The Million Dollar Way quotes a press release from Montana-Dakota Utility without a link. MDU has purchased the Thunder Spirit wind farm project from Allete Clean Energy. MDU currently has a commitment to buy all the electricity from the project on a 25 year contract. Now MDU owns the wind farm.

Project consists of 43 towers with rated capacity of 107.5 mW. Cost is reported in the press release to be $220M.

At cost of $220M for 107.5 mW, that works out to $2.05M/mW.

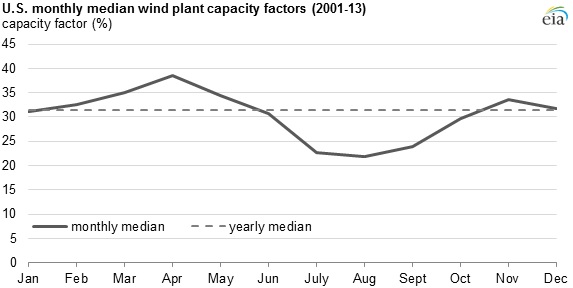

Keep in mind in the upper plains the average capacity of wind farms is about 34%. See EIA graph here. Peak is about 43% in fall and low is about 21% in the late summer for about 2 months. The upper plains have a flatter capacity curve than other regions. Looks like about 40% can be achieved for half of a year.

Theoretical output (also called nameplate) is 107.5 mW. Average output will likely be 36.6 mW (107.5 x 34%).

So the actual cost for each mW of actual average output would be: Continue reading “Update on Thunder Spirit wind farm. Project sold to MDU.”