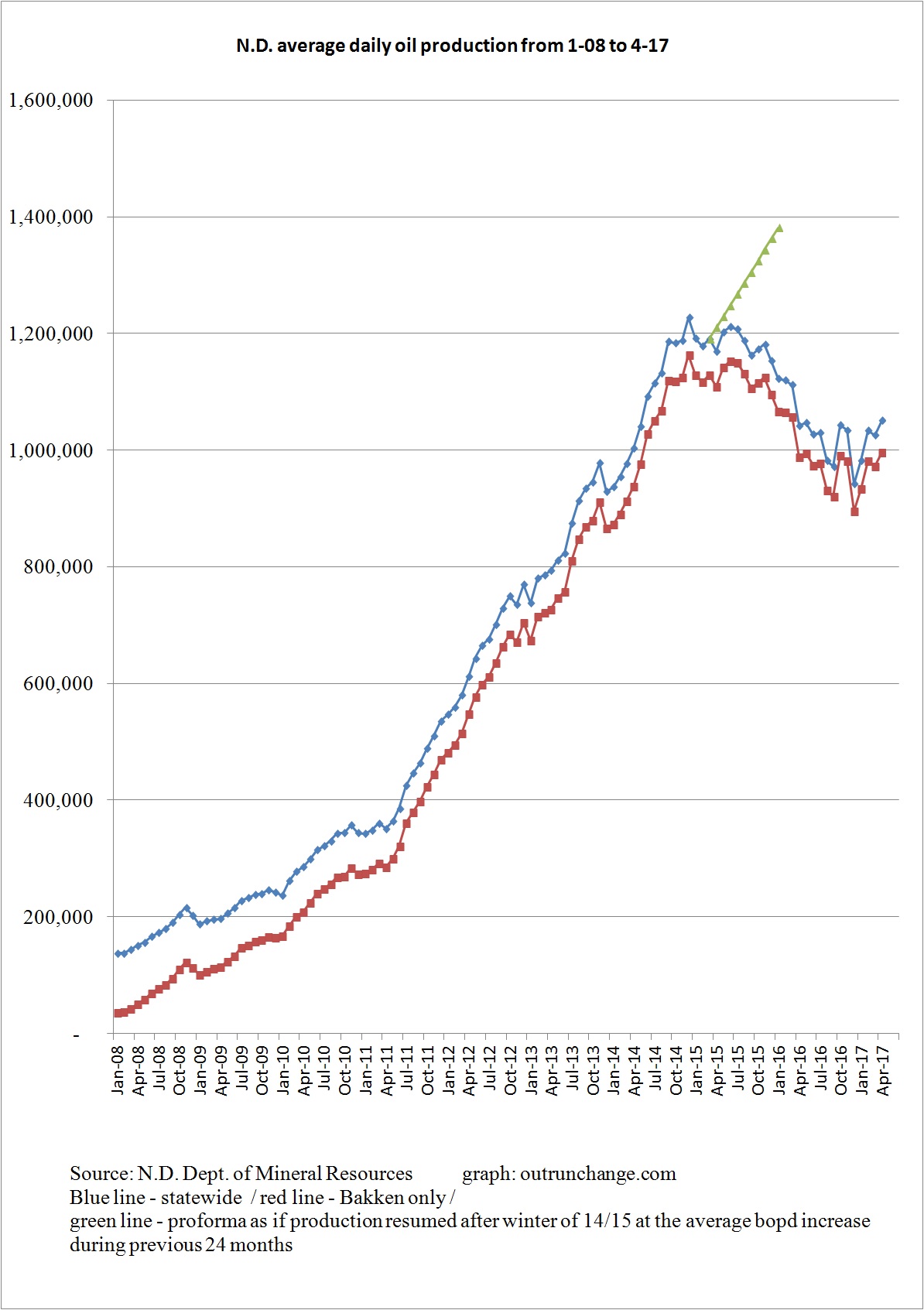

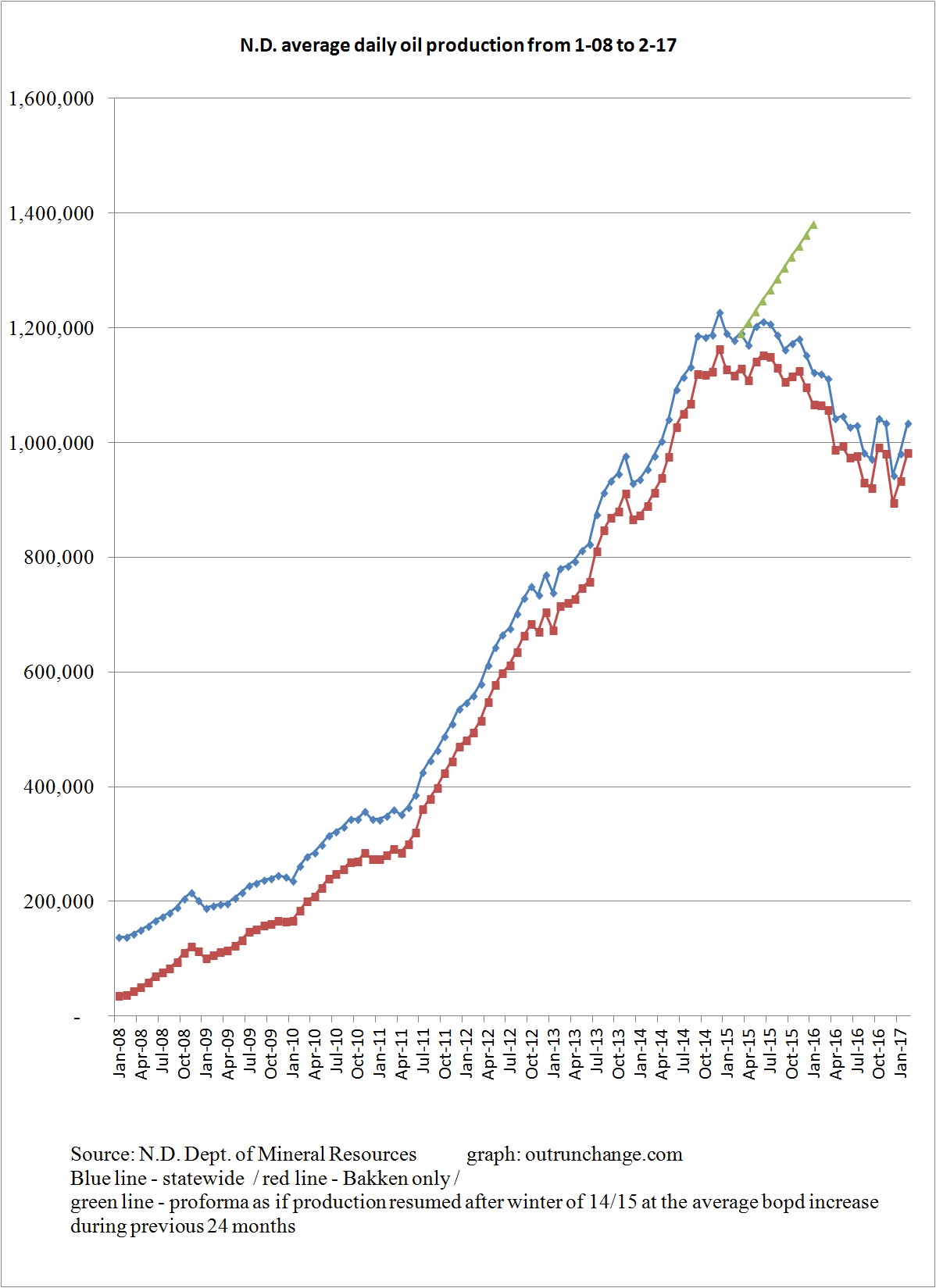

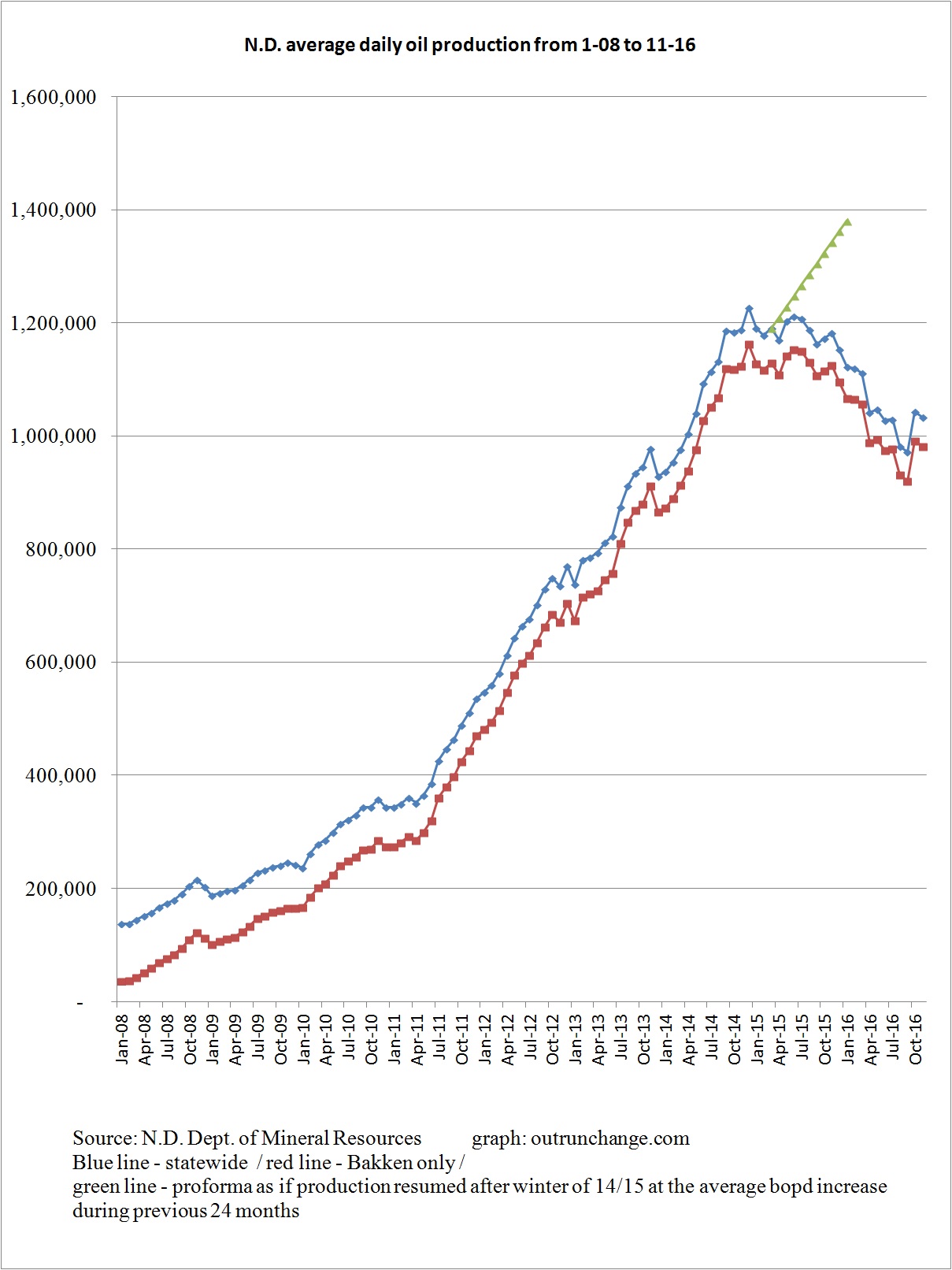

Big increase in production in the state. Increase of 2.43%, from average of 1,025,690 bopd in March (revised) to 1,050,630 bopd in April (preliminary). That is the highest average production since March 2016. The April production was only 160,700 below the high water mark of 1,207,276 bopd in July 2015.

That upslope since last fall is not quite what OPEC+Russia had in mind.

