(Poorly focused photo by James Ulvog. Workover rig, one pumpjack ready to go, and three not yet complete. Gonna’ be lots of wells on that pad.)

Big drop in tax on produced oil in North Dakota won’t happen. Also a recap of the tax rates on oil.

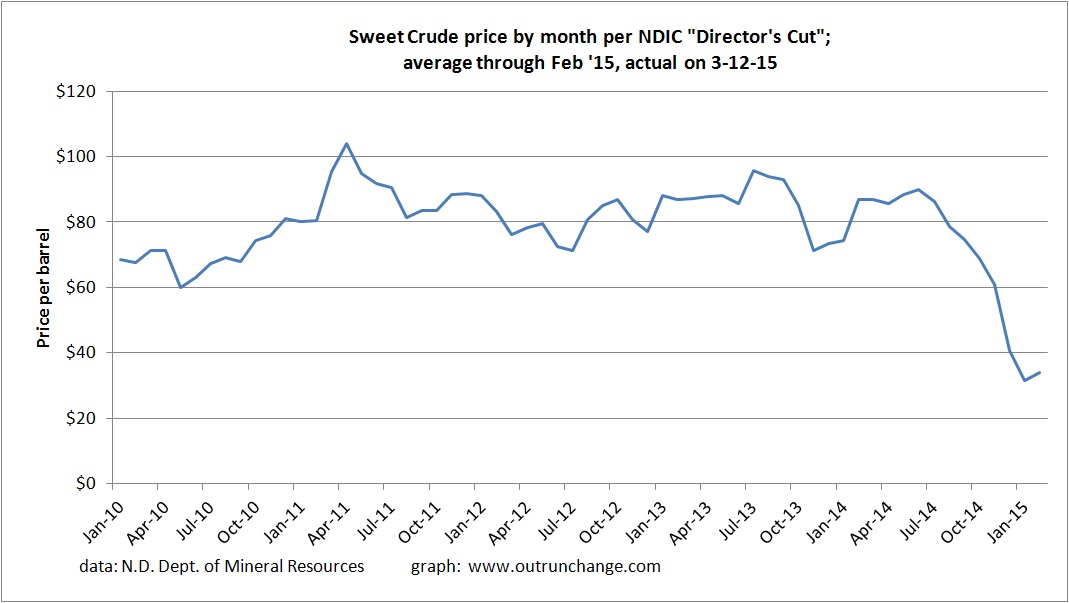

5/29 – Associated Press at Bakken.com – Oil price increase means North Dakota tax trigger won’t hit – If crude oil prices are below a certain threshold, currently $55.09 for five consecutive months there would be a dramatic reduction in the tax on oil produced in the state.

Prices have been running below that cut off for January through April. During May the key index has been above the cutoff.

Continue reading “North Dakota’s “big trigger” tax reduction not going to get pulled”