not quite.

EIA expects crude oil will increase by these amounts:

- +8.1% – increase in 2015

- +1.5% – increase in 2016

What Peak Oil?

Please remember that Peak Oil doctrine states that after hitting a peak back in the 1970s, oil production would begin an inevitable, irreversible decline towards zero.

Consider that doctrine as you check out these graphs, from EIA. Change in barrels per day, in millions:

Notice the huge increase in each of the last three years and increases for six years in a row.

Change in percentage terms:

Again, both graphs are from EIA.

Again, what Peak Oil?

posted 4/2/15

Peak Oil is still wrong. Peak Oilists are the new Flat Earthers – #39

Apparently it is necessary to point out that Peak Oil doctrine is still wrong.

Ronald Bailey explains Hubbert’s Peak Refuted: Peak Oil Theory Still Wrong. He points out an author who has written multiple books defending Peak Oil.

I just checked Amazon and can find four books from the mentioned author, written in 2001, 2005, 2008, and 2010. All are selling well. Not great, but okay. I’m astounded that so many people still believe that foolishness.

Article gives some info I’ve not seen before:

As I have explained earlier geologist M. King Hubbert famously predicted in 1956 that U.S. domestic oil production in the lower 48 states would peak around 1970 and begin to decline. In 1969 Hubbert predicted that world oil production would peak around 2000.

Yes. The ol’ gig of my precisely calculated, ironclad calculation of the date of disaster is totally wrong so I will just fine tune my calculations and pick another date.

Usually we see that with false-doctrine-advocating religious “teachers” who have calculated the exact date Jesus will return. That is in spite of the Bible verse saying no one, not even Jesus when he was on the earth, knows when that would happen. Those teachers, however, are smarter than the bible. When the world is still here the day after their precisely calculated date, they quickly make another calculation.

Dr. Hubbert and his disciples are in good company.

(Is that ridicule? Yes. Well deserved too. Sometimes making fun of the foolishness of an idea is the best way to illustrate its foolishness.)

Here’s a superb explanation of Peak Oil doctrine from the article:

Hubbert argued that oil production grows until half the recoverable resources in a field have been extracted, after which production falls off at essentially the same rate at which it expanded. This theory suggests a bell-shaped curve rising from first discovery to peak and descending to depletion.

Article points out that author’s books continue the revisionism habit by calculating new dates of the always-soon-to-arrive afternoon we will finally hit Peak Oil.

In one book, anyone who disagrees is labeled a “flat-earther.”

With rapidly rising oil production, article asks:

Who’s a flat-earther now?

Author introduces a phrase I’ve not seen before, but which fits well:

Peak oilists

Flat-earther is also a good description for the Peak Oil disciples.

6/10 – Say Anything Blog – Who Are the Flat Earthers Now? – Article pointed me to the one I just discussed. Thanks, Mr. Port!

The production surge in North Dakota of the last five or so years is merely the latest in a long string of proofs that Peak Oil is false.

Article rephrases the comments I’ve seen so many times, especially from Prof Mark Perry. Mr. Port’s comment:

But our understanding of the world is always evolving, and we should never underestimate the ability of humanity to invent, innovate, and adapt.

The ignorance proudly on display by commenters show another reason it is still necessary to point out that Peak Oil is completely, totally false. There are still lots of true believers.

Oh, two more articles that blow apart core components of Peak Oil doctrine:

6/10 – Yahoo Finance – U.S. Ousts Russia as Top World Oil, Gas Producer in BP Data – Data from BP shows that the U.S. is world’s biggest producer of hydrocarbons, surpassing Russia for the first time.

Most of that oil production is from fields that were technologically untouchable two decades ago. There was no one on the planet that had any possible idea on how to get the stuff out of the ground. Yet today shale oil and shale gas has moved the US past Russia in output.

5/27 – Rigzone – Norway Has More Oil than a Decade Ago – The Norwegian Petroleum Directorate announced that the country has more recoverable oil now than it did 10 years ago.

New fields have been discovered, existing fields have been explored and proved recoverable, reservoirs understood better, development solutions improved, and drainage strategies optimized.

I don’t know (and won’t bother to look up) how much oil Norway has pulled out of the ground, but they have more that is economically and technologically recoverable today than a decade ago.

Let me make that point again, since so many people hold to the false doctrine of Peak Oil: in spite of all the oil Norway has produced, they have more technologically and economically recoverable oil today than they did 10 years ago.

posted 6/11/15

Peak Oil doctrine is still dead. (40)

Previously discussed an amazing article by Mark Perry at Carpe Diem. Post provides yet another reminder that Peak Oil is a failed concept.

Check out the June 23 post from Carpe Diem at American Enterprise Institute: Bakken updates: 1) Williston as ground zero for the American spirit and 2) Here comes Shale 2.0!

Recoverable oil

The post quotes a correspondent who works for a drilling company and has deep knowledge. This correspondent says the expectation at the beginning of the boom was 3.5% of the original oil in place would be recovered. Industry estimates today suggest the recovery rate is 15-18%. With additional technological developments, the correspondent’s guess is there could be another 5% of the oil recovered.

Get a fresh cup of coffee and journey with me as my little brain processes through what this means.

Let me pull together a few numbers. Watch the progression.

- 3B – 2008 estimate from USGS

- 6.5B – NDIC estimate as mentioned in this post in February 2015

- 24B – Continental Resources estimate, which MDW considered pushing the limit

- 35B – my guess based on 500B OOIP x 7% recovery. Recover rate of 3.5% would be ‘only’ 17B.

- 78B – midpoint of correspondent’s estimate of 15-18% current recovery rate

- 102B- extra 24B recoverable based on correspondent’s guess of 5% increase in recovery rate

Astounding.

Oh, by the way, keep in mind that same technological knowledge can be applied in Eagle Ford and Permian Basin.

What Peak Oil

It isn’t as if more indicators are needed that the Peak Oil concept is dead, but the above correspondent provides yet another.

Keep in mind the Hubbert curve that is the core of Peak Oil doctrine.

In one oversummarized sentence, that means oil production will rise on a roughly bell-shaped curve until it hits a peak, at which point production will begin an irreversible slide back to near zero with the shape of the production curve looking somewhat like a normal distribution.

In Figure 20 of his 1956 paper, Dr. Hubbert calculated worldwide cumulative production of crude oil was 90B barrels with proven reserves of 250B. The Hubert curve precisely calculates there will be 910B barrels of additional oil discovered in the future. That means total worldwide production of crude oil for all of time will be 1,250B barrels.

In other words, we will run out of oil, we can calculate when that will happen, and the date will be soon.

