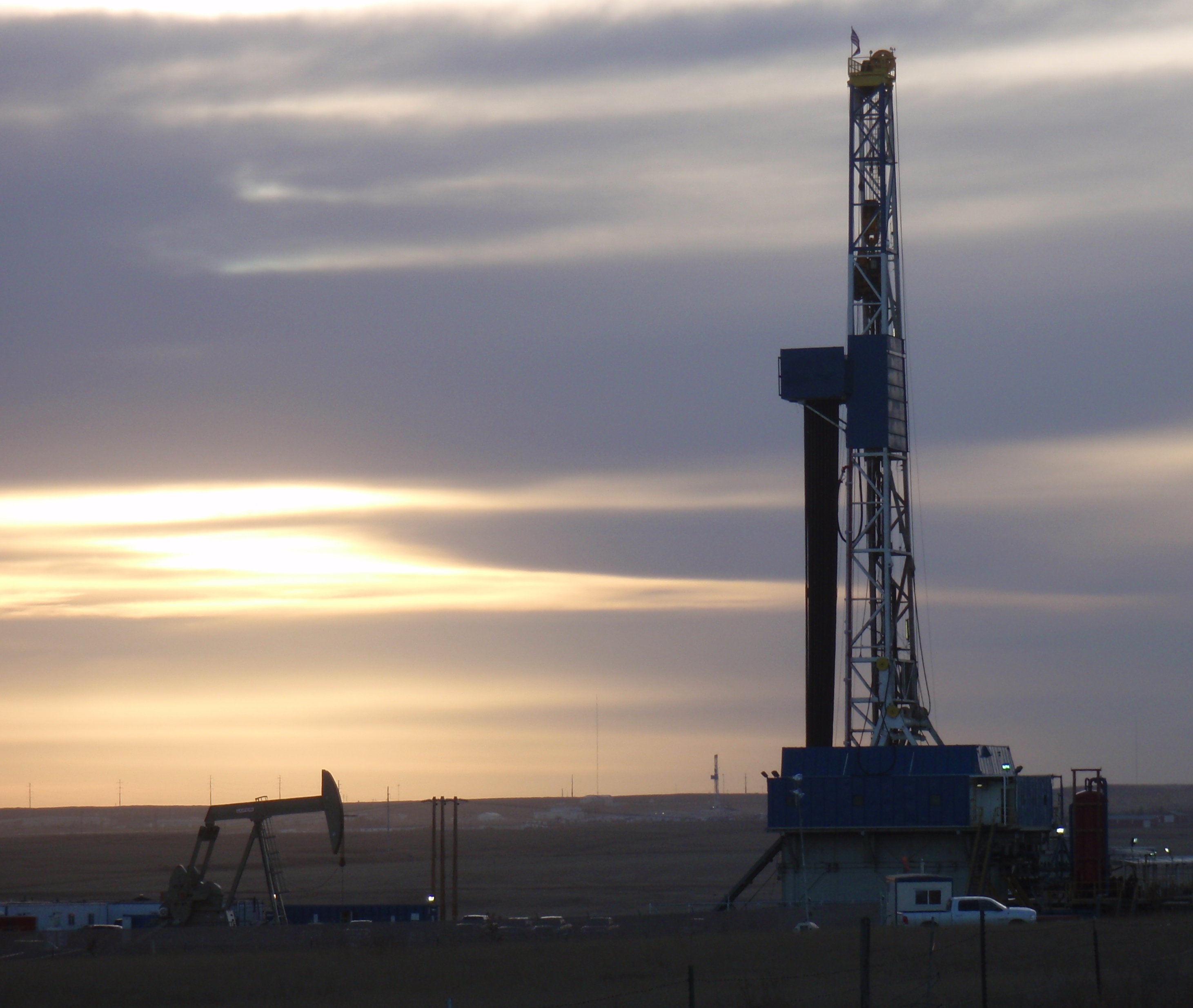

(Photo by James Ulvog. A view of what OPEC is trying to shut down. One drilling rig and one pump in foreground. One drilling rig in distant background. About half a dozen working pumpjacks are on the very short road to this site.)

