More news on the energy market. Supply and demand may equalize soon. Maybe.

Saudi Arabia may have bit off more than they can chew. The US and world markets will benefit, along with everyone who consumes energy.

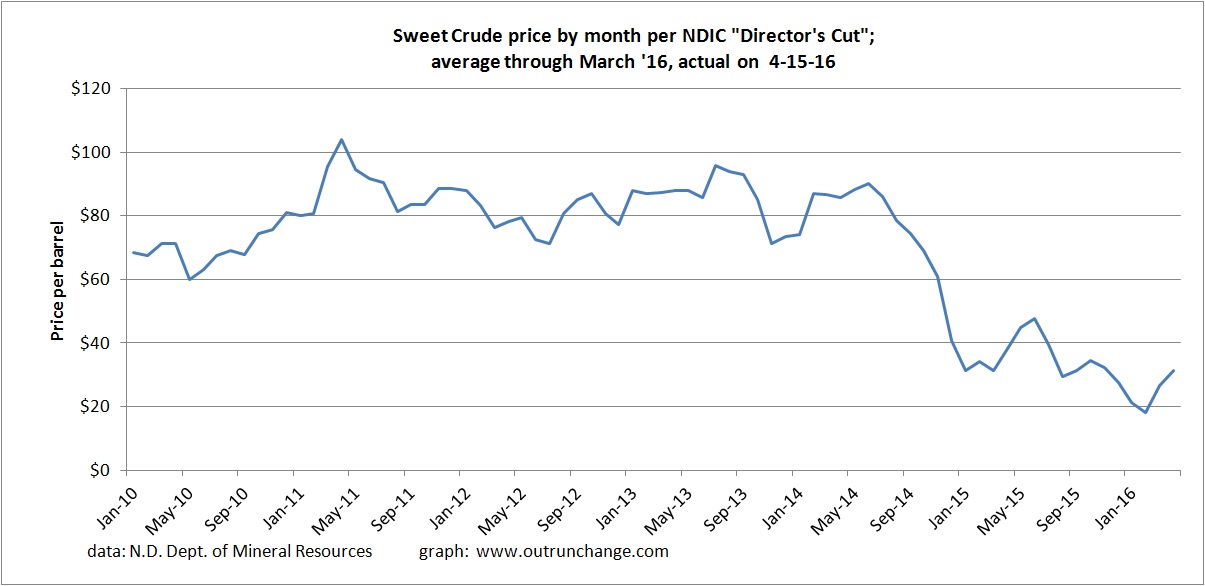

7/1 – AP at Bakken.com – US energy secretary sees oil market coming into balance – The Saudi oil minister thinks worldwide demand will catch up with production by around the end of 2016. The US Energy Secretary thinks it will go into 2017, perhaps another year. Prices likely to go up as demand and supply stabilize.

7/18 – Wall Street Journal – Oil Prices Steady but Products Glut Looms – There are hints in the air that several markets, such as gasoline, are oversupplied, which will put downward pressure on crude oil prices. Another indication that nobody can predict the future.

