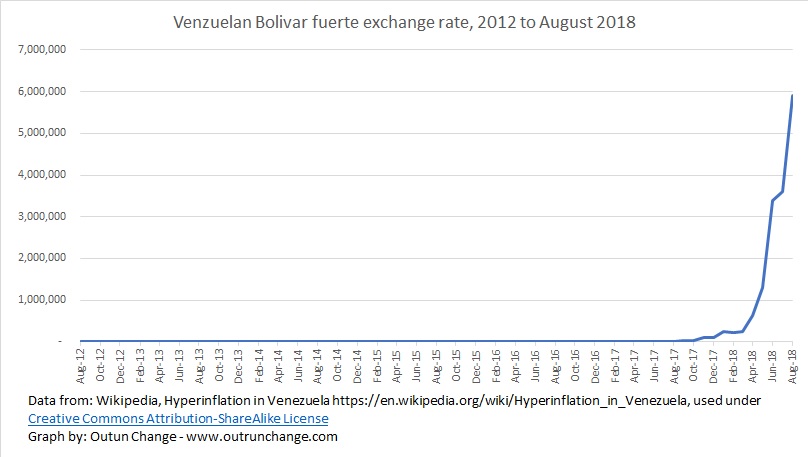

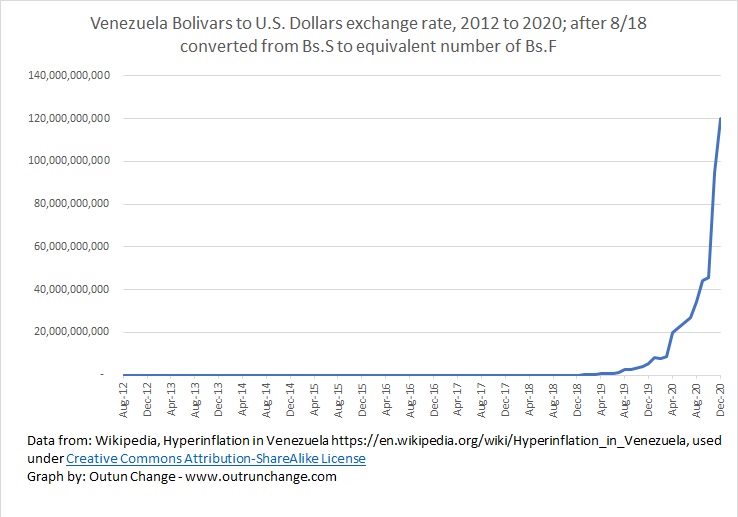

Ongoing hyperinflation in Venezuela was so severe after the conversion to Bolivar soberano (Bs.S) in August 2018 that far higher denomination currency had to be introduced in June 2019.

To illustrate the concept, the exchange rate at the end of July 2018 was 3,600,000 Bs. F. to $1. That would be equivalent to 36 Bs. S. to $1 using the new currency.

At the end of August 2018 the exchange rate was 90 Bs.S to $1. From 36 to 90 in a month.

At the end of December 2018, the exchange rate was 730 Bs. S to $1.00. That meant that the highest denomination note in circulation, the 500 Bs.S. was worth less than one US dollar. By the way it had been worth it $8.47 at the end of August 2018, just four months earlier.

By the time the new denominations were in circulation at the end of June 2019 the exchange rate was 7,880 Bs. S to $1.

Oh, that 500 Bs. S. issued back in August 2018? It was worth $0.06 at the end of June 2019.

That one bill dropped from being worth US$8.47 in August 2018 all the way down to US$0.06 in June 2019.

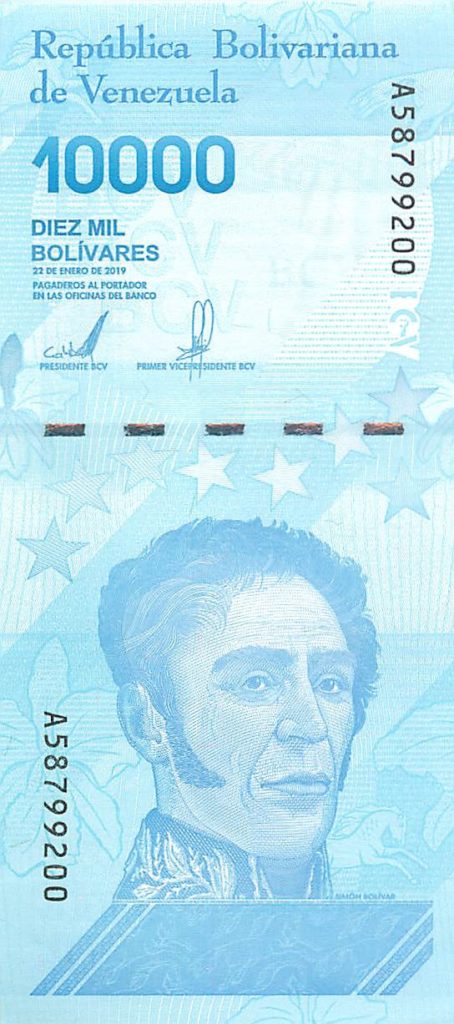

The obverse (front) of the bills issued in June 2019:

10,000 Bs. S, equal to 1,000,000,000 Bs. F., yes one billion

Simon Bolivar

Continue reading “Front (obverse) of 2019 currency issued in Venezuelan.”