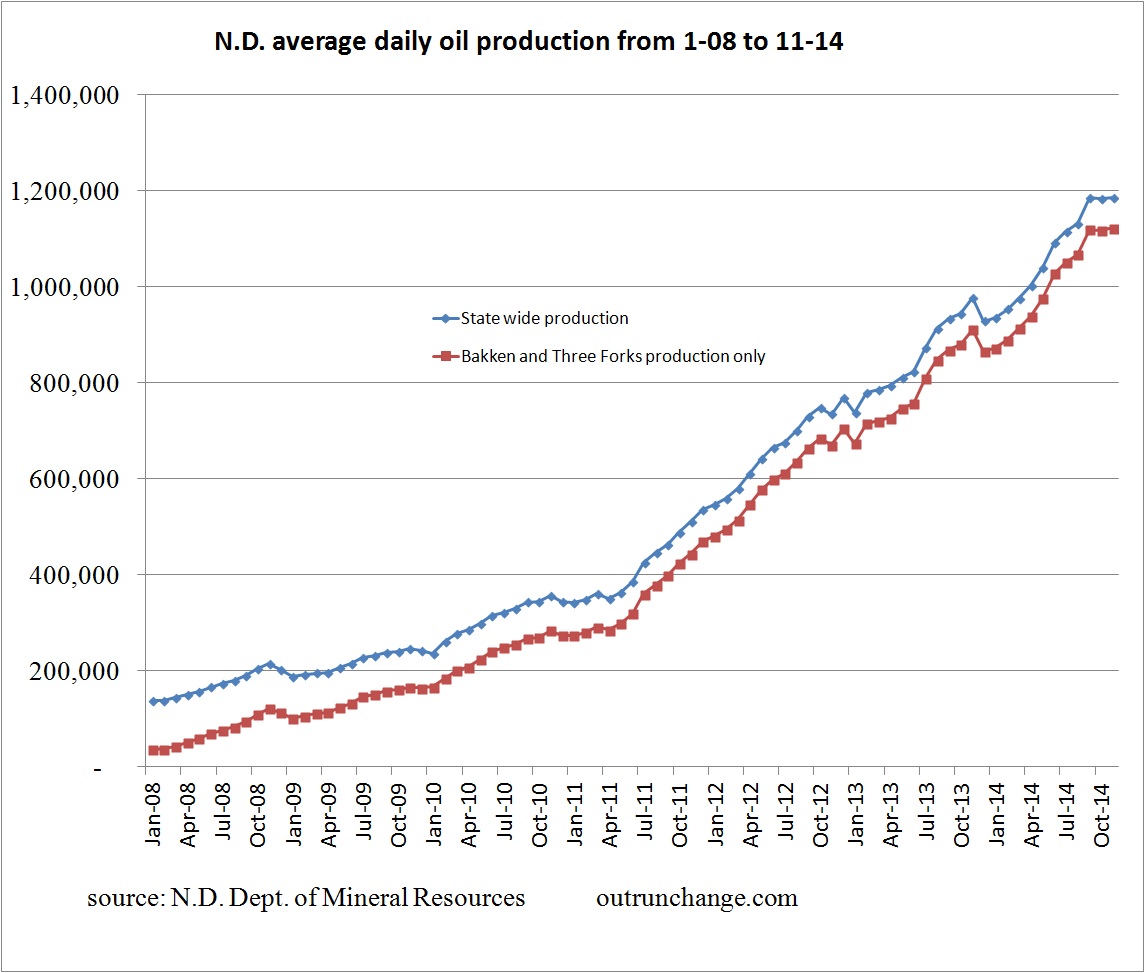

The top oil regulator in North Dakota, Lynn Helms, spoke to media after releasing the monthly production data for November.

Multiple media sources covered the presentation. These comments from the Dickinson Press – Helms: Oil production could decline by third quarter.