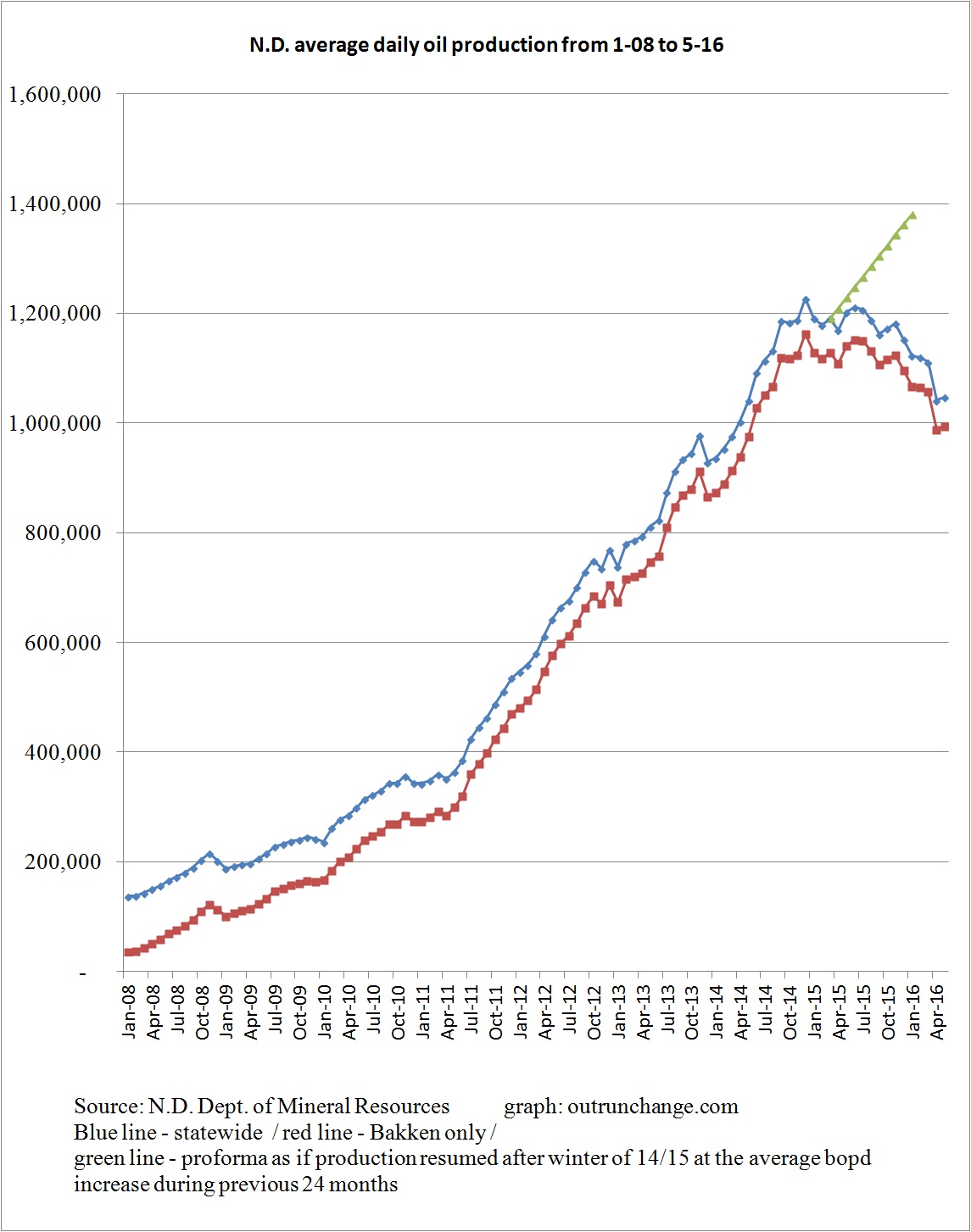

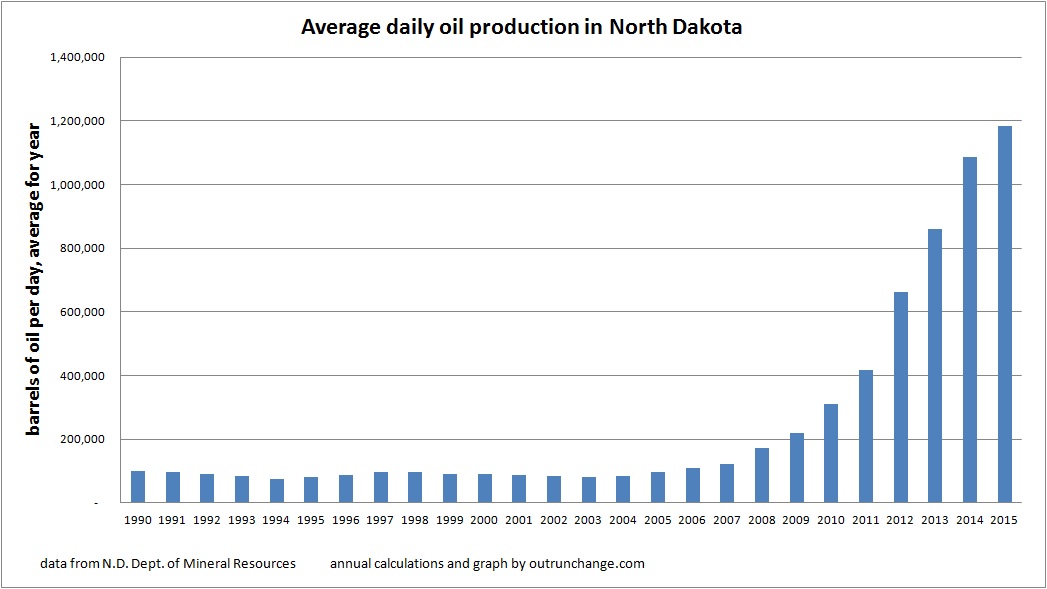

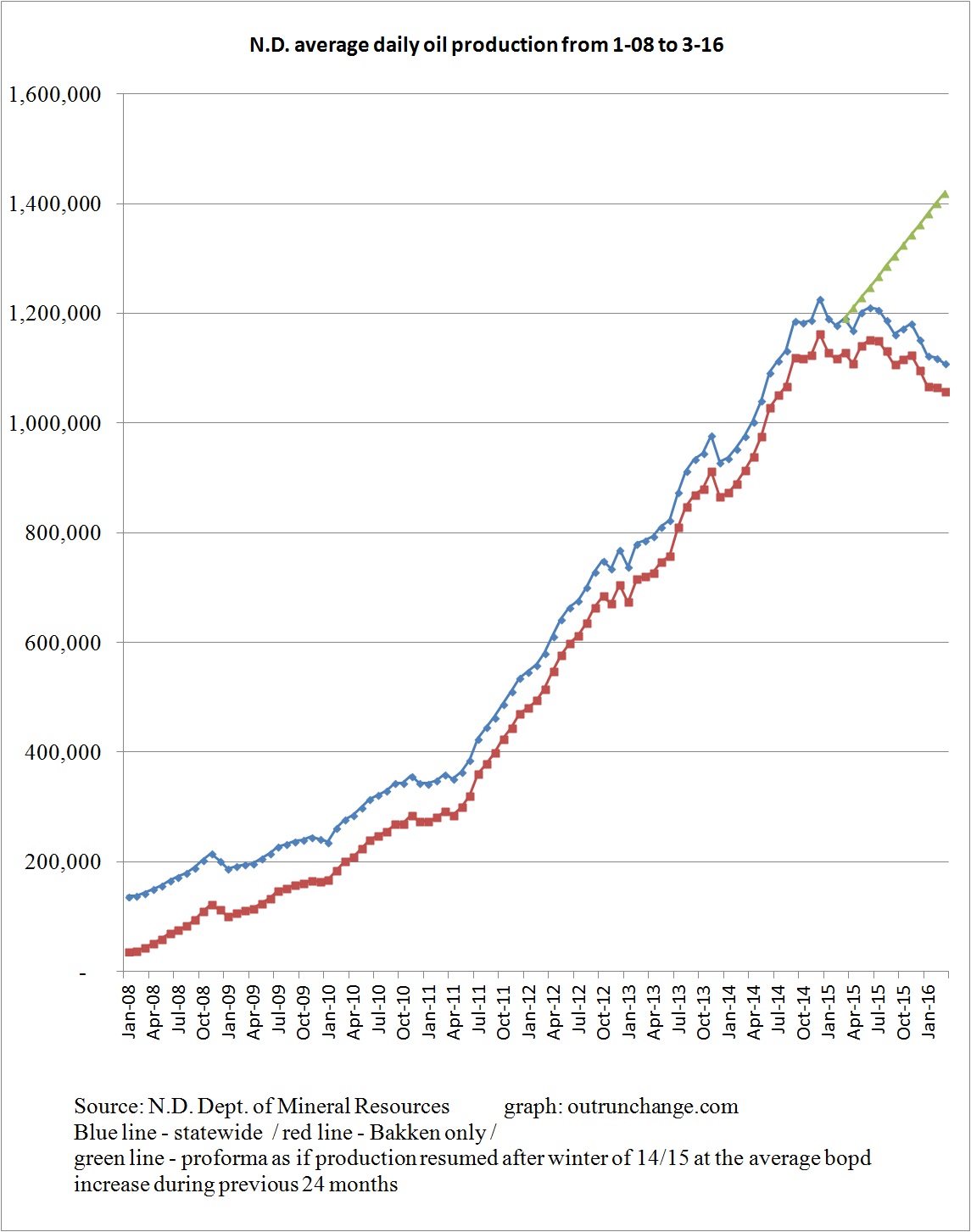

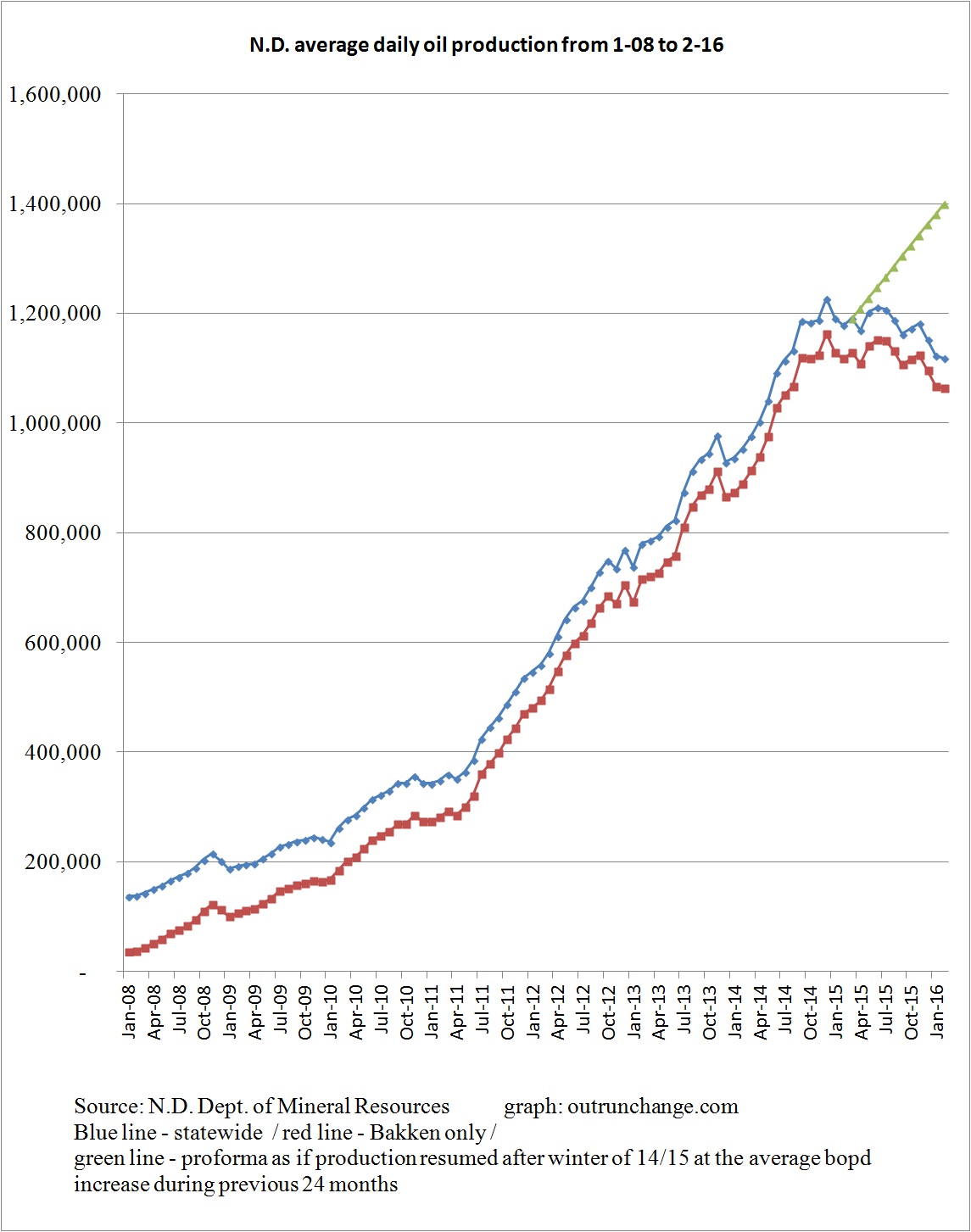

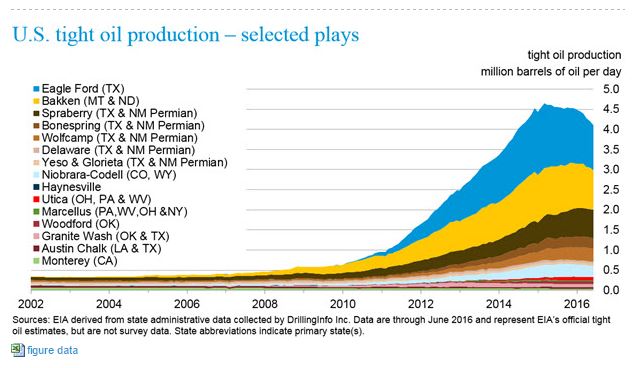

7/31 – Ambrose Evans-Pritchard at the Telegraph – Texas shale oil has fought Saudi Arabia to a standstill – This is a must-read if you follow my blog.

Twenty months ago Saudi Arabia launched a price war, generally considered to be an effort to take out American shale producers.

Didn’t quite work out that way.

Continue reading “Outlook for oil, some short-term and long-term thoughts”