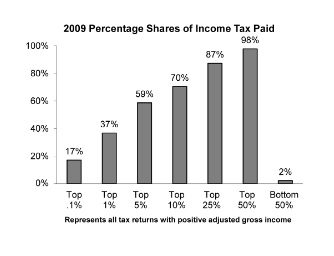

You read that right. 37% and 2%.

Over a third of individual taxes are paid on tax returns in the top 1% of filers and 2% paid by the bottom half combined.

That’s according to IRS stats from 2009. Here’s the graph from the IRS’ Individual Income Tax Rates and Shares, 2009:

Graph by IRS; public document

Here’s some data from the article:

Taxpayers filed 81.9 million taxable returns (58.3 percent of all returns filed).

The top 1 percent of taxpayers, with an approximate average AGI of $960,000 counted for 16.9 percent of AGI.

The top 10 percent of taxpayers, with an approximate average AGI of $245,000, accounted for 43.2 percent of AGI.

The bottom 50 percent of taxpayers, with an approximate average AGI of $15,000, accounted for 13.5 percent of AGI.

That means the top 1% category had about 819,000 returns. There were about 40,950,000 returns filed by people in the bottom half. There are obviously 50 times more tax returns for people in the bottom half.

The top 1% of filers paid 18.5 times more in total than the bottom half of filers.

That means each tax return in the top 1% had a 925 times larger tax bill than each tax return for the bottom half. Average AGI was higher by a factor of 64.

(Hat tip: Carpe Diem)