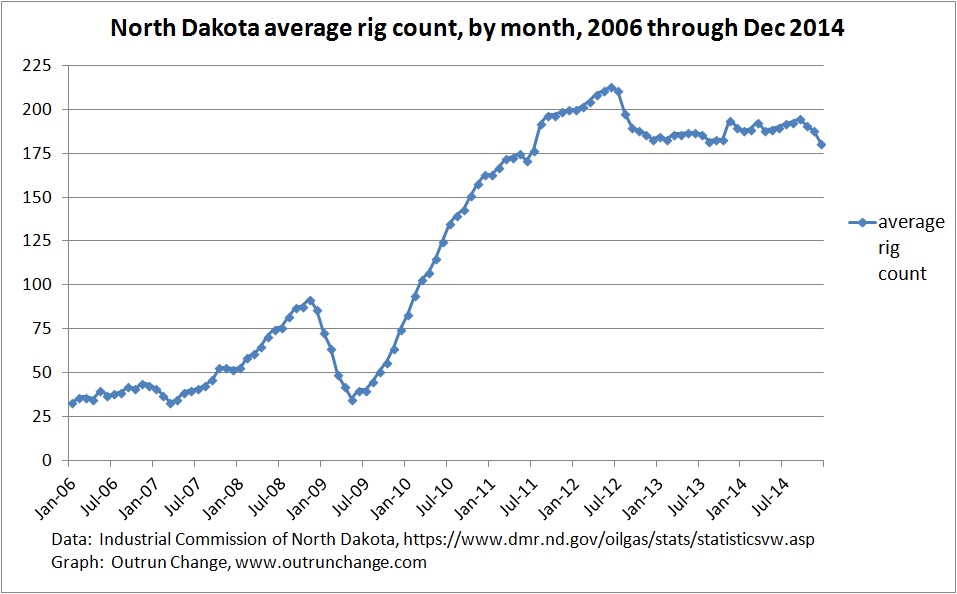

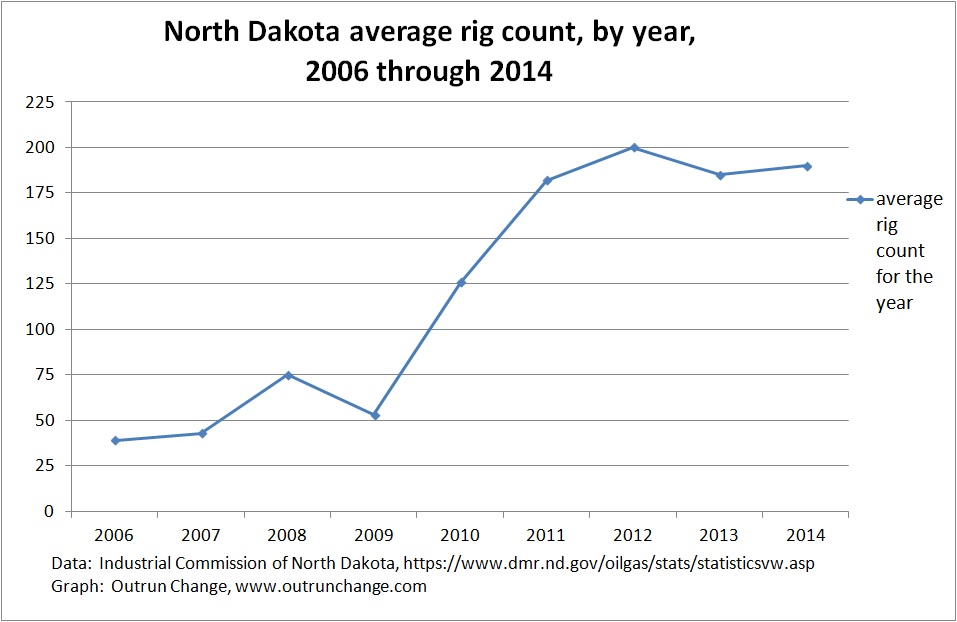

He indicated drillers have pulled back to the four key counties of the Bakken region because the returns there are rich enough for drilling to remain profitable. Only 10 of current count of 158 rigs are outside those counties.

Info on rig count Continue reading “Comments on North Dakota oil production. More info on big trigger and little trigger – 1/15/15”