A June 6th Reuters article in the Dickinson Press says North Dakota refuses to flinch as OPEC keeps output high. Unnamed company officials in North Dakota are calling OPEC’s decision to maintain a price war

… a questionable bet.

Article points yet again that drillers are dramatically reducing their costs. One executive said:

“High commodity prices hide a lot of inefficiencies in the system,”

Place your bets for or against ingenuity

The WSJ article below says OPEC members believe their strategy of high production (a.k.a. a price war) has been successful. Ooooookay.

As Prof. Mark Perry often says: Don’t bet against American ingenuity.

OPEC has doubled down on their bet.

Go for it.

Maintaining maximum production

Wall Street Journal reports OPEC Keeps Output Unchanged. At their meeting on June 5, OPEC kept their official production cap the same. Article points out this is now referred to by OPEC as “an indicator.”

Perhaps that is merely a recommendation, since producers are pumping as much oil as they possibly can with output understood to be about 1 million barrels a day above the suggested level.

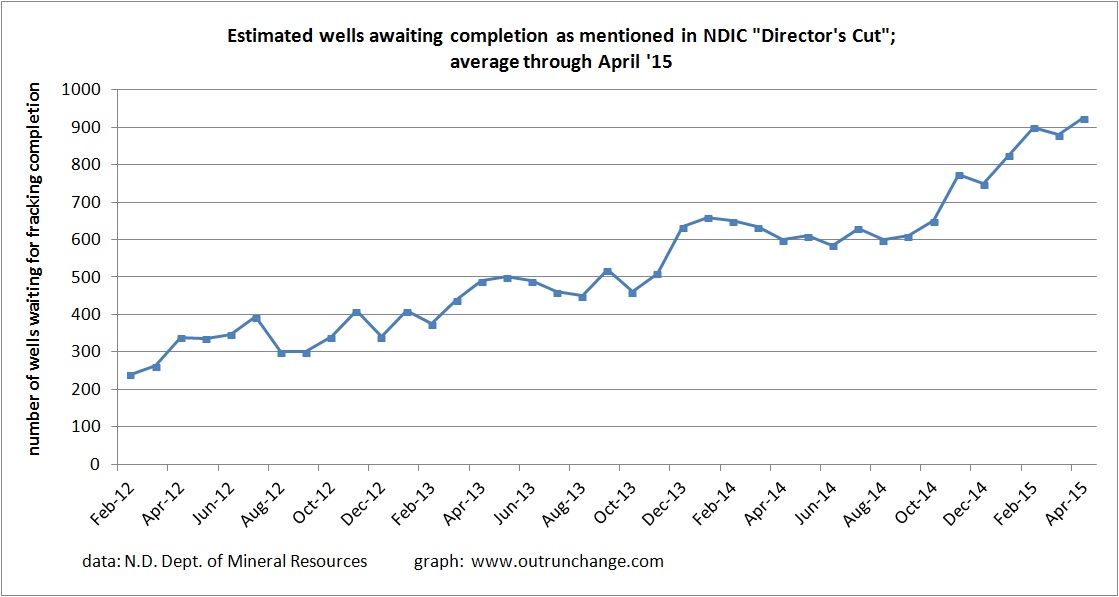

Article says this confirms that OPEC, especially Saudi Arabia, is no longer the swing producer. That role, undesirable as it may be, has now shifted to American shale oil. It is slowly moving into common understanding that drilling in American shale is something that can be turned off and on rapidly.