That increase in recoverable oil in the Bakken field only from 3B to somewhere around 80B today and to something that may be in the range of 102B is severely problematic in light of Peak Oil doctrine. That increase represents approximately 8% of Dr. Hubbert’s precisely calculated total production for all of time. The estimated 102B+/- recoverable is equal to 11% of all the oil that will ever be discovered, according to Dr. Hubbert’s calculations.

Actually, every drop of oil that has been pulled out of any one of the Bakken and Three Forks benches is severely problematic.

When he made the calculation, the vast majority of the known oil in the Bakken field was absolutely untouchable. You know those current wells with initial production of hundreds of barrels of oil from one of the Bakken benches? In 1956 there was no way, no how, no possibility in the world of ever getting even one day’s worth of production from a well drawing on the tight oil in the Bakken formation, let alone a million barrels a day across the state.

One possible way to resolve this tension is that perhaps what we are seeing in North Dakota today doesn’t actually exist. It isn’t happening. Maybe itt’s all a scam from Prof. Perry, his correspondent, the state regulators, and all those people who have installed fake oil pumps in North Dakota.

Or perhaps all that production will collapse next Monday afternoon and be zero by the end of next month. Or the end of the year. Or the year after.

There’s another possibility. Perhaps Peak Oil doctrine is completely invalid. Perhaps it has always been invalid.

Look at this from another direction

If you don’t know why I am pushing so hard against Peak Oil, then never mind. Instead just consider this from a completely different perspective:

Seven years ago, the best estimates were that the Bakken fields would produce about 3.5B barrels of oil.

Today, an estimate from someone with detailed industry knowledge is guessing the recovery with current technology will be somewhere around 65B to 90B barrels. Tech developments that nobody currently knows about could increase that to somewhere around 90B to 115B barrels.

That massive increase from around 3B to something maybe in the range of 100B is due to newly discovered knowledge.

Even that initial 3B was untouchable 15 years ago.

To put that in perspective, at the current production level of 1.1M barrels of oil a day (bopd), the 2008 estimate of 3.5B barrels would represent almost 9 years of production (3.5B / 1.1M bopd / 365.25 = 8.7 years). Continental’s ‘out there’ estimate of 24B would be about 60 years of production (24B /1.1M bopd / 365.25 = 59.7 years).

Those point estimates of 78B at current recovery rates and 102B at what recovery rates might be in a few years would be 194 years and 254 years, respectively. If production steps up to and sustains at 2M bopd, that would be merely 107 years and 140 years.

Again, for any of that oil to be recoverable is only because of human ingenuity which invented new ways of getting to oil that was previously untouchable.

Update: Bruce Oksol at Million Dollar Way also discusses the article: Getting Ahead of Our Headlights, part II.

Superb reminder that the recovery rates tossed around are primary recovery. If you get that comment, all the above info is even more astounding. If not, I’ll need another post to explain.

Recovery rates he mentions:

- 3% – initial estimates

- 8% – later estimate from him based on his reading

- even higher – indications in 2012

- 15%-18% – Carpe Diem’s correspondent’s estimate of recovery rates today

- 20%-23% – possibilities for five years out

Every extra percent is around another five billion barrels of oil.

Mr. Oksol points out the 440B or 500B OOIP estimates do not include lower benches of Three Forks. If recoverable oil is found there, increase all the above production guesses accordingly.

posted 6/24/15

“Everybody point and laugh” at Peak Oil doctrine – #41

What oil production curve should have been for last couple of decades according to Peak Oil doctrine. Image courtesy of DollarPhotoClub.com

Ridicule is the appropriate way to address the false idea that oil production follows a bell curve and at any moment production will drop off and head to zero. Gonna’ happen any hour now. It is an undisputed scientific certainty…

Only problem is the inconvenient truth that production has consistently blown out every prediction from the peak oilists. It’s almost like the entire concept is bogus.

8/11 – Ronald Bailey, author of The End of Doom, at Reason – Peak Oilers Shut Up Forever Please – One of the main apostles of Peak Oil precisely calculated the peak of oil production would be Thanksgiving Day in 2005 with an inevitable, unavoidable decline thereafter.

The absolute peak production, never to be seen again?

85M bopd.

Please remember Peak Oil doctrine clearly states that production will drop the day after the peak and enter a bell shape curve decline, quickly heading to zero. Production graphs are supposed to have already resembled the image at the top of this post.

Petroleum liquids in July 2015?

96M barrels.

Um, that would be up 11M barrels. A 13% increase.

Another prediction busted.

Check out Glenn Reynolds observation:

8/11 – Instapundit linked to the above article saying Hey, remember when they were telling us we were at “Peak Oil?” Everybody point and laugh.

Just so you know this is not a straw man argument, please observe a few of the comments at the ‘point and laugh’ discussion continue to push Peak Oil doctrine.

Feel free to join in the laughter.

Just to prove the foolishness and falseness of Peak Oil doctrine, I checked out the International Energy Agency’s 2014 Key World Energy Statistics.

Page 6 shows total primary energy supply from all sources: coal, oil, natural gas, nuclear, Hydro, and the astoundingly thin sliver of renewables. Table is measured in Mtoe, which is million tons of oil equivalent.

Graph from 1971 through 2012 shows oil increasing. The amount in 2012 is larger than 1971. Below the graph is a pie chart. Here’s some info:

- 1973 2012

- 46.1% 31.4% – oil as percent of total primary energy supply

- 2,814 4,198 – my calculation of oil, in Mtoe

- 0.1% 1.1% – other as percent of total, which includes geothermal solar wind heat etc.

- 6 147 – my calculation of all other, in Mtoe

I think that total worldwide production of oil increasing by 49% from 1973 to 2012 rather persuasively proves yet again that Peak Oil doctrine is false.

Page 10 shows crude oil production in graph form. This would be without liquids, I think. Production dropped for a few years after about 1979 and then started rising. Production didn’t return to the 1979 level until about 1992 or so.

Production increased for about 26 of the 31 years from 1982 through 2013.

So much for the long string of peak dates.

