There was lots of news yesterday about the House passing a budget that covers all federal operations for the 2016 fiscal year.

I will leave the heated political observations to others. They seem to all be having fun.

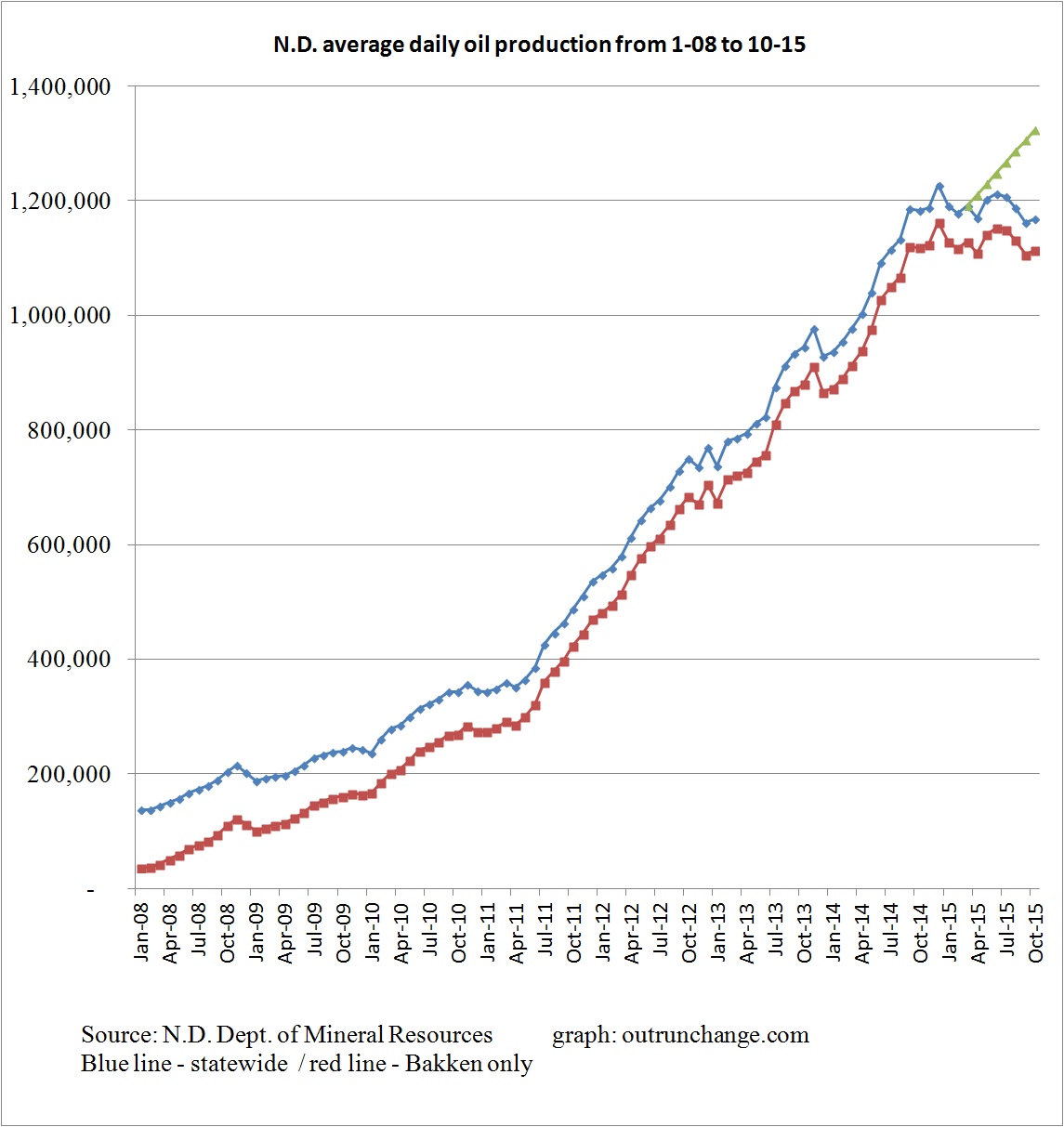