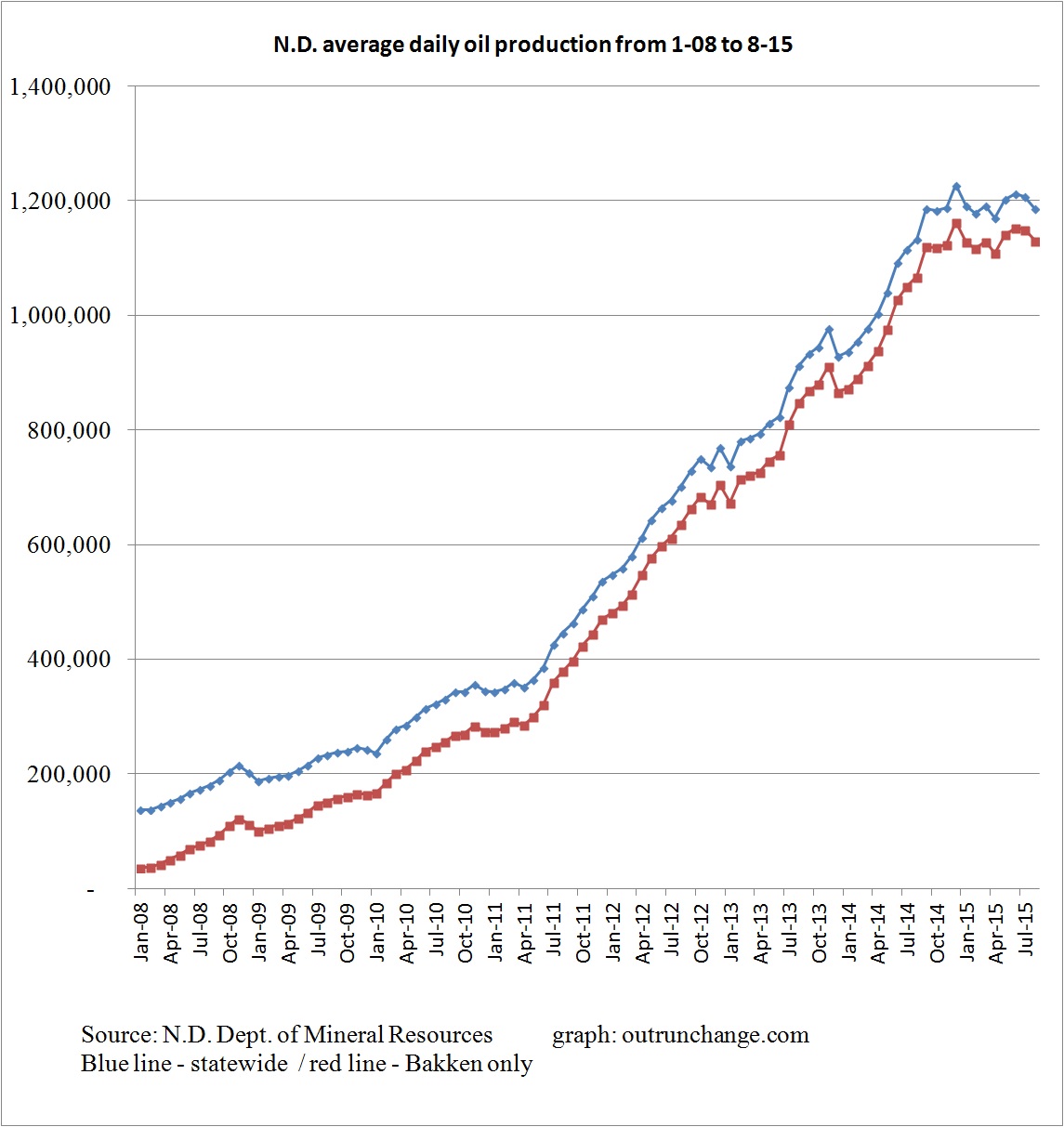

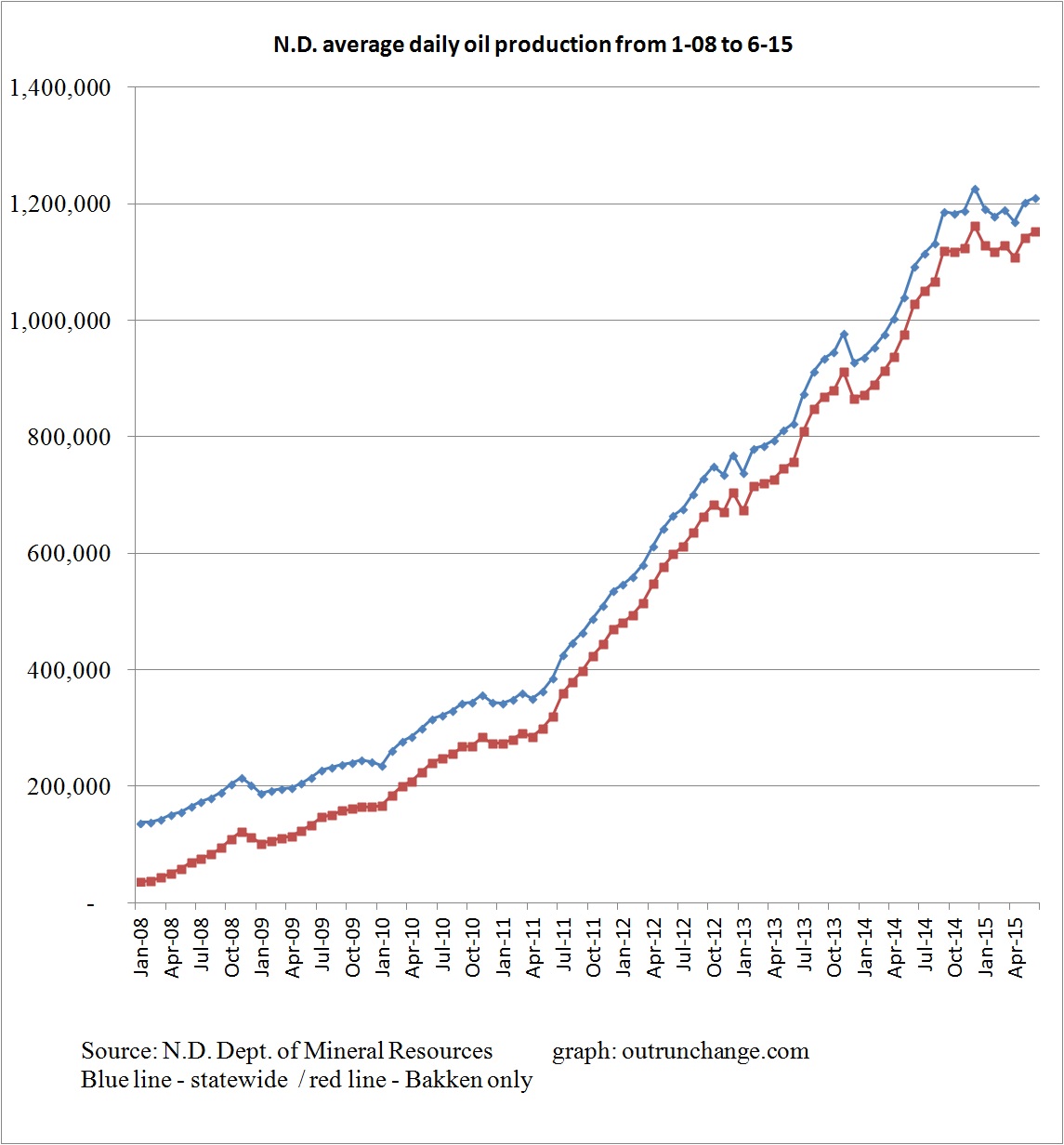

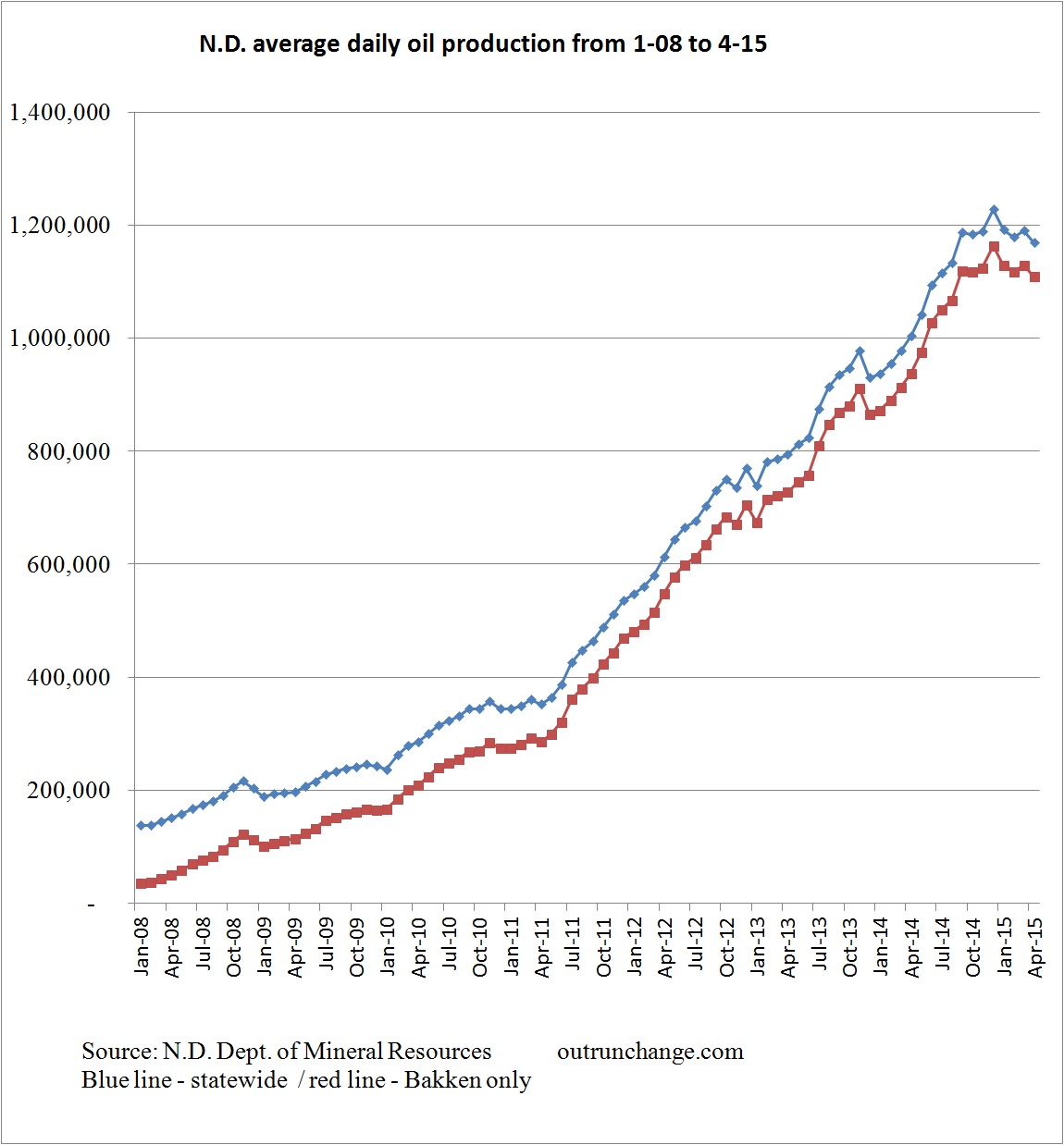