Back to Mr. Reynolds’ suggestion on how to deal with Peak Oil – I point as often as I can. I laugh as hard as I can.

posted 8/13/15

More failed predictions that we have already passed Peak Oil #40. oops #42

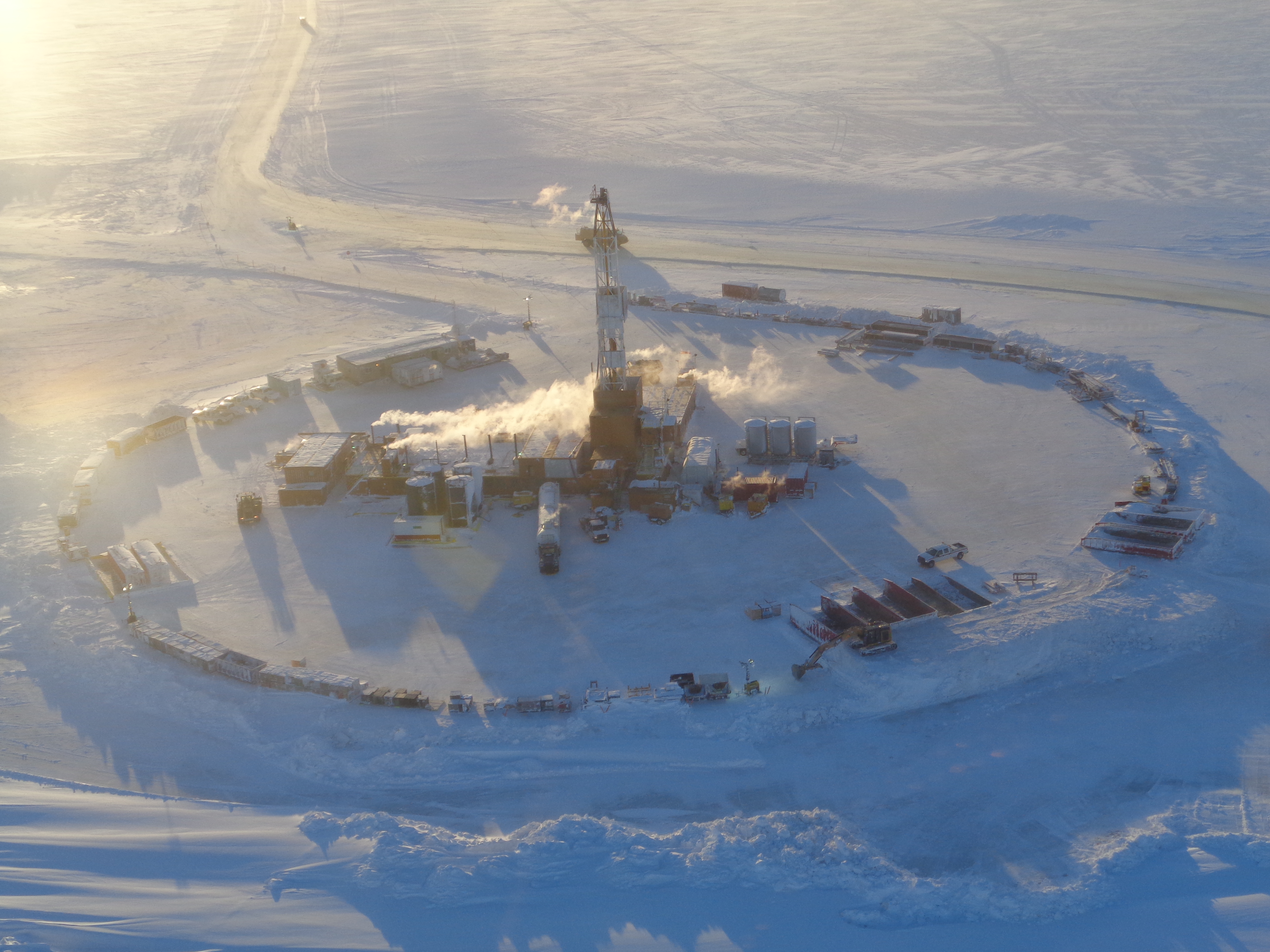

According to conclusive predictions over the last 100 years, the oil coming out of those wells can’t exist, because we have already used up all the oil on the planet. Perhaps the wells are just a figment of my imagination that is as fertile as the plains of North Dakota. Photo and sarcasm by James Ulvog.

It is so entertaining to read about all the failed predictions of when we will run out of oil or some other critical resource. I keep coming across more and more absolute guarantees of when we already ran out of oil.

At its core, Peak Oil is merely another variation of the long discredited Malthusian arguments that we will run out of stuff. Such thinking is foolishly and fatally flawed.

Remember that until just a few years ago it was universally agreed by eeeeeeveryscientist and researcher on the planet that we would absolutely run out of oil. It was settled science. No debate or argument necessary. No disagreement allowed.

For this particular journey down the trail of failed predictions, I thank Rob Port, writing at Say Anything Blog, for pointing me to the trail head for this expedition. In his articleSettled Science: America Will Be Out Of Oil By 2015, he wrote

Because, you see, peak oil was settled science. Except, it also turned out to be wrong science, as most malthusian projections do, because it failed to take into account humanity’s infinite capacity to invent and innovate. In 2015 the big problem for the oil industry isn’t that they can’t find more oil, but rather that the market is being flooded with oil and that’s driving down prices.

The article points to a discussion at PaleoFuture on 9/18/15 which points us to an Article from 1975: The World Will Be Out of Oil by 2015. It quotes a 1975 article from Brownsville Herald which was syndicated by UPI and printed in many newspapers:

The United States may be totally independent of Arab oil by the year 2015.

Unfortunately so will everyone else because statistically that will be the year the last barrel of oil is pumped from the last well on earth.

The indisputable, unarguable, conclusive scientific proof cited in the article is the known proven world reserves were 103B metric tons at the time with annual consumption of 2.8B metric tons. Statistically, that gives exactly 36.78 years before all the oil on the planet is consumed. Adding that many years to the September 1975 publication date would actually give June 2012 for oil to completely run out. We will give the original author credit for another three years.

Point stands is that according to that article back in 1975, we are absolutely, totally, completely out of oil today.

Even as you read this post we all know the power for your car to get you to work tomorrow will be coming from the coal you loaded in your car’s boiler purchased from your friendly neighborhood coal station. (I don’t do sarcasm well, but that is the appropriate respect to give Peak Oil doctrine.)

Or perhaps, if you have an electric vehicle, which is only usable for commuting if your office is only a few miles away from your home, the power will come from a coal-fired generating power plant in Arizona. Yes, EVs are coal powered.

The same author of that article pointed out on December 11, 2014 that We’ve Been Incorrectly Predicting Peak Oil For Over a Century.

Please check out his article for the full detail of all the failed predictions. I will just give the headlines of when we will run out of oil or hit the peak, at which point production will begin an irreversible fall to zero:

1909: 25 or 30 years longer

1919: Two to five years until maximum production

1937: Gone in 15 years

1943: Peak oil has been reached

1945: Just thirteen years left

1956: Ten to fifteen years until peak oil

This was Dr. Hubbert’s prediction. His theories, calculations, and predictions are the foundation of Peak Oil doctrine.