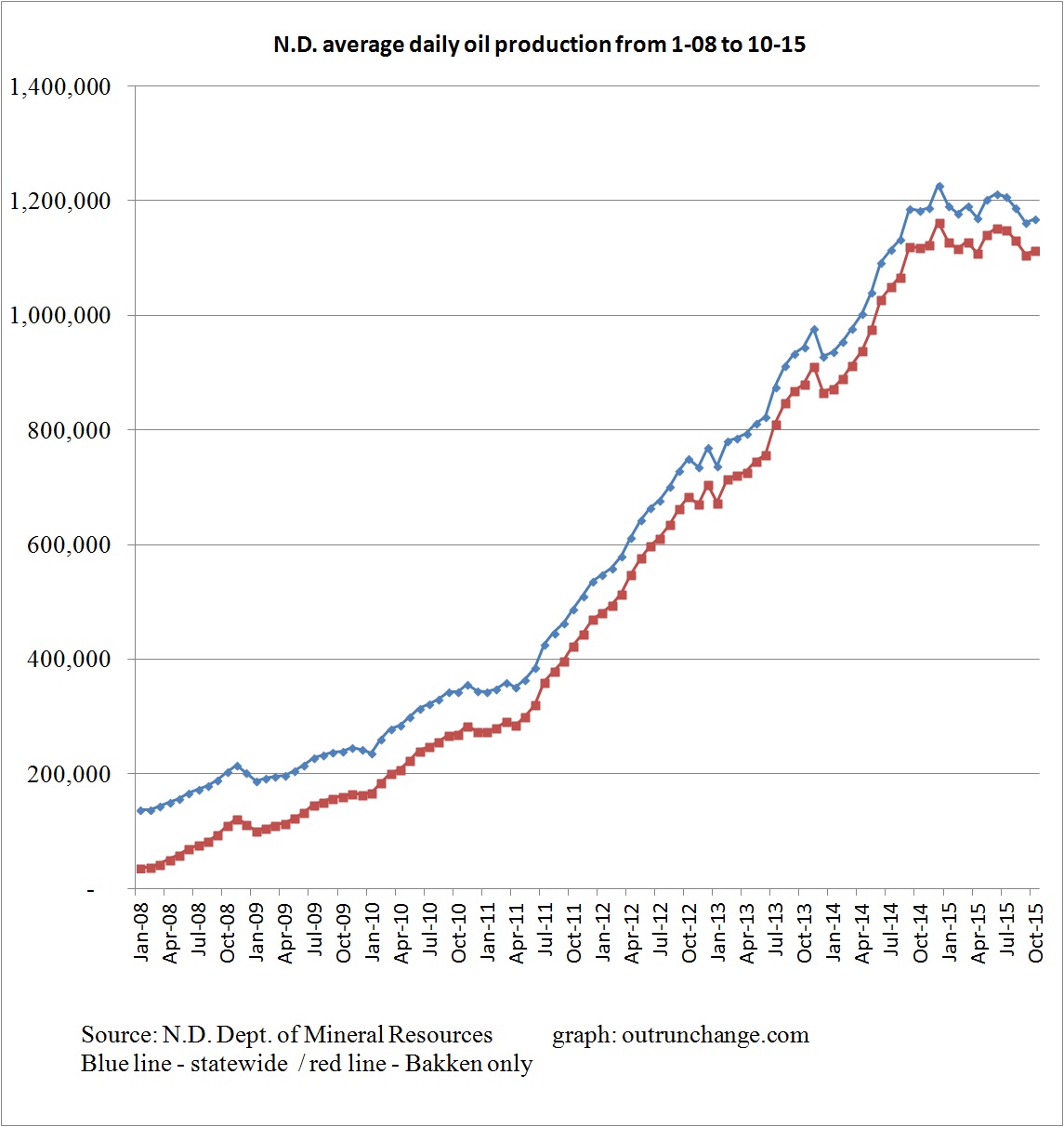

What I’ll focus on is several ways that the sausage-making legislative compromises affected some of the wide open frontiers I’m watching.

Export ban on crude oil

Continue reading “Government intervention can stop an industry or make the good times roll”