Bruce Oksol wonders whether Bakken oil production is entering the manufacturing phase after a frantic construction phase.

2/3 – The Million Dollar Way – Idle Chatter on DUCs and Related Data Points – Before a big factory or electrical plant or other major project begins production there is a massive construction effort. The number of jobs to run the facility is a fraction of the number of workers needed to construct the thing. When completed, the number of jobs at the facility drops off.

Mr. Oksol uses the illustration of a natural gas plant being built. During construction there will be around 2,000 temporary jobs. When that gas is turned into electricity, the plant will employ 45. That’s 2,000 temporary and 45 permanent jobs.

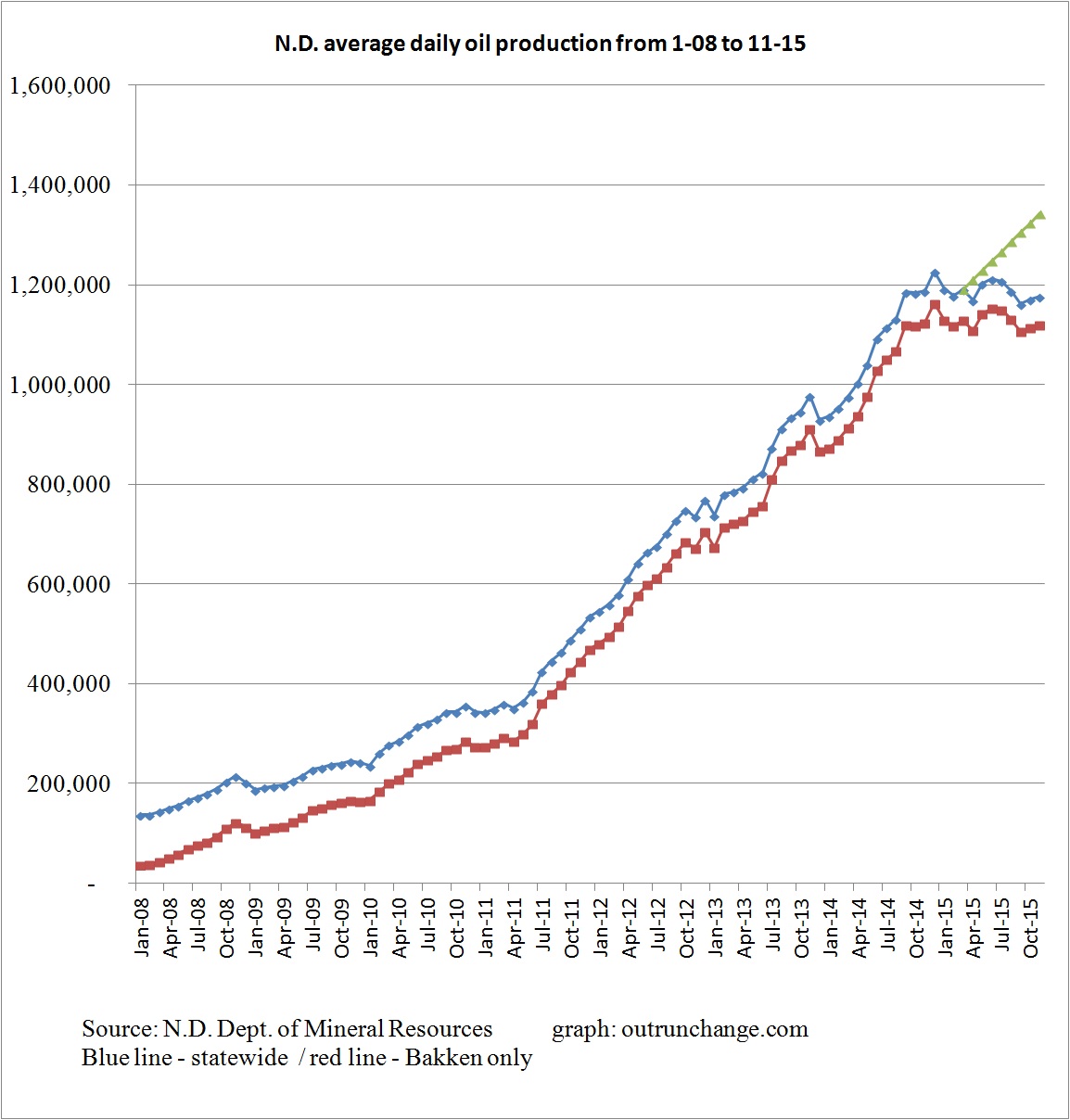

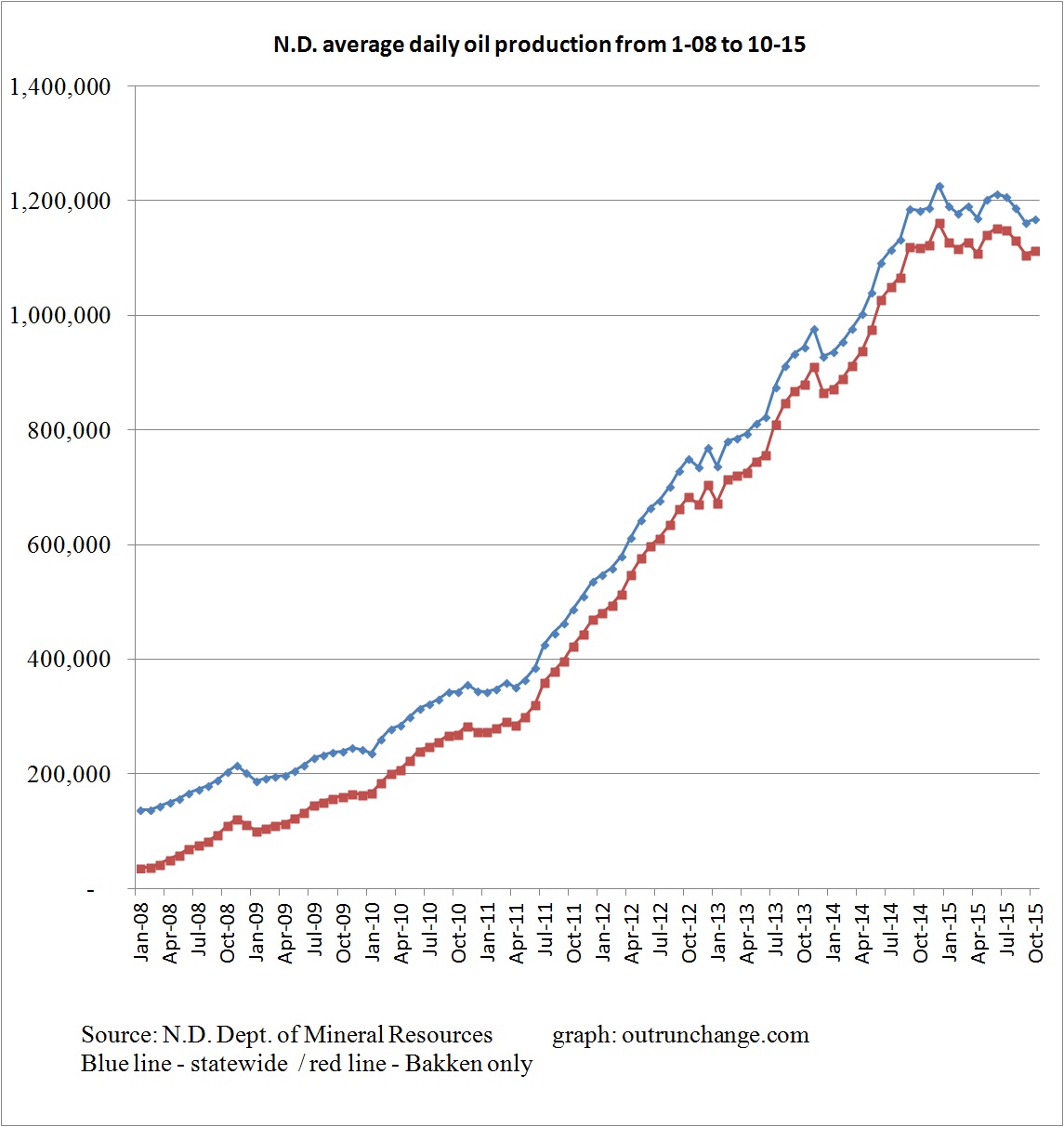

He wonders if Bakken is like that, having finished the ‘construction’ and now moving into manufacturing.

Continue reading “Bakken entering ‘manufacturing’ stage? Also, count of oil rigs in field.”