1966: Gone in ten years

1972: U.S. oil depleted in twenty years

1977: Oil will peak by the early 90s

1980: In the year 2000

1996: Peak oil likely by 2020

2002: Global peak by the year 2010

2007: Sometime between now and 2040

The failed predictions from 1937, 1977, and 2007 are from official US Government sources. The others are from physicists, Nobel laureates, or industry experts.

Without a hint of irony, the author suggests the 100 year history of failed predictions is further proof that we need to end our reliance on fossil fuels. I’m not being sarcastic now. That is his point.

More figments of my imagination:

Each of those little brown spots is a well pad with 1 or 4 wells, each of which can produce around half a million barrels of oil that was completely unrecoverable two decades ago. Photo by James Ulvog.

posted 11/18/15

Peak Oil doctrine is still wrong. And still dead. #41. Oops #43

Each of those little spots of light brown is a well pad with 1 or 4 wells, with each well likely to produce around half a million barrels of oil. Two decades ago every drop of that oil was completely unrecoverable. Visual proof of the foolishness of Peak Oil. Photo by James Ulvog.

Remember that Peak oil doctrine states unequivocally that production peaks and then begins an irreversible, inevitable, unavoidable slide to zero. The curve of production inevitably follows a pattern that looks roughly comparable to a bell curve.

That means that by 2015 we should have already approached the point of very minimal oil production worldwide. Yesterday’s post described a century’s worth of failed predictions.

Where is production today? Umm…not exactly approaching zero.

Production is running so high in spite of collapse prices and in spite of increasing demand that there is a worldwide glut of crude. Having enough space to store all of the surplus oil is becoming an issue.

Here are just a few of the articles I have seen in the last week on point. This does not include another six or eight articles I’ve seen in the last month that make the same point.

11/13 – The American Interest (previously Via Meadia) – Oil Supply Reaches High Water Mark – Not only is Peak Oil completely dead (a.k.a. Peak Nitwitery as Carpe Diem would say), there’s actually logistical issues for how to store all the extra crude that is on the market. Worldwide inventory is 2.98B barrels.

Onshore facilities are so full that there is 100M barrels intentionally stored in tankers just offshore.

The pricing could get worse because those tankers are needed to keep the oil moving. If enough tankers are tied up just acting as storage tanks, that could force another drop in prices just to move the oil stored on tankers in order to free them up to move more oil.

11/13 – News on Invest – Global oil inventory hits record level – Amount of oil in storage is at a record level. OPEC says worldwide inventory is at the “excessive” level, which they say has only happened twice in the last 10 years.

To summarize a variety of comments in the article, it looks to me like OPEC is pushing output as fast as they can. Combine that with minor drop in shale production in the US means that output is at record levels. The drop in prices is pushing rising demand.

Financial Times has another article on point, but it is behind a paywall.

Not quite what Saudi Arabia had planned.

If you adhere to Peak Oil doctrine, I would guess you are thinking all those news outlets must be imagining things because this obviously just cannot be happening because Peak Oil doctrine says it can’t.

posted 11/19/15

We ran out of oil in 2011. You didn’t know that? (Peak oil #42. Oops #44)

A prediction from 1976:

“We need to have, uh, a realization that we’ve got about 35 years worth of oil left in the whole world. We’re gonna run out of oil.”

That scientific certainty was from candidate Jimmy Carter during the 1976 Presidential Debate.

Check it out for yourself:

Here is some math:

- 1976 – date of prediction

- 35 – years of oil left on entire planet

- 2011 – year we ran out of oil

It must be a figment of my imagination that I have put gasoline in my car so many times in the last five years. Recall all those oil wells in North Dakota that are showing up on my blog? They must be made of cardboard.

Continuing his befuddled, fuzzy-brained analysis, Mr. Carter went on to say:

“We need to shift from oil to coal. We need to concentrate our research and development effort on coal-burning and extraction. It’s safe for miners. It’s also clean burning.”

More cardboard illusions in North Dakota under construction in September 2015:

posted 1/22/16

Peak oil doctrine is still false. Please point out to me on my graph the irreversible decline in production after 1970. #45

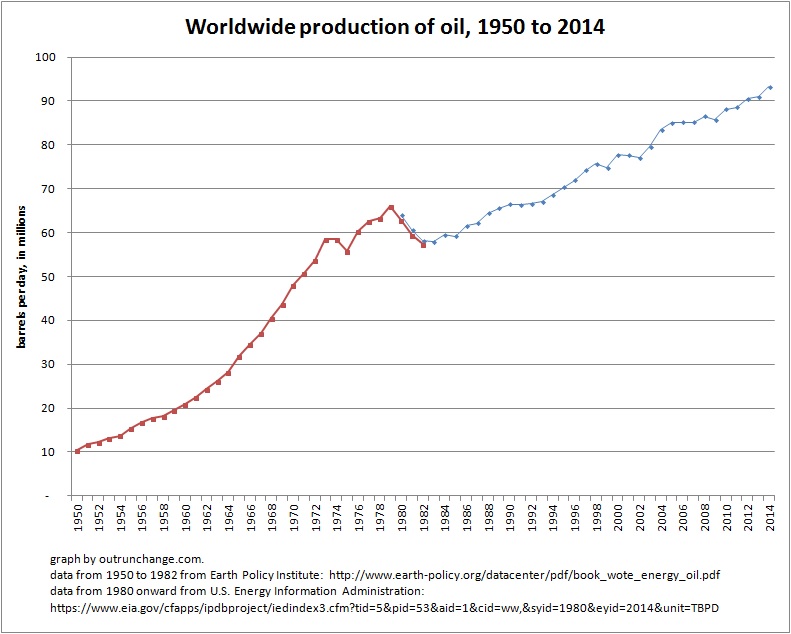

An article explaining why Peak Oilers are in hiding prompted me to graph worldwide oil production.

Peak Oil doctrine was wrong when announced by Dr. Hubbert. It was wrong at the turn of the century before the energy revolution was kicked off by technology that was unimaginable 50 years ago. Peak Oil doctrine is still wrong. It will continue to be wrong.

Check out my graph to see a visual explanation of the foolishness.

1/21 – Hit and Run blog at Reason – Where Have All the Peak Oilers Gone? – Article points out that four of the most visible Peak Oilers are in hiding. Another one of them is still speaking out. In addition, he wrote a new forward in 2010 to his 2007 book proclaiming yet again oil production will go into an irreversible, inevitable slide.

Two data points that provide more proof of the foolishness of Peak Oil doctrine:

- 84M barrels a day – average global production in 2007

- 94M barrels a day – average global production at the end of 2015

Doesn’t quite look to me like an irreversible, inevitable, unavoidable decline to zero.

