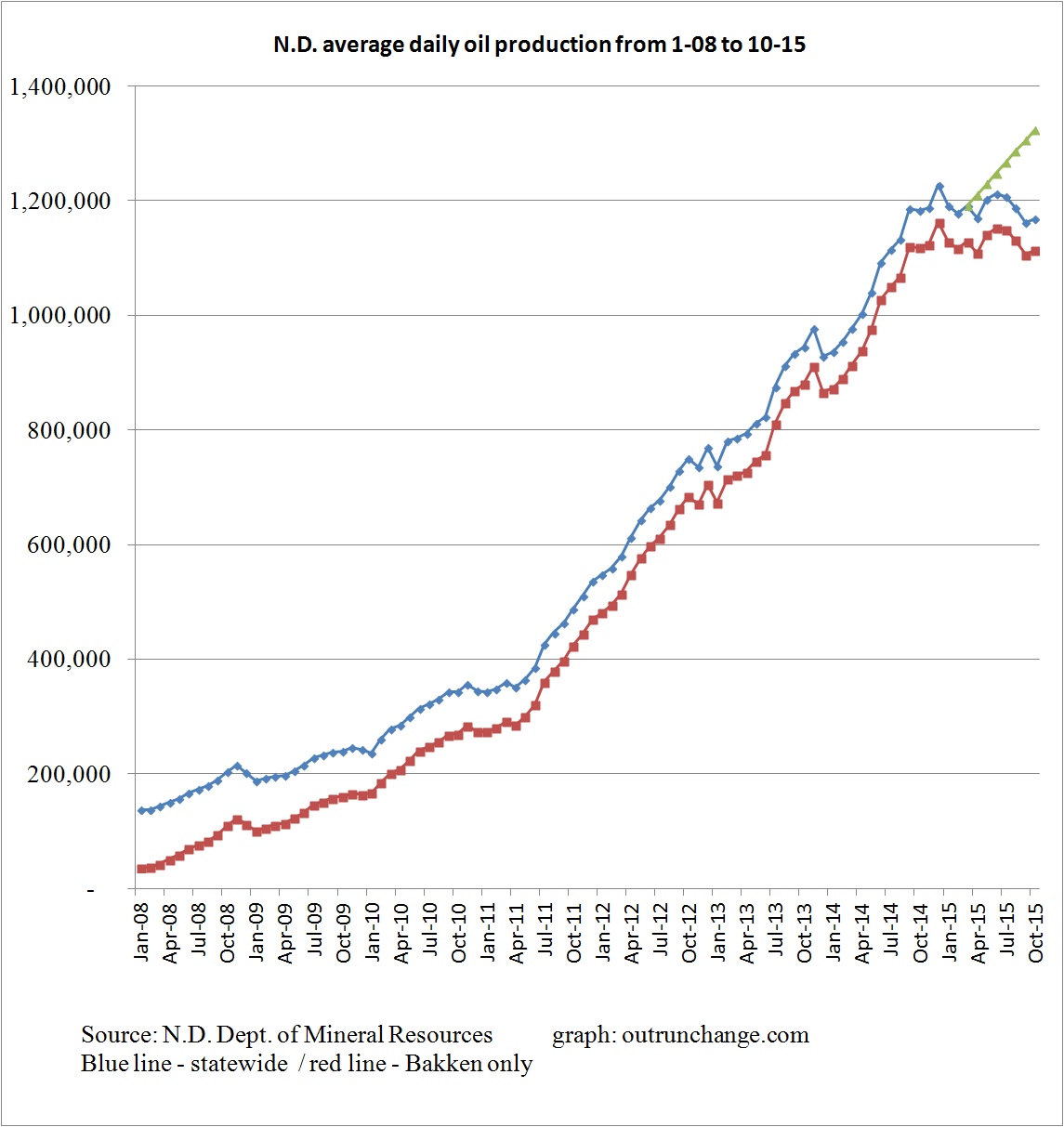

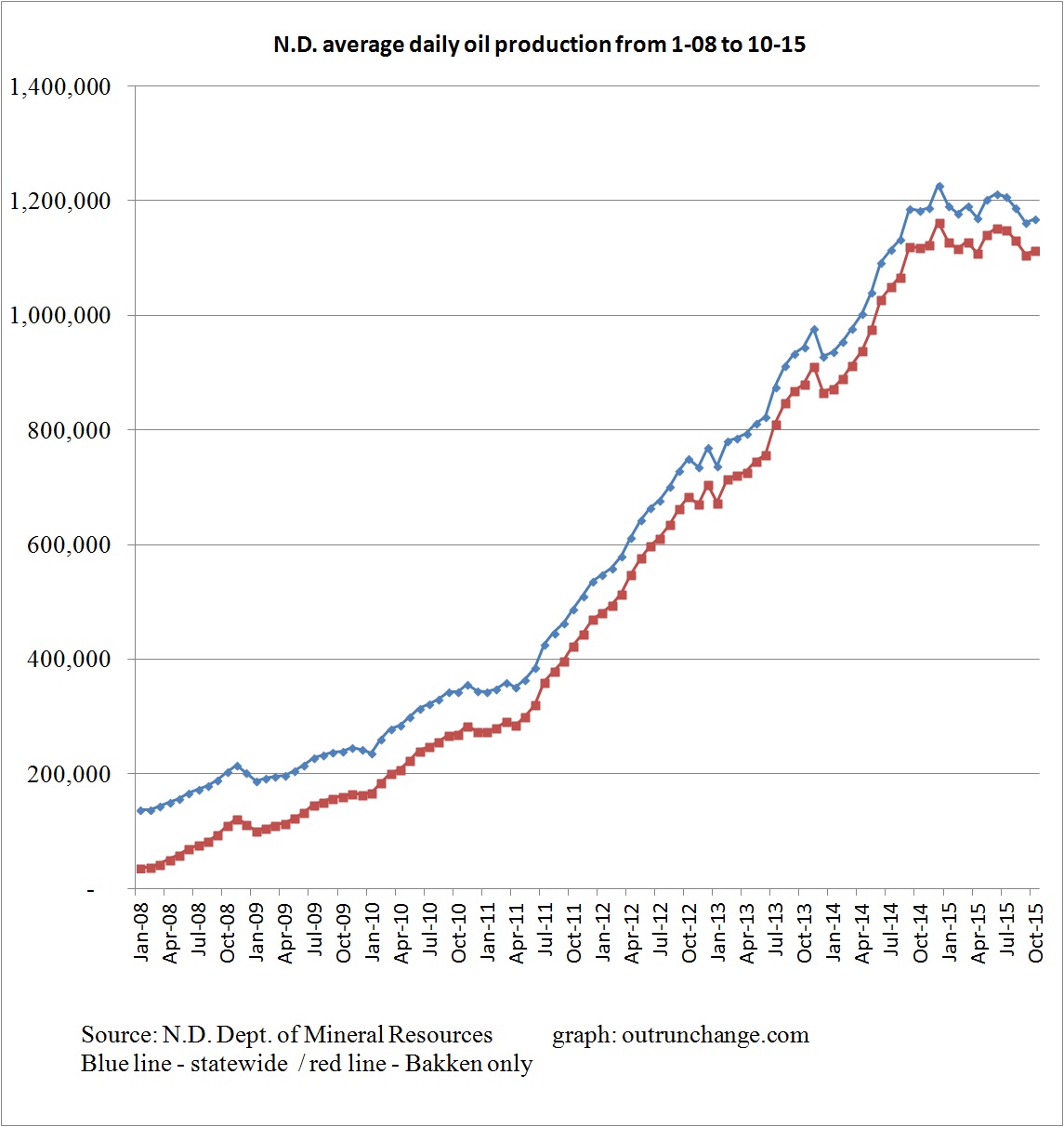

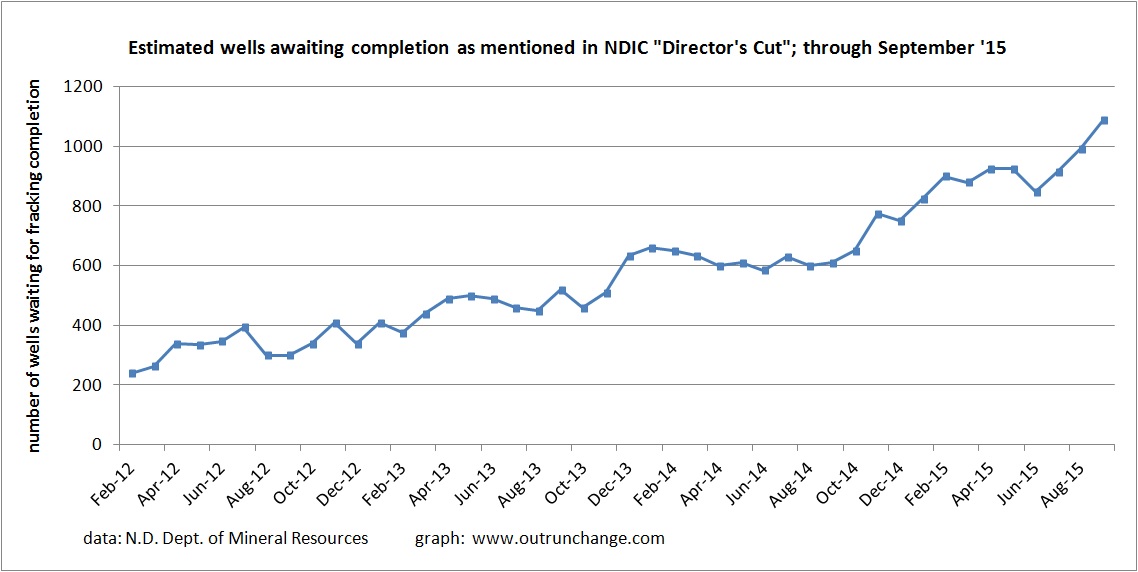

If you let an economy function, market forces will create pressures to smooth things out. The forces of supply and demand have an amazing ability to balance a temporarily unbalanced marketplace. Several recent articles illustrate this concept in North Dakota.

11/17 – Amy Dalrymple at Dickinson Press – Pipelines now outpacing trucks for gathering Bakken oil – After oil is pulled on the ground it needs to be moved from the well pad to either a rail-loading terminal where it leaves the state by rail or it gets moved to a major transmission pipeline where it leaves the state by pipe.

The oil is initially moved by either trucks or underground pipes.

The number of small gathering pipelines to carry oil away from the wells is finally large enough that more oil is moved by gathering pipelines than by trucks.

Continue reading “More signs the North Dakota infrastructure is catching up”