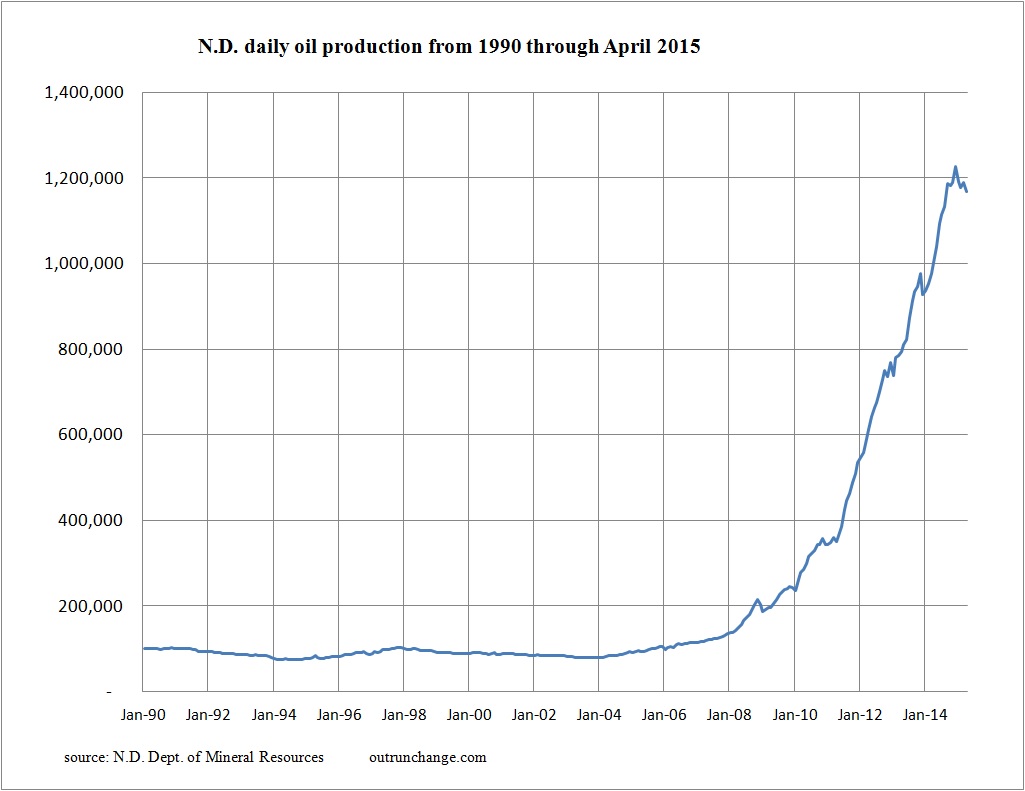

The irony is the level of American shale production has not dropped off at the same time as OPEC has increased their production by roughly the amount that is produced in Bakken. That means the price war continues.

Continue reading “OPEC continues price war against shale”