That post prompted me to see if I could graph the worldwide production.

Hmm. Yes, turns out I can prep such a graph.

Here it is:

Had to use two sets of data to develop the graph. I overlapped the data by three years to show the small amount of inconsistency between the two data sets. Several moments of search at the EIA site did not reveal where they have data before 1980 and I’m not going to spend more time searching their site.

Remember Peak Oil doctrine states that oil production would hit a peak in 1970 and then begin an irreversible, inevitable decline to near zero. Production should look like an inverted V. The decline should essentially mirror the runup to the peak.

Notice the trend from 1950 to 1970? The decline in production after 1970 should be a mirror reflection. Is that what you see after 1970?

Could someone far smarter than me please point out where the peak was?

Please, point out to me the reversal and drop toward zero?

Please, can someone explain why some year in the ’70s was not the high point of the graph?

What do you think?

Only professional comments will be approved. On the other hand, all professional comments will be approved.

A glowing tribute to the founder of Peak Oil foolishness – peak oil #46

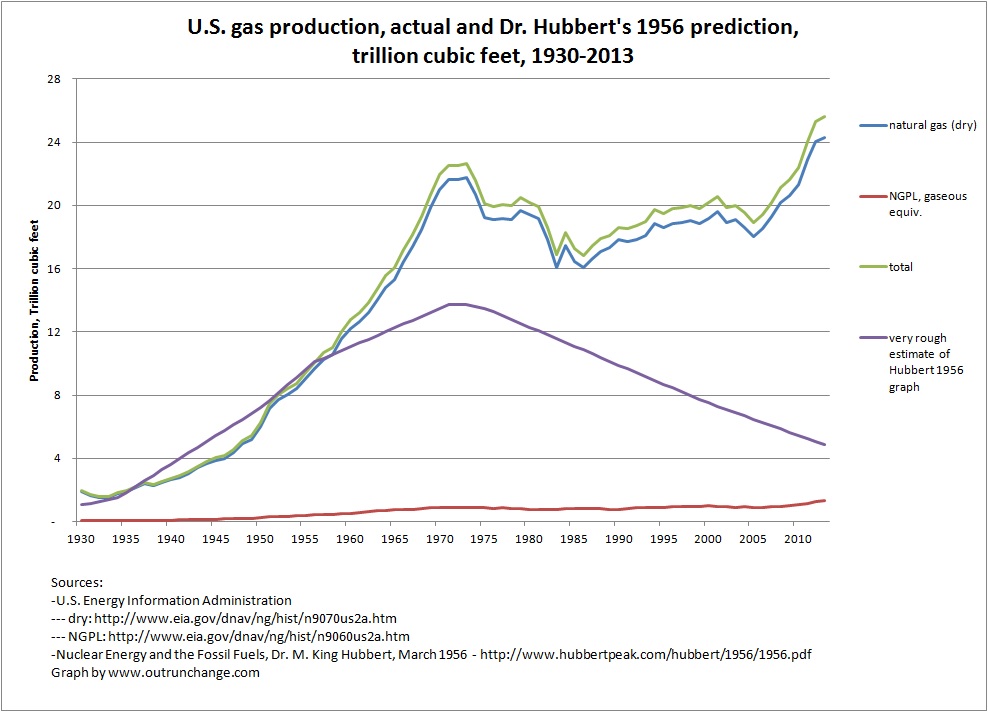

Comparison of Dr. Hubbert’s 1956 prediction with actual gas production. Rough approximation of Dr. Hubbert’s graph.

Professor R. Tyler Priest has a review at the Wall Street Journal of The Oracle of Oilby Mason Inman. His assessment is covered in the title: Ignoring the Shale Revolution / U.S. oil production, at nearly nine million barrels per day, is nine times what Hubbert predicted it would be in the 21st century.

My rough graph above shows the lousy accuracy of Dr. King’s 1956 projections of natural gas production in the US.

Dr. M. King Hubbert fell in with a fellow named Howard Scott, whom Prof. Priest calls

a magnetic charlatan.

Mr. Scott dreamed of a glorious time in which scientists and engineers would run the world through a powerful Technate or Technocracy Inc. As I have mentionedbefore, I’m not sure if this authoritarian system was more fond of fascism or communism, but it certainly was authoritarian. My inclination is this tended toward fascist, meaning our betters would let us peons own private property but they would tell us what we can do with our property and how we can live.

Dr. King was apparently not a very nice person. The review highlights Dr. King’s approach to knowledge:

It was not enough for him to be right. Someone had to be humiliated in the process. Mr. Inman appears uninterested in pondering the mixture of arrogance and resentment that shaped Hubbert’s personal interactions.

That Dr. King had an overabundance of arrogance is visible if you read through his 1949 and 1956 papers.

He was confidently able to calculate the total amount of coal, natural gas, and oil that will ever be produced on the entire planet. Usually he is able to calculate to within two or three significant digits. All the energy that will be produced. Ever. On the entire planet.

Did I already mention he knew how much of those energy sources that would be produced through all time?

He was also able to determine there would never be any technological breakthroughs. The review quotes Dr. King in a 1959 interview:

“I think we can rule out any radical improvement in geophysical techniques.”

The review points out the author of the book does not acknowledge seismic surveying breakthroughs that took place a few years after that confident prediction that knowledge would not develop further.

I am guessing that secondary recovery, tertiary recovery, directional drilling, horizontal drilling, hydraulic fracturing, pad drilling, and all sorts of things I don’t know anything about are skipped over in the book.

Apparently Dr. King got into a big fight with his boss at USGS about whether the ultimate amount of oil ever to be recovered in the US was just over 200 billion barrels or around 590 billion, as his boss estimated.

I’m not going to take time to look up total US production to date plus proven reserves in order to compare to Dr. King’s ironclad calculation. Hope to do that analysis later.

The review points out several additional conceptual problems with Dr. King’s work, which the reviewer says were not addressed in the book. Specific issues are “curve-fitting” and over reliance on aggregate data. I was already aware of the problems of ignoring any future discoveries and that reserves might be larger than what the geologists can see.

Next to last paragraph points out that current production of crude oil in the US is nine times larger than what Dr. King predicted. Off by a factor of nine. Nine. That is almost a large enough error to lead one to think Dr. King was all wet even if you had never taken a look at Peak Oil foolishness.

Last paragraph points out some of the major paradoxes in Dr. King’s life that the book did not address. Just one example: he was a breakthrough innovator who discounted the value and possibility of any further breakthrough innovation.

