[youtube:https://www.youtube.com/watch?v=6JJDXcu9KNM]

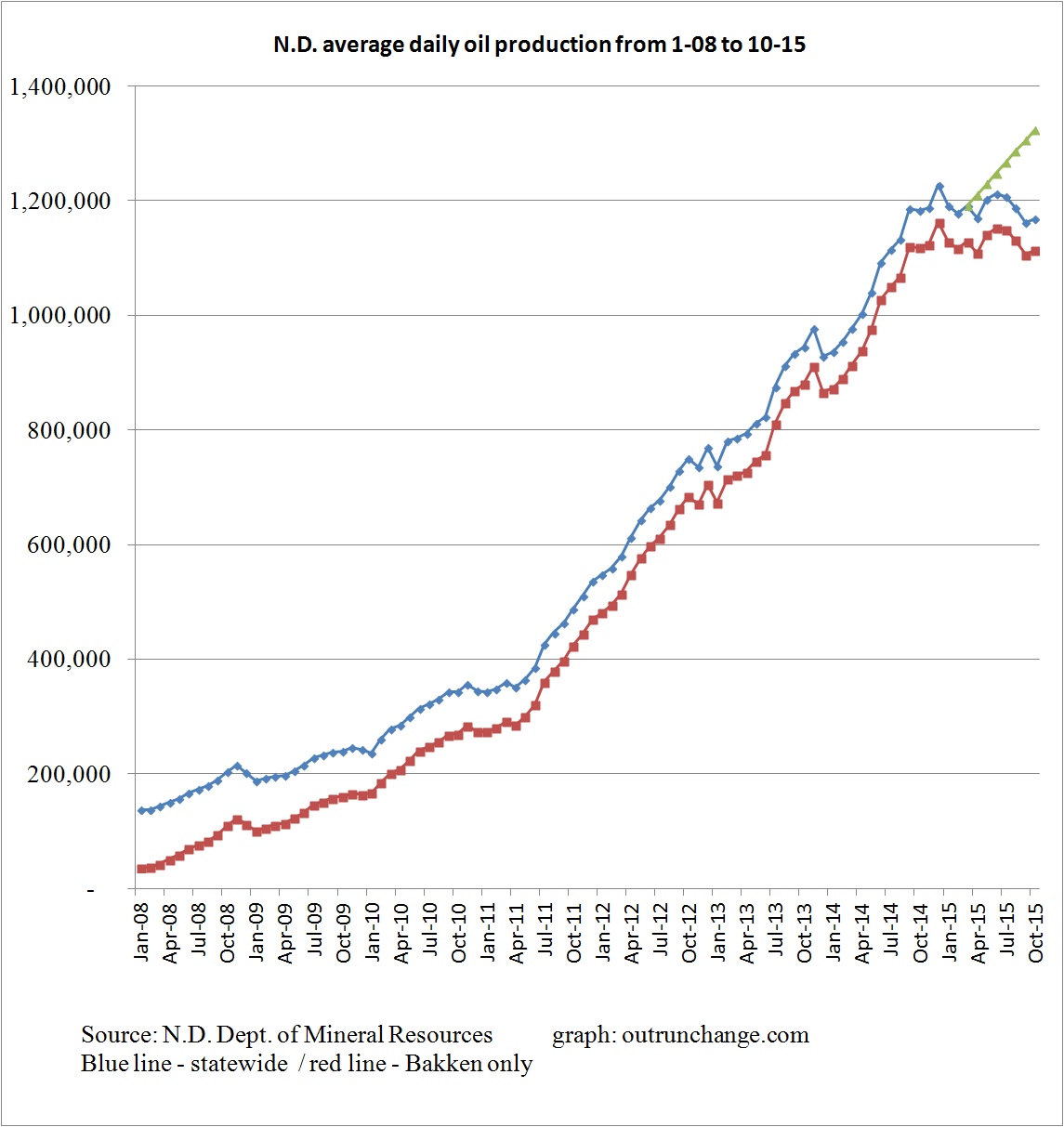

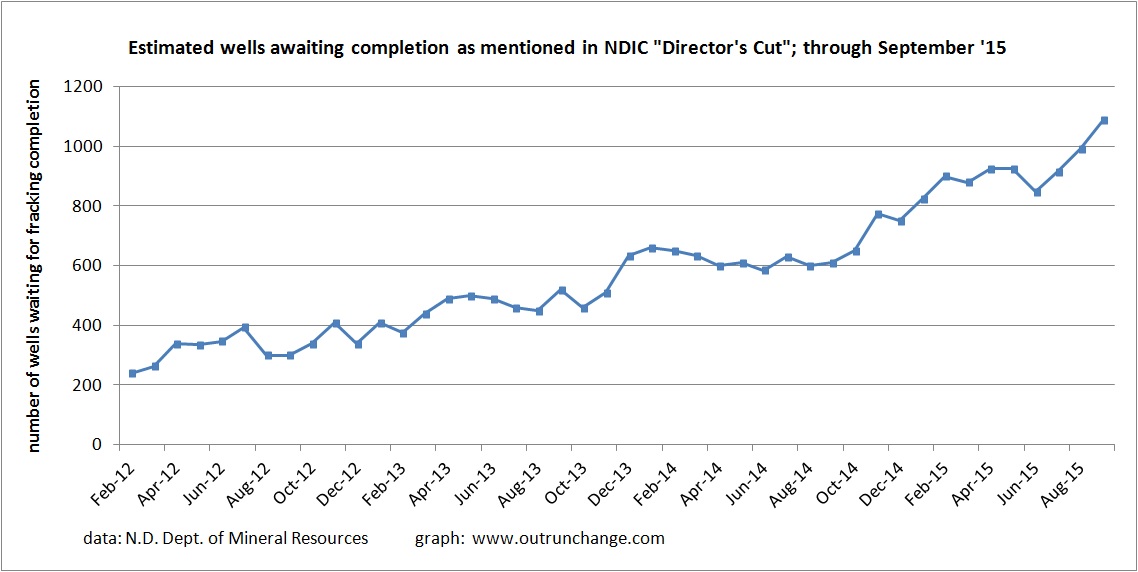

Lots of news lately on what is going on with crude oil. Here are a few articles of particular value for me: zombies appearing in the oil patch, low prices are due to worldwide oversupply and thus will likely continue a while, increased production and thus competition by producers will likely keep prices low.

12/10 – Reuters – Zombies appear in US oil fields as crude plums new lows – Here is a phrase that will make OPEC happy: zombies, in the context of the energy industry. That refers to a drilling company with such poor income that it is using all its cash to cover interest payments. That leaves no cash for drilling new wells.