There’s an idea that we don’t make anything in the U.S. anymore. Well, we do import a huge portion of the good stuff we enjoy everyday. Yet we still make a huge amount of stuff here.

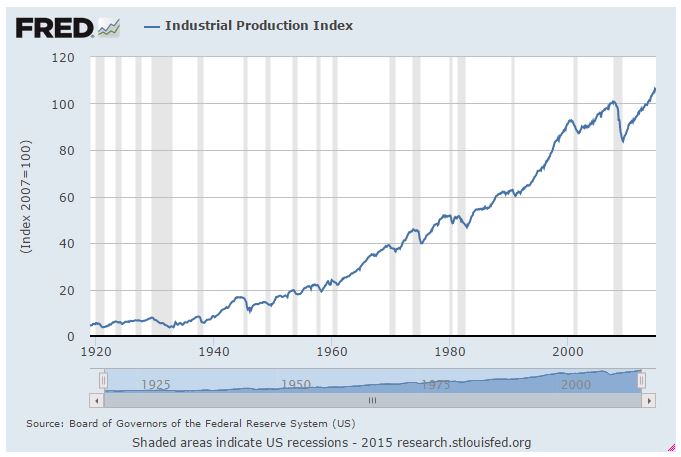

Check out this indicator of total industry production in the US. The peak production level is today:

This is from the St. Louis Federal Reserve, which has a humongous database called the Federal Reserve Economic Data, or FRED.

What does the index above cover? From the FRED site:

The Industrial Production Index (INDPRO) is an economic indicator that measures real output for all facilities located in the United States manufacturing, mining, and electric, and gas utilities (excluding those in U.S. territories).(1)

So industrial production in the U.S. is at a record level. Cool.

Want to check out manufacturing only? Okay, here is it: Continue reading “Has the U.S. just stopped making stuff? Yeah, I’d think so too if industrial output in the U.S. wasn’t at all time record high.”