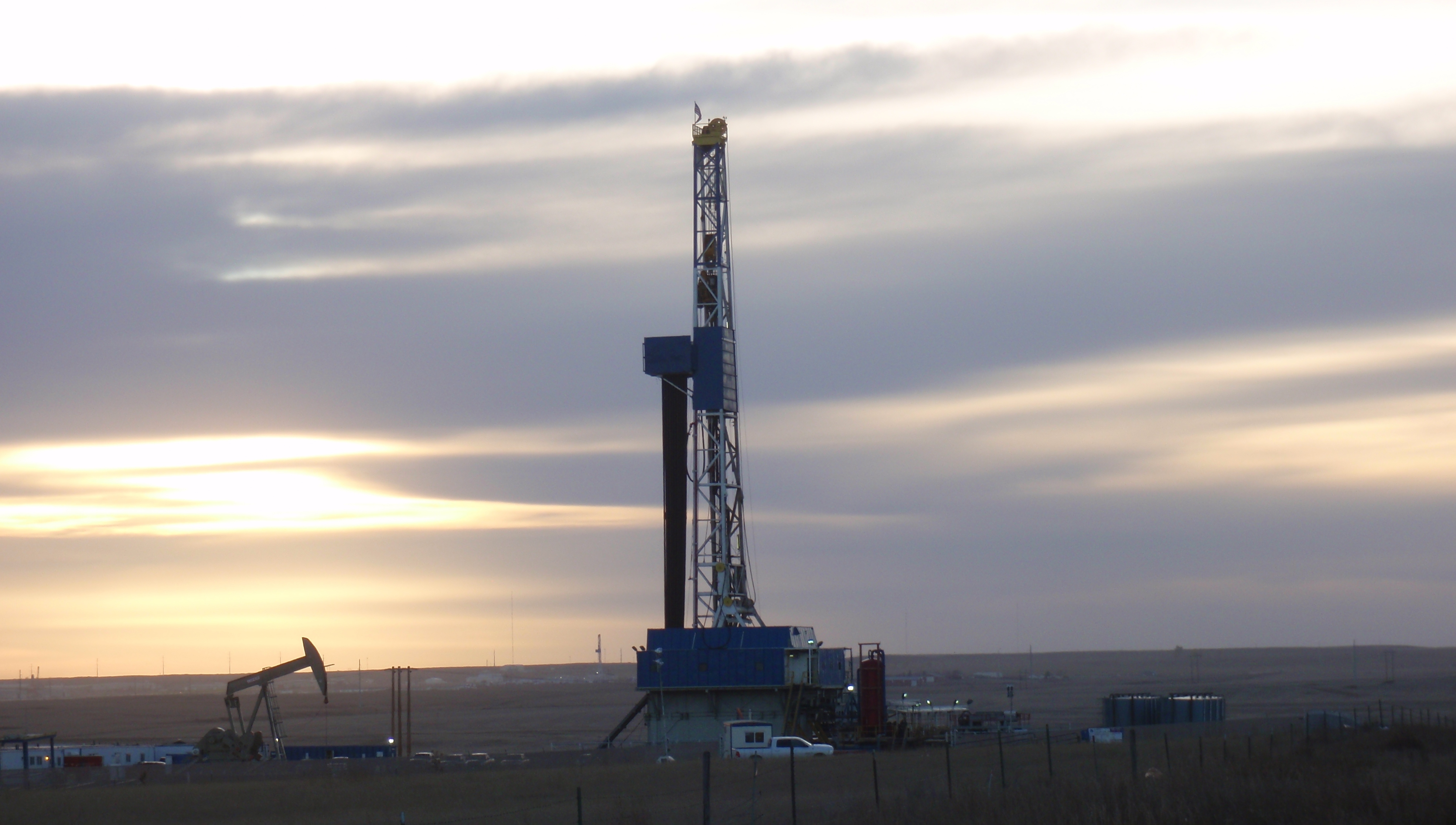

Update: Greetings to readers arriving from The Million Dollar Way! Enjoy! Oh, by the way MDW, you are very welcome. For other readers, if you enjoy my writing on energy in general, Bakken in particular, and the wide open frontier of the energy revolution, somewhere around one-quarter of the credit for what I know goes to the learning provided by MDW.

I’ll make a guess we will be hearing lots more stories of hiring in Bakken. Some recent articles:

- Two articles on oil companies hiring fracking crews

- Scuttlebutt is staffing shortages to develop

- Two articles on Target Logistics converting crew camp into hotel

12/29 – Grand Forks Herald at Dickinson press – Oil companies hiring fracking crews in Bakken – Job Service North Dakota said there are 60 companies wanting to staff up fracking crews. Each crew will need between 45 and 65 workers, so that something in the range of 300 or 350 jobs in the new year.

Let’s extend that out. The Million Dollar Way helps us in a post asking Worker Shortage Looming In The Bakken on 12/30.

It takes about two or three days to frack a well. Assume two wells per crew per week. That would be 12 wells a week for 6 crews, or somewhere around 48 wells in a four-week month. Keep in mind that’s on top of whatever fracking crews are in the field now.