Another project on my ‘to do’ list is graph Dr. King’s 1956 predictions of US and world-wide production of crude oil against the actuals. My graph of his failed prediction of natural gas production is shown above.

posted 4/27/16

More on the foolish Malthusian mindset that we’re gonna’ run out of everything

(#47 in Peak Oil)

Here are three more stories in just the last week proving yet again the foolish of Malthusian thinking. The experts in a field have no clue, absolutely no clue, of the total amount of any resource available on this amazing planet. Whether it is water, crude oil, or helium, the experts don’t know what previously unknown field they will find next.

7/1 – The Million Dollar Way – Peak Oil? What Peak Oil? Huge Discovery For Hess, Exxon; $70 Billion at Current Prices – This post points to an article at Yahoo: Exxon Might Have Just Made The Largest Oil Find In Two Years. ExxonMobil and Hess Corp are in a joint venture that just discovered a huge field in deep water 120 miles off the coast of Guyana.

The new field, called Liza, likely has somewhere between 800M and 1.4B oil-equivalent barrels. Yeah, that’s somewhere in the range of one and a half billion barrels of oil. That nobody knew about. Until now.

To put this in context, there have been only five brand-new discoveries in the last four years with recoverable amounts of over 500M barrels. Only five? ONLY? To my little brain that is astounding.

The rate of new discovery is down in recent years to around one new field a year that nobody anywhere knew about until the geology wizards realized, oh, hey, there is half a billion barrels of oil right over there.

Lets’ do a little math on how much that find is worth:

- 800M barrels x $50 current price = $40B

- 1,400M barrels x $50 current price = $70B

- 1,400M barrels x $65 cautious estimate over next 2 decades = $91B.

Mr. Oksol calculates the new find has oil worth a point estimate $70B. I agree with the point estimate and will add a range of somewhere between $40B and $100B. That produces an estimate of $70B plus or minus $30B.

Will likely take $18B to develop the field. Will be well worth it.

7/1 – JH at The American Interest – Rediscovering Gaia’s Riches – Article points to other articles describing a new, never known before aquifer under California and a huge find of helium in Tanzania.

Author closes with this comment:

The Malthusians of the world are always right until they’re wrong. They’ll warn of impending resource depletion until they’re blue in the face, but time and again human ingenuity (and natural providence) has made fools of them. We’ve seen two welcome new examples of Gaia’s riches this week—what’ll we find next?

What’s next? How about something in the range of 1 billion barrels of oil-equivalent off the coast of Guyana?

I can’t wait to see what follows that.

The two reports:

6/27 – The Washington Post – California may have a huge groundwater reservoir that nobody knew about – A report from Stanford researchers finds strong evidence of an aquifer no one knew about that could possibly, maybe hold 2700 billion tons of water. The aquifer ranges from 1000′ to around 10,000′ below the Central Valley with most of the water less than 3250 feet down.

There are still questions about how good the water might be. It might be brackish, it may have some or lots of saltwater, and it is deep enough that there could be some seepage from underground oil. Typically groundwater is less than 1000′ down and thus exquisitely well insulated from oil.

Author of the article found two scientists who brushed off the report. One said even if the water is usable it will not make a difference to the water crisis in California. Um, yeah, I guess two and a half trillion tons of water is trivial.

6/28 – University of Oxford – Huge helium discovery “a life-saving find” – Using new exploration techniques, researchers have discovered a huge find of helium.

Researchers estimate a probable reserve of 54 billion cubic feet (BCf). For context, global consumption of helium is around 8 BCf. In the US, total reserves are something in the range of 153 BCf. The new find is about one-third of the known reserves in the US and equal to something just under 7 years worldwide consumption.

Why is this a big deal?

As I just learned, helium is critical for high-end technology projects such as MRI scanners and nuclear energy. It is key for basic industrial work such as welding and industrial leak detection.

The volume of helium production has been dropping for a number of years. The American Interest article says the shrinking supply in the last 15 years has led to an increase in price by factor of four.

The find in Tanzania should turn things around.

I agree with the closing comment in the American Interest article that Malthusians are regularly proved to be fools. I disagree with one other comment:

Malthusians are always right until they are proven wrong, according to the article.

That is incorrect.

Malthusians are always wrong on every issue all the time. It just takes a while to gather yet another round of proof.

posted 7/2/16

Two new fields found where the energy wizards didn’t realize there were billions of barrels of oil in the ground. Oh, what Peak Oil? #48

There are two big finds in the last few weeks of fields with a few billion barrels of recoverable oil each where the petroleum engineers didn’t realize there were billions of barrels of oil.

Still needs to be a lot of work to develop the fields, but major point is the wizards know today there is somewhere around 5 billion more barrels of oil “we” can use to power our comfortable industrialized life than the wizards knew about a month ago.

Not that it is really necessary, but those two big finds prove yet again that Peak Oil is a busted, bankrupt, invalid theory.

10/5 – New York Times – Oil Glut? Here Comes Some More! – Author spends the first one-fifth of the article bemoaning the discovery of two new oil fields (yeah, I eye-balled the amount of pixels allocated to bemoaning).

The last thing the world needs is more oil and gas he points out, while typing at his coal-powered computer, which was constructed with plastic made from cracked natural gas, his words stored on a server farm powered by natural gas, his article delivered around the world at the speed of light, visible to me on my nuclear power driven monitor, which I read in my natural gas warmed office.

After the lamenting, he provides more detail.

Caelus Energy announced they believe there is potentially 2.4 billion barrels of recoverable oil in the Smith Bay field, closely offshore in Alaska, west of Prudhoe Bay. After 2 exploratory wells and 3D seismic testing, the company thinks they could get 200K bopd out of the field.

Apache Corporation has been looking at a new field they call Alpine High which they think holds 3 billion barrels of oil and 75 trillion cubic feet of natural gas. This field is described as overlooked in the article. It is near the Permian Basin.

Company bought up lease rights for one-fortieth of the price Permian leases are going for.

Article cites unnamed industry execs saying the E&P budgets industry-wide were cut $250B in 2015 and another $70B in 2016.

10/5 – Caelus Energy LLC – Caelus confirms large-scale discovery on the North Slope of Alaska – Press release says the company estimates 6 billion barrels of oil in place with recovery estimated at 30% or 40%. That would mean they are estimating recoverable oil in the range of 1.8B to 2.4B barrels.

That makes two finds in the last few weeks, both in the U.S., neither of which were part of the proven reserve calculation a year ago. The assumption that energy wizards will never find another oil field is one of a long list of reasons why Peak Oil is such a foolish concept.

