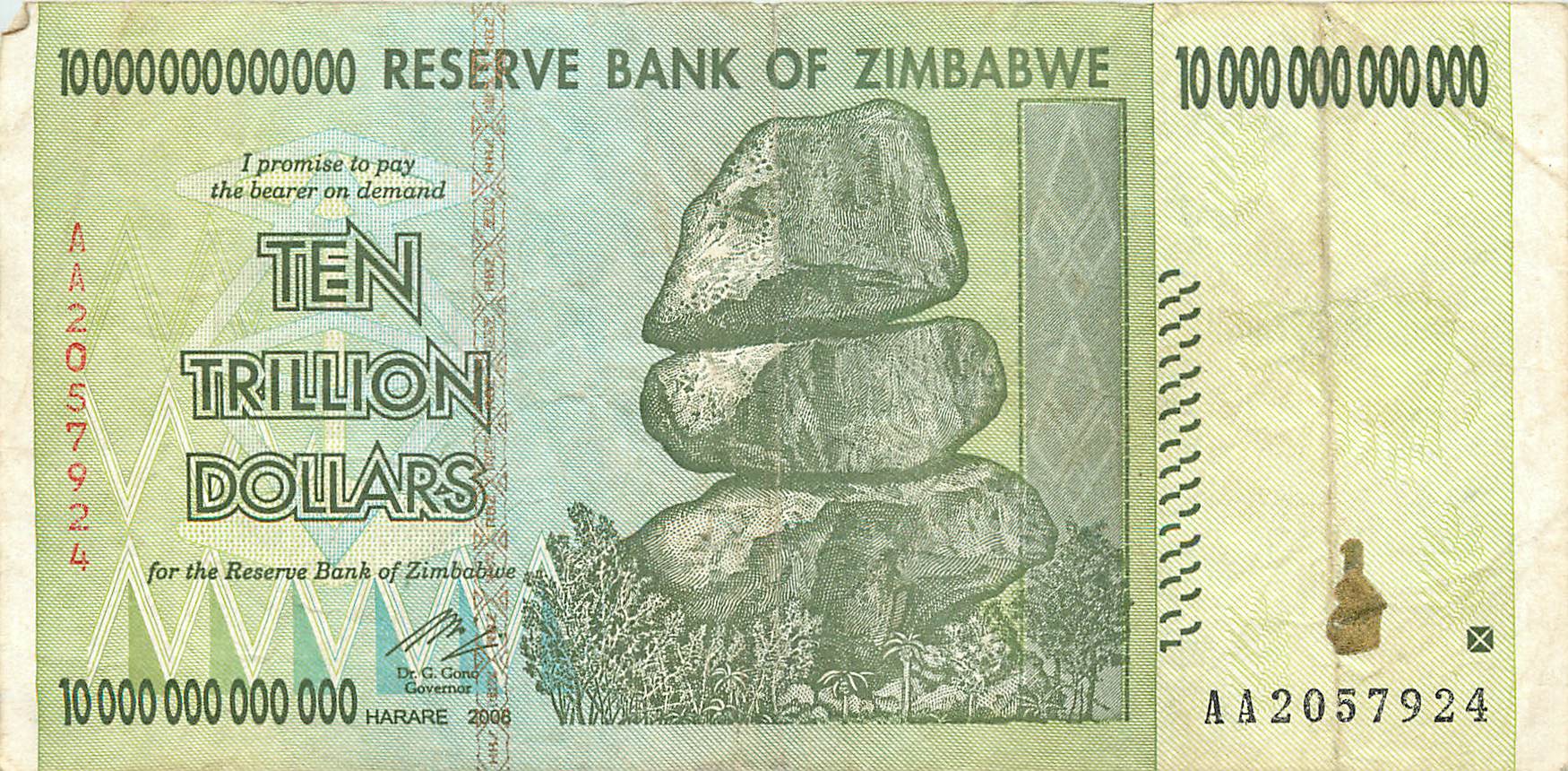

The hyperinflation in Zimbabwe resulted in a ten trillion Zim note being worth four cents in American dollars. That would be:

- Zim$10,000,000,000,000 = US$.04

When that level of financial devastation happens, it is the result of government policy. Usually socialists pull it off, but German also did so before WWII.

Previous posts:

- 6/30/15 – This is what hyperinflation looks like

- 8/20/15 – Follow up on Zimbabwe hyperinflation – Government introduces coins for making change

Venezuela

If you are so interested, you can now watch the sad story as it plays out in Venezuela.

2/3 – Wall Street Journal – Inflation-Wrought Venezuela Orders Bank Notes by the Planeload – Usually governments deal with out-of-control inflation by adding two or three zeros to the currency. Instead of the largest bill in circulation being a 100 unit note, the next run of currency is for a 10,000 unit note. In six months or a year there will be a 500,000 or 1,000,000 note in circulation.

Article says the Venezuelan government isn’t doing that because to do so would acknowledge the astronomical inflation. As the saying goes, denial isn’t just a river in Egypt.

Instead of acknowledging that inflation is running out of control, the government of Venezuela is flooding the economy with the same denomination note. In the last several months of 2014, the article says there were three dozen flights of 747s into the country hauling nothing but currency. Over 30 cargo holds filled with currency.