Wow. I tripped across the PDF slides for the presentation by Mr. Lynn Helms, North Dakota’s Director of Mineral Resources, at the Williston Basin Petroleum Conference on May 25, 2012. You can find the presentation on this page. The title is WBPC Activity.

A big thank you to Mark J. Perry at Carpe Diem for pointing me to the PDF slide presentation.

Mr. Helms presentation is the source for many of the articles I’ve read and the resulting posts on this blog.

What is the very condensed message from the presentation?

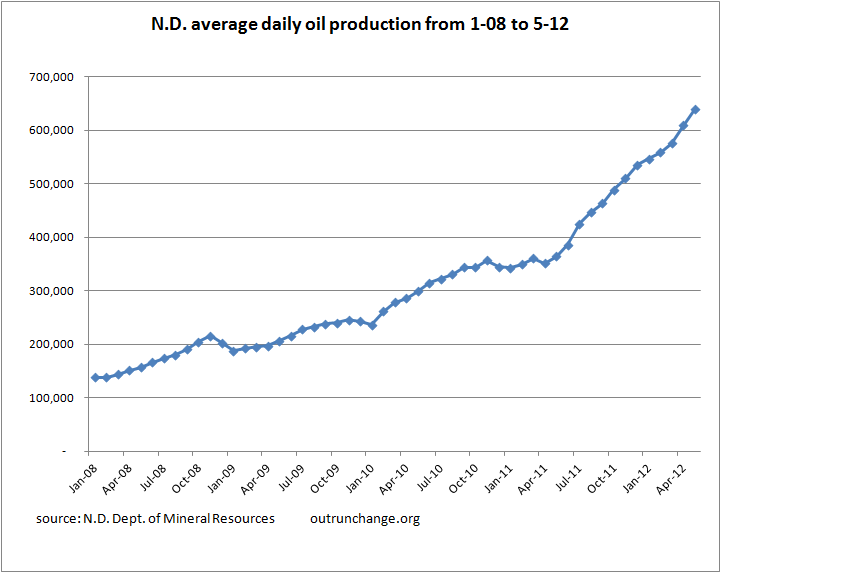

The oil boom in North Dakota, which has seen production skyrocket to over 600,000 barrels per day, is just getting started.

Typical production from a well

Continue reading “Forecasts for Bakken field. Part 1”