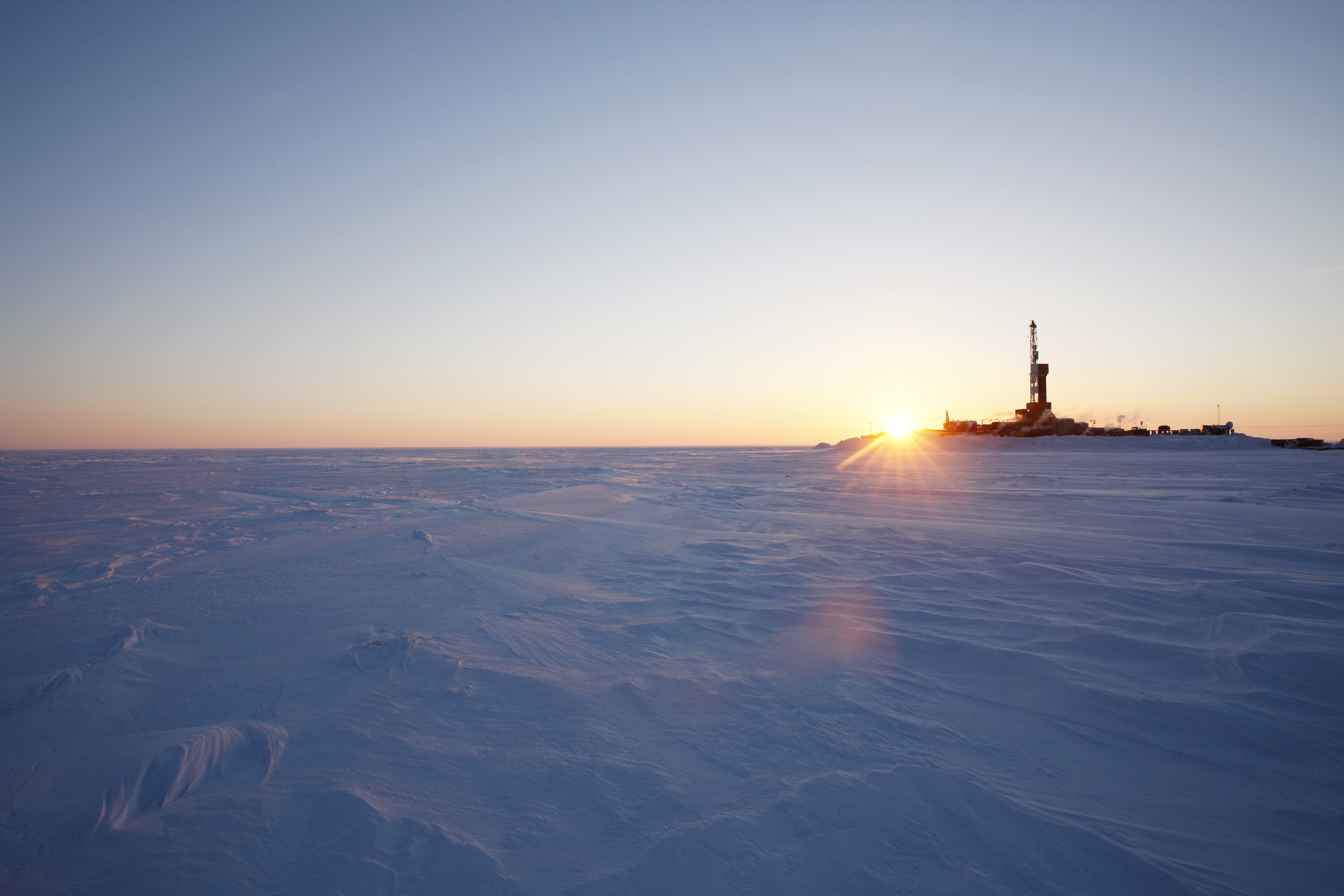

One more super-cool (um, make that freezing cold) photo from Caelus:

10/4 – Bloomberg – Alaska Oil reserves May Have Grown 80% on Giant Discovery – Proven reserves in Alaska are about 2.86B barrels. Another 2.4B would be an increase of 84%. A recovery rate of 30% would be 1.8B, or an increase in reserves of 63%.

According to the company, this would be the biggest discovery in the state in the last 40 years.

The total project will cost about $8B or $10B to fully develop. It could start producing by 2022.

10/5 – The American Interest – So much for Peak Oil / Alaska Just Nearly Doubled its Oil Reserves – Article quotes a WSJ comment that the volume of oil going through the Alaska Pipeline is declining enough that it might have to close. If there isn’t a certain volume of oil, the pipeline won’t work. The Smith Bay find would keep the pipeline open.

Article points out this find is very bad news for two groups of people.

First, OPEC. The big petrostates need to see higher prices, not more oil supply on the market, especially oil with a production break-even of somewhere around $40.

Article gently hints the second group for whom this is troublesome is those few remaining folks advocating Peak Oil foolishness. They just saw another proof of the foolishness.

Okay, okay, here are two more fantastic photos from Caelus Energy.

Last view. Thanks to Caelus Energy for permission to use their photos.

posted 10/7/16

Another 20 billion barrels of oil. What Peak Oil? – #49

Oh, by the way, the geology wizards just discovered another twenty billion barrels of recoverable oil where the wizards knew something existed but had no idea how much.

Twenty billion barrels. Billion, with a B.

11/15 – Star-Telegram – Permian’s Wolfcamp formation called biggest shale oil field in US – Estimate from USGS is the Wolfcamp formation in the Permian Basin holds 20 billion barrels of oil. There are four layers of shale that make up Wolfcamp. That puts this find somewhere in the range of three times the size of the entire Bakken formation in North Dakota.

Several drillers with leases in Wolfcamp have increased their estimates of proven reserves

Figuring out there’s many billions more barrels of oil under the ground than the wizards realized was there a year or decade ago is a recurring reason I keep asking What Peak Oil?

11/17 – Watts Up With That – Newsbytes: US geological Survey Discovers “Largest Oil & Gas Deposit Ever Discovered In America” – Article points out this one find is equal to three years worth of petroleum consumption in the entire United States. This one field increased our reserves by three full years.

To put this into perspective the article gives some comparison. Wolfcamp has more technically recoverable oil than the Prudhoe Bay field on the North Slope of Alaska has produced in the last 43 years. This field has not quite three times the amount of oil as produced in the largest field in the contiguous states.

11/15 – USGS – USGS Estimates 20 Billion Barrels of Oil in Texas’ Wolfcamp Shale Formation – official estimate is:

…an estimated mean of 20 billion barrels of oil, 16 trillion cubic feet of associated natural gas, and 1.6 billion barrels of natural gas liquids, according to an assessment by the U.S. Geological Survey.

This is technically recoverable:

This estimate is for continuous (unconventional) oil, and consists of undiscovered, technically recoverable resources.