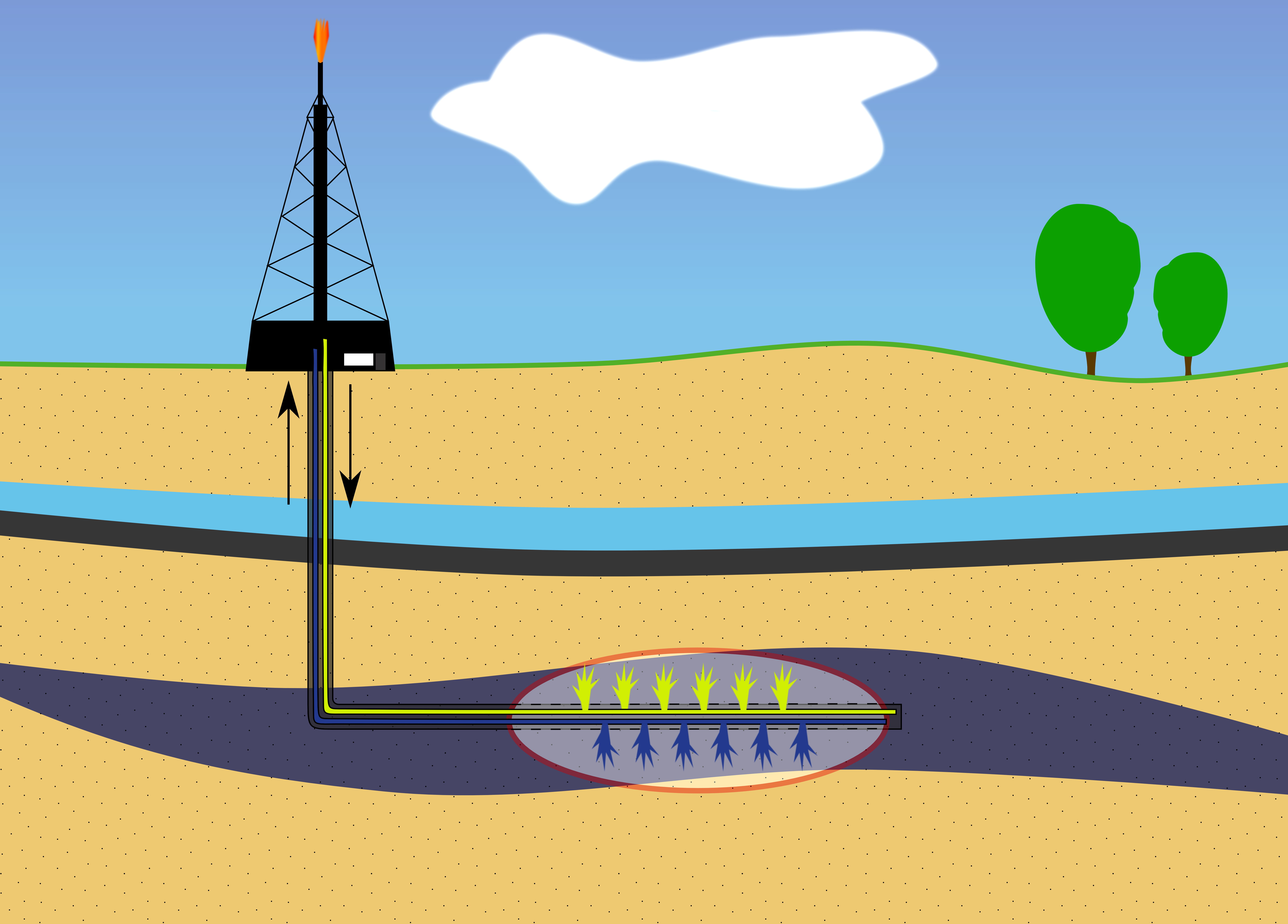

Million Dollar Way pointed out the production increased at the same time as the number of inactive wells increased and the fracklog increased. I sure don’t understand the dynamics.

Producing wells increased 122 to 13,434; fracklog increased 141 to 830; inactive well count increased 167 to 1,466. Some of that is a recovery from drops in March.

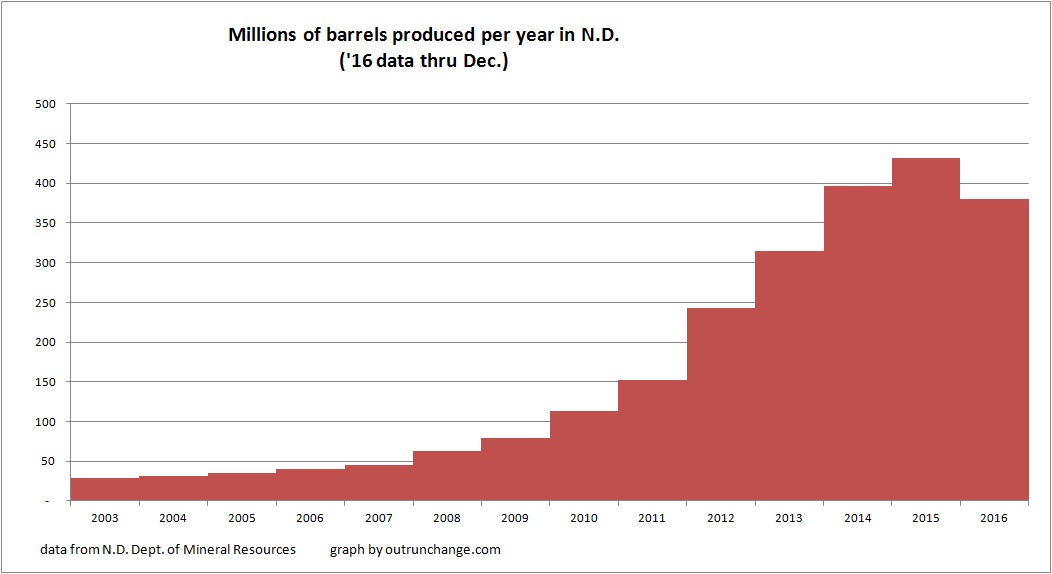

Here is another graph of production, for a longer term perspective:

Continue reading “Oil production in North Dakota up 2.4% in April 2017”