The New York Times ran an entertaining hit piece on the entire Bakken oil field with particular focus on the intentionally lackadaisical enforcement effort from the state. I learned of the front page article from some complimentary twitter comments, from which I guessed this was a major attack before even reading the first paragraph.

Check out The Downside of the Boom.

As I’ve expanded the horizons of my reading over the last four years, I’ve learned how to see the slant on articles. It’s easy to pick up on agendas if you read carefully, watch the choice of words, and assess the point of view. The goal in this report from the NYT is oh so obvious.

Million Dollar Way’s read is the same:

It was clearly an editorial which will be used by movers and shakers in Washington to support their case that the environment is too important to leave it up to state regulators.

Having said that, I believe my point of view is just as visible – since I’m not a professional journalist, I don’t try to hide my worldview when writing about an issue on which I have an opinion. You may thus filter my comments and the NYT article as you wish.

On to the article…

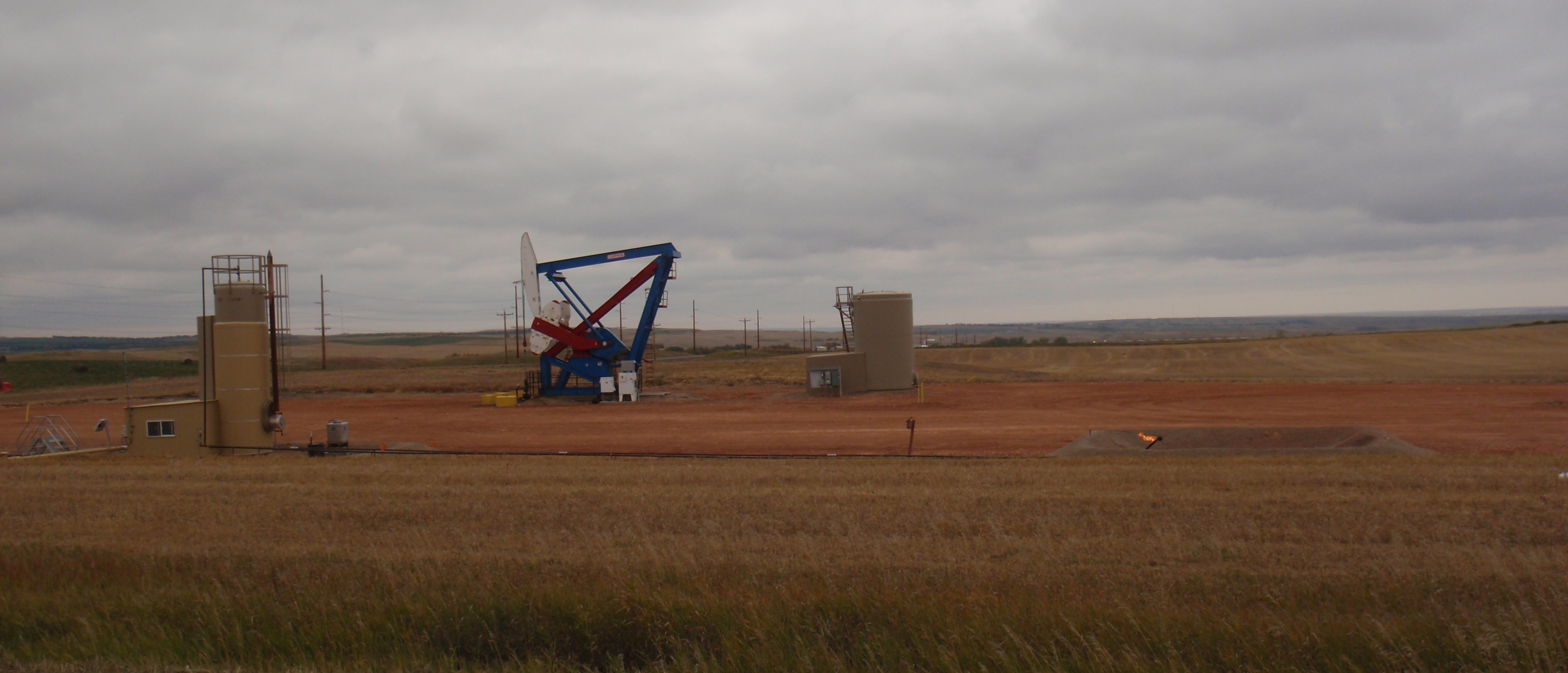

At a simple level, the adjectives and adverbs are slanted. The oil service roads “slash” through the landscape. That description is in a caption for a photo showing a peaceful farm in the foreground, pump jacks on the hill at the horizon, and not a service road in sight. The farmer with those slashed wheat fields is likely depositing checks for twenty or fifty thousand dollars each month.

Leaks in pipelines which are under federal and not state supervision are the fault of the previously mentioned lackadaisical state regulators. Keep in mind a federal agency is responsible for most pipelines and all the big pipes.

Continue reading “Editorial hit piece on Bakken presented as front page reporting”