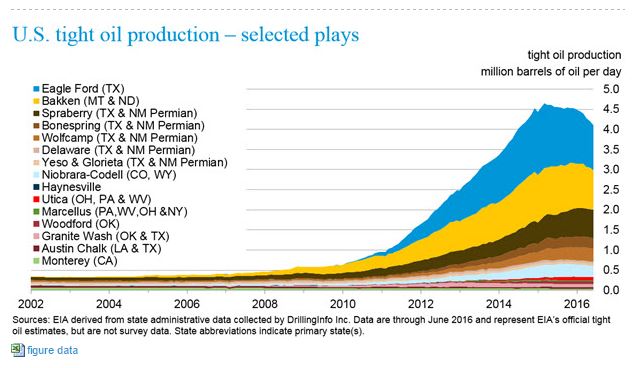

Keep in mind that U.S. shale drillers will be able to make a lot of money if oil prices go up to $60 as I describe the distress facing Saudi Arabia.

Four articles for your consideration:

- Shale drillers likely to get busy if oil hit $60

- Saudi Arabia still in distress in spite of successful bond issue

- One Saudi official cautions bankruptcy could be a few years off if oil prices continue the way they are

- Another article describing the distress in Saudi Arabia because of low oil prices

11/16 – Reuters – IEA expects US shale output rise if OPEC pushes oil to $60 – IEA expect there will be a lot more drilling and production coming out of shale fields in the US if prices go up to $60. If OPEC (meaning Saudi Arabia) reduces production sufficiently to drive up prices it will draw shale drillers back to work.

I take exception to one comment made by IEA, specifically that it will take nine months for any new production to get on the market. Continue reading “Financial distress in Saudi Arabia and OPEC not likely to end soon”