An explanation of those terms:

Continuous oil and gas is dispersed throughout a geologic formation rather than existing as discrete, localized occurrences, such as those in conventional accumulations. Because of that, continuous resources commonly require special technical drilling and recovery methods, such as hydraulic fracturing.

Undiscovered resources are those that are estimated to exist based on geologic knowledge and theory, while technically recoverable resources are those that can be produced using currently available technology and industry practices. Whether or not it is profitable to produce these resources has not been evaluated.

The field is three times the size of the 2013 assessment of the Bakken-Three Forks field.

Imagine that. There is a new field in the Permian equal in size to the already massiveBakken, and another field equal to Bakken next to that one, and yet another field equal to Bakken next to that one. Picture three Bakkens sitting side by side. In addition to all the other oil in Texas.

Oh, the geological wizards previously knew there was something there, but they just figured out there were 20B barrels of technically recoverable oil that they couldn’t quantify before. Twenty billion barrels of new oil.

Again, What Peak Oil?

posted 11/18/16

Possible new technology to extract oil shale – Peak Oil #50

Here’s another brain stretcher for you in the realm of the open frontier in energy – how about using microwave to tease oil shale out of the ground?

11/4 – Oxy – Move Over Fracking, There’s a New Technology in Town – First, keep in mind that oil shale is not the same as shale oil. I have to wrap my brain around that every time the topic of oil shale comes up.

Shale oil is crude oil that is trapped in rocks. Fracking is the way to get shale oil out of the ground.

Oil shale is sort-of-like crude oil stuff (actually kerogen, but that label doesn’t register for me) that has to be heated, or cooked, out of the rock. Usually done by strip mining then cooking the stuff. Other option is steam injection to liquefy the oil shale which then can be pulled out of the well. Fracking won’t do the trick.

Try this on for size: Using microwaves comparable to the power of 500 household machines to heat the rock turning the oil shale liquid. The water, which is mixed in with the kerogen will be converted to steam, which in turn will help pull the liquefied oil to the wellbore.

So where could this be used?

How about the Green River Formation in Colorado, Utah, and Wyoming? There is an estimated 4 trillion barrels of oil shale there. Yeah, trillion, as in a thousand billion.

Contrast that to the astounding find a few weeks ago in the Wolfcamp formation, which I discussed earlier: Another 20 billion barrels of oil. What Peak Oil?

If it was possible to extract that oil shale in the Green River Formation, it would be equal to 200 Wolfcamps. That would be enough to provide all the oil we need in the US for 165 years, according to the article.

I can’t get my brain around that – imagine the jobs needed to drill five or ten thousand wells a year. Imagine the amount of oil the US could produce and sell worldwide.

Company has a demonstration well in process that they hope to have in production by the end of 2017.

The technology is in development. Sources cited in the article say that it may be another decade or 15 years before the technology is ready to be used in the field.

I’ll place my bet on human ingenuity and predict it won’t take that long.

Pumping costs

Article brings up interesting data point on what it costs to get oil out of the ground after the well is finished. This is called pumping costs.

The company developing the technology estimates their pumping costs will be about $9 a barrel.

This is in contrast to conventional wells of about $7 a barrel.

Will it work?

Maybe this won’t go anywhere. Maybe the technology won’t be deployable. Maybe something else will stop it.

But what if it works? Seems silly but that is what directional drilling and hydraulic fracturing looked like before it worked.

Oh, with the potential of pulling out a few billion barrels of oil that are untouchable today, I need to ask, what Peak Oil?

posted 12/7/16

What Peak Oil? I’m having trouble keeping up with all the billion barrel finds.

15 wells on 1 pad. Notice a drilling rig on right edge of view. September 2015 photo by James Ulvog.

Yeah, I’m still new to this effort of watching the energy field. One of the things that still amazes me is the frequency with which the geology wizards find another billion or so barrels of recoverable oil that ‘we’ didn’t know about and a decade ago couldn’t get out of the ground profitably even if the wizards had known for sure it was there.

3/9/17 – E&P – Repsol, Armstrong Strike Big Oil Find in Alaska’s North Slope – The two companies announced a find in the Nanushuk Play with 1.2 billion barrels of recoverable oil. Two wells confirm the find.

First production is expected in 2021, four years from now. Production level expected to hit 120,000 bopd, or 43.8M barrels a year.

Oh, what Peak Oil?

By the way, I’m having a hard time keeping track of all these massive new finds of oil which either nobody knew about a decade ago or it would have been technically impossible to ever get any of it out of the ground.

Again. What Peak Oil?

(Hat tip to The Million Dollar Way.)

3/10 – Energy Media Group – at Bakken.com – Respol announces largest U.S. oil discovery in 30 years – Announced estimate is 1.2 billion of recoverable light oil. This is asserted to be the largest onshore find in three decades.

This will also be a boon to the Alaska Pipeline since the daily delivery has dropped from 2.1M bopd to 520k bopd in the last 28 years.

12/13/16 – Rigzone – After Alaska Flop, Shell’s Search For Oil Moves Closer to Home – Shell, along with BP and Exxon Mobil are pulling back from looking for massively huge finds and previously undeveloped areas. Instead they are looking for modest finds near where there is current drilling. This is far cheaper and with improved technology, including better sonar mapping, can find fields quicker and bring resources online faster.

To illustrate the payoff, in the past 28 months Shell has found 16 fields that hold 1 billion boe (barrels of oil equivalent).

A billion barrels found. Sixteen times.

Apart from the change in strategy, which is brand-new to me, I’m prompted to ask yet again, What Peak Oil?

And the discoveries are going to continue and continue….

3/10/17 – The American Interest – Oil Prices Stumble as American Shale Rebounds – Many articles recently have commented on the rising output from American shale. This article has the best summary.

OPEC efforts to balance world supply of oil have hit the snag of increased output from shale. US production is up 500k bopd and thus crossing the 9M bopd level for the first time in a year.

One of many consequences is that prices aren’t up much, which was the goal of the entire production freeze. Remember, Saudi Arabia needs $100 oil. They have rebudgeted for $80.

Most entertainingly, the article point to another article which mentions that some frackers have relocated their operations to Alaska so they can sort out how to apply fracking technology on the North Slope.

Article mentioned above from Energy Media Group says fracking is about three times as expensive in Alaska as in Permian (or Bakken I assume). Several reasons for that include the higher cost to move water and proppant long distances along with regulatory requirements for water testing.

Get ready for more billion barrels fields being moved from

- we-don’t-know-how-much-is-there-and-we’re-never-going-to-touch-it-anyway category

into

- recoverable.

posted 3/17/17

By the way, in case it isn’t obvious: Copyright © 2015, 2016, 2017 James L. Ulvog